Bitcoin soars above $111,000 after 'wonderful' Trump-Xi meeting

On October 30, the leading cryptocurrency briefly recovered to $111,300. This was due to hints of a warming in relations between China and the United States.

At the time of writing, digital gold has corrected to ~$110,200.

Binance BTC/USDT hourly chart. Source: TradingView.

Binance BTC/USDT hourly chart. Source: TradingView.

Following a meeting with Chinese President Xi Jinping in South Korea, US President Donald Trump announced plans to reduce trade tariffs on Chinese goods, AP News reported, citing his remarks.

“I think on a scale of zero to 10, with 10 being the best, I would say the meeting was a 12,” Trump said, also noting that a trade deal with China could be reached “very soon.”

His earlier announcement of a 100% tariff on Chinese imports starting November 1 triggered a massive cascade of liquidations in the crypto market.

Besides Bitcoin, Ethereum also showed positive momentum. The leading altcoin briefly rose to $4,000, but then fell to around $3,900.

Binance ETH/USDT hourly chart. Source: TradingView.

Binance ETH/USDT hourly chart. Source: TradingView.

The broader crypto market remains in the red. The Fear and Greed Index stands at 34, indicating investor uncertainty.

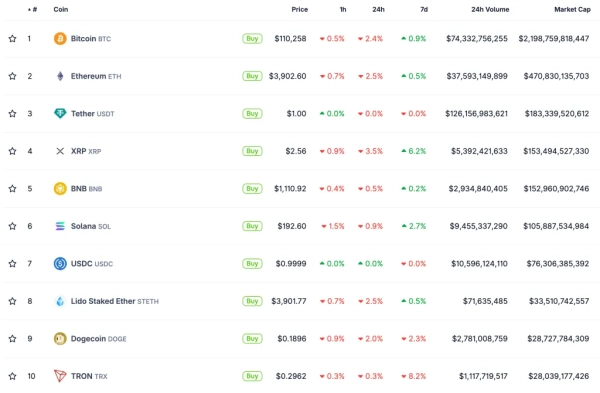

Source: CoinGecko.

Source: CoinGecko.

Uncertainty remains

According to analysts, the macroeconomic outlook remains unclear, leading to a continued risk of increased volatility.

“So far, we've only heard statements from Trump; China hasn't confirmed anything. […] There's still uncertainty,” Derek Lim of Caladan told The Block.

The expert also noted unexpected statements during the FOMC meeting, with some speaking out against easing the Fed's monetary policy. Fed Chairman Jerome Powell also expressed uncertainty about further interest rate cuts.

Lim saw no clear catalysts for market growth. He said all possible factors are already factored into the price of the leading cryptocurrency.

Analyst Axel Adler Jr. believes that the Fed's next steps will depend on US employment and inflation data. He emphasized that “significant changes in these indicators in the coming months are unlikely.” However, he still expects a rate cut in December.

The Fed's next moves will depend on incoming employment and inflation data. Significant changes in these indicators over the next two months are unlikely, so I still expect a rate cut in December despite the current rhetoric.

However, since the market trades on expectations and… pic.twitter.com/te4THD5l7H

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 30, 2025

“Given that the market is trading based on expectations and statements from the Fed, we should prepare for increased volatility,” he warned.

Earlier, Adler Jr. suggested a new rally in the leading cryptocurrency could occur following the US Federal Reserve meeting.

Further market uncertainty was sparked by the actions of an early Bitcoin investor known as Owen Gunden. According to Lookonchain, the whale has transferred 2,587 BTC (~$290 million) to the Kraken exchange over the past few days.

Owen Gunden, a #Bitcoin OG who holds over 10,000 $BTC, has been aggressively dumping $BTC recently!

In less than 10 days, he's deposited 2,587.6 $BTC($290M) to #Kraken.https://t.co/Fx6wtq0Whmhttps://t.co/TOWQgX2CS3 pic.twitter.com/jUtqSepzwM

— Lookonchain (@lookonchain) October 30, 2025

Users speculated that the player was preparing to sell assets to secure profits.

“The guy seems to have realized that Halloween is coming, so he decided the market needed a corresponding horror image,” one user commented.

Positive signal

In October, spot Bitcoin trading volume on major exchanges exceeded $300 billion, reaching a record high. This was highlighted by a CryptoQuant contributor who goes by the handle “Darkfost.”

🗞️ October stands out as one of the strongest months of the year for BTC spot volume.

“This October has seen a renewed surge of interest in the spot market, particularly on Binance. Major exchanges recorded more than $300B in Bitcoin spot volume this month, with $174B coming… pic.twitter.com/Txe5aajolX

— Darkfost (@Darkfost_Coc) October 29, 2025

“The trend demonstrates growing activity among both retail traders and institutional participants, who are increasingly operating in the spot market,” the expert wrote.

He added that the October 11 liquidations prompted investors to shift to more conservative strategies. According to Darkfost, this indicates increased stability and resilience in the sector.

“A market driven more by spot trading than derivatives is typically healthier and more stable, as it is less vulnerable to extreme volatility caused by excessive open interest. This also reflects stronger organic demand and increased resilience,” he concluded.

As a reminder, an analyst using the pseudonym Crypto Dan predicted the end of the correction and a rally in altcoins.

Source: cryptonews.net