Bitcoin (BTC) Price Drop Due to Leverage Will Be Short-lived

Bitcoin (BTC) has seen significant swings recently, falling to $112,500 twice this month. The decline is largely due to leveraged positions and is unlikely to last long.

Let's figure out what's happening in the Bitcoin (BTC) market and what to expect from the cryptocurrency price.

Who is to blame for the fall of Bitcoin

Futures market activity is weighing heavily on Bitcoin sentiment, while on-chain gains and losses remain weak during the recent all-time high and subsequent correction.

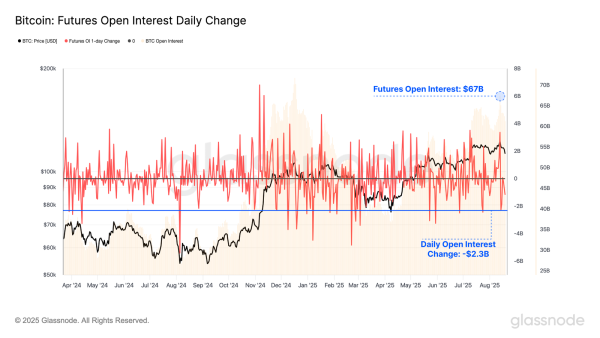

Open interest in BTC futures remains high at $67 billion, indicating significant leverage in the market. Leverage, while it can be profitable, amplifies price swings, as we have seen in recent moves.

More than $2.3 billion in open interest was liquidated during the recent sell-off, one of the largest declines ever. It highlights the speculative nature of the market, where even small price changes can lead to a reduction in leveraged positions.

Bitcoin Futures OI Change. Source: Glassnode

Bitcoin Futures OI Change. Source: Glassnode

In recent weeks, the net realized profit/loss adjusted volatility measure has shown a decline in profit taking activity. In previous breakouts, such as the $70,000 and $100,000 levels in 2024, significant profit taking was indicative of strong investor activity.

At that point, the market was coping with selling pressure from BTC holders. However, the last attempt to reach the all-time high of $122,000 in July was accompanied by less profit-taking, which indicates a change in market behavior.

One explanation for this situation is that the market has had difficulty sustaining gains despite softer selling by current holders. The lack of significant profit taking may indicate weak demand, which explains the current consolidation and limited movement despite new price levels.

Bitcoin Volatility with Net Realized P/L. Source: Glassnode

Bitcoin Volatility with Net Realized P/L. Source: Glassnode

BTC Price Recovers

At the time of writing, Bitcoin is trading at $114,200 after bouncing off the $112,526 support level for the second time this year. The recovery is expected to continue as the decline is due to leveraged selling. A rebound is likely given the strength of Bitcoin's support at $112,526.

If the coin breaks through $115,000 and holds at that level, it will have a chance to rise to $117,261. Holding this support is important for continued growth, which could open the way to $120,000.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if Bitcoin fails to break above $115,000 or investors continue to sell, the price could fall below $112,526. This could take Bitcoin to $110,000 or lower, which would erase the current rally and could signal a long-term bearish phase.

Source: cryptonews.net