Bitcoin Leads Purchase Volumes in Nigeria and South Africa

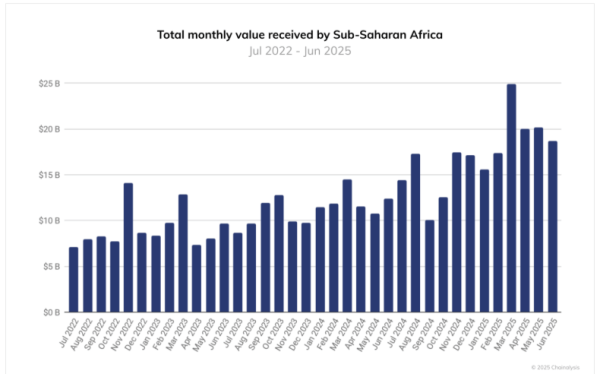

Sub-Saharan Africa saw a significant surge in cryptocurrency activity in March, with monthly transaction volumes on the network reaching $25 billion, largely driven by centralized exchanges in Nigeria.

Nigeria is fueling cryptocurrency growth in sub-Saharan Africa

Sub-Saharan Africa (SSA) saw a sharp rise in cryptocurrency usage in March, with monthly transaction volumes reaching nearly $25 billion, the highest since the start of the year. This surge in activity bucked a downward trend that was prevalent in other regions at the time, according to blockchain security firm Chainalysis.

However, over the next two months, the total amount of monthly inflows into sub-Saharan Africa fell to about $20 billion. Since the beginning of the year, the region has received more than $15 billion. As expected, a disproportionate share of the $25 billion went to centralized exchanges in Nigeria.

“The surge was driven largely by centralized exchange activity in Nigeria, where a sudden currency devaluation led to a surge in cryptocurrency adoption,” Chainalysis said in its report. “Such devaluations typically lead to increased volume in two ways: more users switch to cryptocurrency to hedge against inflation, and existing purchases appear larger in local currency because more fiat is required to purchase the same amount of cryptocurrency.”

Overall, Sub-Saharan Africa generated more than $205 billion in network value between July 2024 and June 2025, up approximately 52% year-on-year. This growth made Sub-Saharan Africa the third-fastest growing region in the world, after Asia Pacific (APAC) and Latin America.

Bitcoin and Stablecoins Dominate

During the same period, Bitcoin (BTC) dominated cryptocurrency purchased with fiat currency in the region, accounting for 89% in Nigeria and 74% in South Africa, well above the 51% seen in markets where the dominant currency is the U.S. dollar. This trend reflects BTC’s role as a store of value and the primary way to access cryptocurrency, especially in regions with volatile currencies and limited investment opportunities, according to Chainalysis.

“Conversely, USDT usage is more prevalent in Nigeria than in markets using the US dollar, accounting for 7% of purchases compared to 5% in the US dollar group,” the report said.

Chike Okonkwo, marketing manager at cryptocurrency exchange YDPay, attributed BTC’s dominance in Nigeria to two factors: trust and accessibility. Okonkwo also explained why Nigerians are particularly interested in Bitcoin and stablecoins like USDT.

“Nigerians are very pragmatic about their use of cryptocurrencies. Bitcoin is popular because it is globally accepted, liquid, and has proven to be resilient over time,” Okonkwo explained. “Stablecoins, on the other hand, appeal to users who want to store their dollar savings without the restrictions of accessing foreign currency. This trend highlights what matters most to Nigerians: protection from inflation, quick access to funds, and reliability.”

According to Okonkwo, Ethereum (ETH) and other altcoins are more suitable for trading as a way to earn additional income.

Source: cryptonews.net