Arthur Hayes Names the Real Reason for Bitcoin's 4-Year Cycle to End

BitMEX co-founder Arthur Hayes agreed that the four-year cycle in cryptocurrencies has ended, but not for the reasons most people believe.

“As we approach the 4-year anniversary of this 4-cycle, traders are looking to use historical patterns to forecast the end of this bullish trend,” Hayes wrote in a blog post Thursday.

He added that while the 4-year model had worked in the past, it was no longer applicable and “will fail this time.”

Hayes argued that Bitcoin's price cycles are determined by the supply and quantity of money, primarily the US dollar and Chinese yuan, rather than arbitrary 4-year patterns associated with halvings or the direct result of institutional interest in cryptocurrencies.

“ Past cycles ended when monetary conditions tightened, not because of timing, “ Hayes said.

The current cycle is different

Hayes argues that the current cycle is different for several reasons, including the US Treasury's release of $2.5 trillion from the Federal Reserve's reverse repo program into the markets by issuing new Treasury bills and US President Donald Trump's push to “heat things up” with looser monetary policy to shed debt.

There are also plans to deregulate banks to increase lending.

Furthermore, the US Central Bank resumed rate cuts despite exceeding its inflation target. According to Chicago Mercantile Exchange (CME) futures data, two more rate cuts are forecast in 2025: a 94% chance of a cut in October and an 80% chance of a cut in December.

It's all about money printing by China and the US

Bitcoin's first bull run coincided with the Federal Reserve's quantitative easing and China's credit expansion, ending when both the Fed and China's central bank slowed money printing in late 2013.

The second “ICO cycle” was driven primarily by the explosion of yuan lending and the currency's devaluation in 2015. According to Hayes, the bull market collapsed due to slowing lending growth in China and tightening conditions for the dollar.

During the third “COVID-19 cycle,” Bitcoin surged solely due to US dollar liquidity, while growth in China remained relatively subdued. Hayes explained that this cycle ended when the Fed began tightening policy in late 2021.

This time China won't kill the cycle

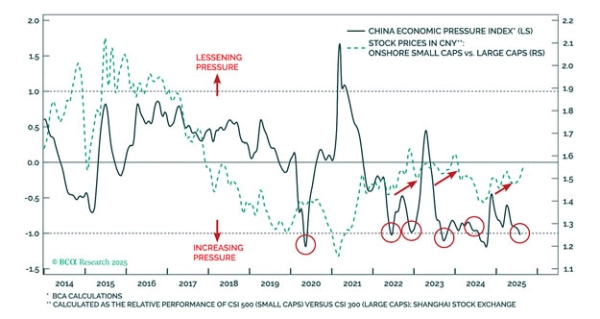

Hayes argued that while China will not fuel this growth as aggressively as in previous cycles, policymakers are seeking to “end deflation” rather than continue to pump out liquidity.

This shift from deflationary counteraction to neutral or moderately accommodative monetary policy removes a major obstacle that could kill the cycle, allowing American monetary expansion to boost the price of Bitcoin without counteracting Chinese deflation, he said.

“Listen to our financial masters in Washington and Beijing. They're clearly saying that money will become cheaper and more plentiful. That's why Bitcoin continues to rise in anticipation of this very likely future. The king is dead, long live the king!”

When economic pressure becomes too great, Chinese policymakers print money, says Arthur Hayes. Source: Arthur Hayes.

Many people still believe in the four-year cycle.

Blockchain analytics firm Glassnode stated in August that “from a cyclical perspective, Bitcoin's price dynamics also reflect previous trends.”

“I think when you talk about a four-year cycle, the reality is that it's very likely that we'll continue to see some form of cycle,” Saad Ahmed, head of Asia-Pacific at cryptocurrency exchange Gemini, said earlier this month.

Source: cryptonews.net