Bitcoin Price Forecast: Strategy's $3.9B Gain Boosts Sentiment

- After the breakout, Bitcoin is defending $123,000, with the next growth targets at $125.5K–$128.5K.

- Strategy reports $3.9 billion in fair value growth for the third quarter, strengthening enterprise adoption of Bitcoin.

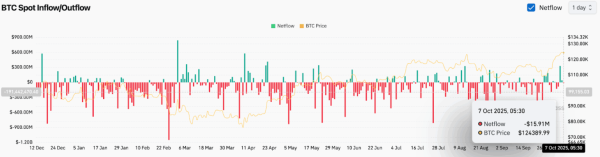

- On-chain flows show outflows of $15.9 million, suggesting cautious accumulation amid consolidation.

Bitcoin's price is hovering around $124,180 today, holding steady after a powerful breakout from a multi-month triangle structure. Buyers are defending the recently reclaimed $123,600 zone as the market digests news that corporate giant Strategy reported a $3.9 billion increase in Bitcoin's fair value for the third quarter of 2025, demonstrating institutional investors' continued confidence in BTC's long-term valuation.

Bitcoin price continues to rally within an ascending channel

BTC Price Analysis (Source: TradingView)

BTC Price Analysis (Source: TradingView)

The daily chart shows Bitcoin continuing to rise steadily within its ascending channel, with the price currently testing its midpoint near $124,800. The 20-day exponential moving average (EMA) at $117,800 and the 50-day exponential moving average (EMA) at $115,500 have formed a strong support cluster, confirming the bullish trend.

Momentum remains high, although the RSI near 71.6 indicates moderate overbought conditions following last week's sharp rise from $111,000. As long as BTC holds above $123,000, the short-term structure remains constructive. A break of $125,500–$126,000 could open the way to $128,500, which corresponds to the upper boundary of the ascending channel.

Strategy's $3.9 billion report strengthens institutional narrative

Strategy reports $3.9 billion in total Bitcoin fair value appreciation in Q3 2025. $MSTR $STRC https://t.co/Tcw67JHCSe

— Michael Saylor (@saylor) October 6, 2025

Investor sentiment was significantly boosted after Michael Saylor confirmed that Strategy has recorded a $3.9 billion increase in Bitcoin's fair value in the third quarter of 2025. This announcement underscored the growing role of corporate treasuries in bolstering BTC's macroeconomic case as a digital reserve asset.

The update also revived discussions of institutional Bitcoin growth ahead of the fourth quarter, as public companies and ETFs continue to increase their positions amid tightening fair value accounting standards. Analysts note that the stable profitability of companies linked to BTC assets strengthens confidence in long-term demand and price stability.

Currency flows show controlled outflow amid consolidation

BTC Netflows (Source: Coinglass)

BTC Netflows (Source: Coinglass)

According to Coinglass, spot exchange data shows a net outflow of $15.9 million on October 7, reflecting cautious accumulation rather than aggressive distribution. Over the past two weeks, net outflow has alternated between small inflows and outflows, suggesting traders are taking profits but not closing positions.

Historically, sustained net outflows have coincided with a medium-term rally, as supply moves away from exchanges and toward self-storage. Analysts view the current trend as a healthy consolidation following BTC's 12% rise since late September. Sustained outflows of over $100 million would confirm deeper accumulation ahead of potential breakouts in Q4.

Bitcoin Price Technical Forecast

The short-term Bitcoin price forecast remains based on the continuation of the breakout channel:

- Growth levels: $125,500, $128,500 and $132,000 if the trend continues.

- Downside levels: $123,000, $117,800 and $115,500 as key support

- Trend support: $107,500 (200-day EMA) as a long-term line of defense

Outlook: Will Bitcoin Rise in Price?

Bitcoin remains firmly within its bullish channel, supported by positive corporate catalysts and stable on-chain flow dynamics. Strategy's report confirms the overall institutional momentum, while stable outflows indicate limited selling pressure.

Analysts believe that if BTC can close above $125,500, the next target zone will be in the $128,500–$132,000 region. However, if the price fails to hold above $123,000, it could trigger a minor correction towards the exponential moving average (EMA) cluster before the next leg of the rally.

At the moment, Bitcoin's overall structure remains bullish, with buyers in control as the market anticipates higher resistance levels by mid-October.

Source: cryptonews.net