Bitcoin ETFs Lose $1.22 Billion in a Week, but Schwab Remains Optimistic

Amid Bitcoin's decline, investors withdrew $1.22 billion from Bitcoin ETFs in a week, but broker Charles Schwab doesn't share the market's pessimism. Furthermore, the company reported that its clients own 20% of all cryptocurrency ETFs in the US.

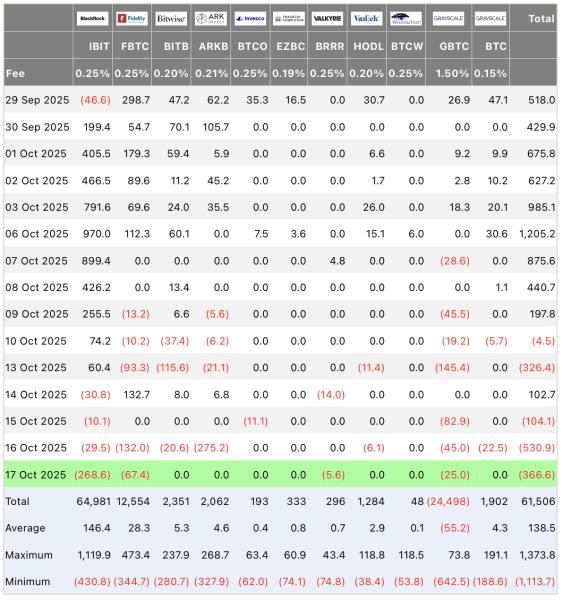

Capital flows into US Bitcoin ETFs. Source: Farside Investors

Capital flows into US Bitcoin ETFs. Source: Farside Investors

A Red Week for Bitcoin ETFs

Eleven U.S. spot Bitcoin ETFs saw a combined outflow of $366.6 million on October 17, capping a disastrous week for institutional Bitcoin investment products.

BlackRock's iShares Bitcoin Trust led the outflows, losing $268.6 million, according to SoSoValue. Fidelity's fund lost $67.2 million, Grayscale's GBTC lost $25 million, and the Valkyrie ETF saw minor outflows. The remaining funds ended Friday with zero investment flows.

The week's results were disastrous: the total outflow amounted to $1.22 billion, and only on October 14 did investors briefly return to the Bitcoin ETF with minimal capital inflow.

The ETF flight coincided with a more than $10,000 collapse in the underlying asset. Bitcoin fell from $115,000 on Monday to a four-month low below $105,000 on Friday.

Charles Schwab sees prospects

However, Charles Schwab CEO Rick Wurster is bullish on cryptocurrency exchange-traded products, saying the company's clients own 20% of all crypto ETFs in the country.

Cryptocurrency ETFs are seeing “very high activity,” he told CNBC on October 17, noting that traffic to the company's cryptocurrency website has grown by 90% over the past year.

“This is a topic that is generating a high level of interest,” Wurster emphasized.

Charles Schwab operates one of the largest brokerage firms in the United States, recalled ETF expert Nate Geraci.

Schwab currently offers cryptocurrency ETFs and Bitcoin futures, and plans to launch spot cryptocurrency trading for its clients in 2026.

A disastrous October for Bitcoin

Bitcoin has shown growth in ten of the last twelve Octobers, but this month has broken the favorable statistics – the asset has lost 6% since the beginning of the month, according to CoinGlass.

However, analysts remain confident that the traditional “October growth” will resume. The bulk of growth typically occurs in the second half of the month, and the expected Federal Reserve rate cut could spur the rally.

Bitcoin ETFs are going through tough times, but the market's largest players continue to bet on the long-term prospects of cryptocurrency investment products. Charles Schwab, with a client base that controls a fifth of all crypto ETFs in the US, clearly has no intention of curtailing its presence in this sector.

Source: cryptonews.net