Bitcoin tested the $86,000 level but pulled back again.

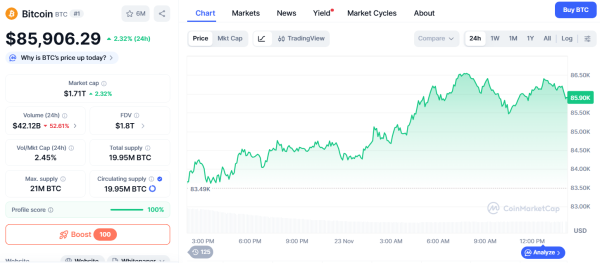

On November 23, Bitcoin (BTC) tested levels above $86,000. Its daily peak was $86,547. By the time of writing, the coin had corrected to $85,843.

On October 6, the leading cryptocurrency set a new all-time high (ATH) of $126,000. At its current price, Bitcoin is trading 38% below its all-time high.

Bitcoin daily chart. Source: CoinMarketCap.

Bitcoin daily chart. Source: CoinMarketCap.

Digital gold trading volume has fallen significantly over the past 24 hours. At the time of writing, it stands at $40.28 billion—52% lower than yesterday's level.

Bitcoin sentiment on social media has reached its lowest level since December 11, 2023. Santiment analyzed bullish and bearish comments from market participants on X, Reddit, Telegram, and other platforms.

On the topic: the market needs to lose another 50% to establish a solid foundation – opinion

Source: H.

Source: H.

Analysts have concluded that retail investors are capitulating and panic selling on a scale not seen in the last two years.

Furthermore, investor and trader sentiment remains in the “extreme fear” zone, according to Alternative.me.

Fear and Greed Index. Source: alternative.me.

Fear and Greed Index. Source: alternative.me.

Community reaction

Strategy founder Michael Saylor, amid the fall of the first cryptocurrency, noted that his company is not a fund, trust, or holding company.

“We are a publicly traded operating company with a $500 million software business and a unique treasury strategy that leverages Bitcoin as productive capital,” he said.

Saylor also added that his “confidence in Bitcoin is unwavering,” and the company's core mission remains the same—to build the world's first digital monetary institution based on sound money and financial innovation.

Bitwise CEO Hunter Horsley, meanwhile, told X that he “bought even more BTC.” He added that he couldn't resist the $85,000 price, and that “it felt good.”

On the topic: Robert Kiyosaki said he expects Bitcoin to reach $250,000 and gold to reach $27,000.

Source: H.

Source: H.

Bitwise CEO Matt Hougan believes investors are overly focused on the market correction, failing to notice that key crypto projects—such as Ethereum (ETH), XRP (XRP), and Uniswap (UNI)—continue to thrive.

In his opinion, further development of regulation in 2026 will help the market properly value these assets and reveal their true value.

On the topic: Morgan Stanley recommended “harvesting” Bitcoin before the arrival of “winter.”

Source: cryptonews.net