Bitcoin (BTC) could fall to $105,000 if it fails to hold at current levels.

On-chain data shows complex signals for Bitcoin price following the Federal Reserve's interest rate decision on Thursday.

According to a new report from on-chain analytics platform Glassnode, it's crucial that Bitcoin's price remains above $115,200. Otherwise, it could fall to $105,500.

Record options expiration looms

Glassnode data shows that fears of a significant price drop have subsided following the Fed's announcement. There was slight selling pressure in the spot market, but low-risk positions increased in the derivatives market.

Open interest in the perpetual contract market has declined slightly. Glassnode noted that open interest, which had reached 3.95 million BTC, has now fallen to 3.78 million BTC. Liquidation analysis shows that while short positions were liquidated shortly before the rate announcement, the share of long positions liquidated increased after the rate cut.

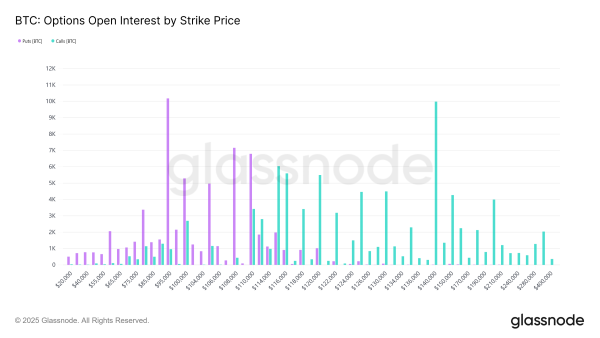

However, the potential for significant volatility remains, as open interest in the options market has reached a record high of 5 million BTC. A record number of these options expire next Friday, September 26.

A drop below $115,200 could derail the momentum.

Glassnode recommends monitoring the “maximum pain” price for Bitcoin options. If the price rises or falls, a large liquidation on either side could significantly impact the spot price.

BTC: Options Open Interest by Strike Price. Source: Glassnode

BTC: Options Open Interest by Strike Price. Source: Glassnode

The current maximum pain point for long positions is $112,700, while for short positions it is $121,600. At the time of writing, Bitcoin is trading at around $116,990.

Most Bitcoin traded on-chain since the September FOMC meeting has been above $115,200. Glassnode notes that maintaining this price is important to maintain momentum. If the price falls, it could reach $105,500.

A hold above $115,200 will support demand, while a drop below that level could return the price to the $105,500-$115,200 range. Glassnode believes that on-chain signal analysis shows that market participants are waiting for Bitcoin's direction to be determined.

Source: cryptonews.net