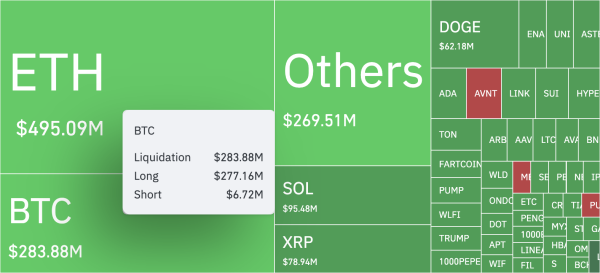

Bitcoin (BTC)'s sharp drop has led to $277 million in liquidations.

Bitcoin (BTC) fell 3% today, marking one of its sharpest declines in 11 days. This decline comes amid a general pullback in the crypto market.

The sell-off triggered a wave of liquidations, hitting bullish traders particularly hard. As bullish sentiment weakens, these investors risk even greater losses.

Bitcoin's plunge triggers wave of liquidations

BTC has continued to decline in recent days. It fell 3% today amid a sluggish start to the trading week. This trend has led to the liquidation of $277 million in long positions on the futures market over the past 24 hours, according to Coinglass.

Long liquidations occur when traders betting on a price increase are forced to sell the asset at a lower price to cover their losses.

Cryptocurrency liquidation map. Source: Coinglass

Cryptocurrency liquidation map. Source: Coinglass

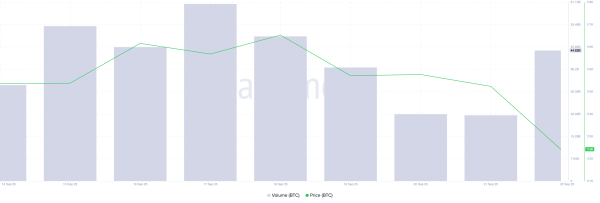

On-chain data suggests bearish sentiment is intensifying, with even more long positions at risk of liquidation. According to Santiment, BTC trading volume has increased by 90% over the past day, reaching $45 billion at press time.

When the price of an asset falls and trading volume rises sharply, this indicates increasing selling pressure and participants exiting their positions.

For BTC, this increases the risk of further liquidations of long positions and points to increased selling as holders may sell in anticipation of continued declines.

BTC Price/Trading Volume. Source: Santiment

BTC Price/Trading Volume. Source: Santiment

BTC Forecast: A Pullback to $110,000 Possible

BTC's recent decline has pushed its price below the Ichimoku Cloud, where lines A and B now create resistance at $113,797 and $115,518.

This indicator tracks the momentum of market trends and identifies potential support and resistance levels. When an asset trades below the cloud, it reflects bearish pressure in the market, as demand declines and selling pressure increases.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

If the trend continues, BTC risks falling below $111,961 and possibly falling back to $110,000. If new demand emerges in the market, the price has a chance to recover and reach $115,892.

Source: cryptonews.net