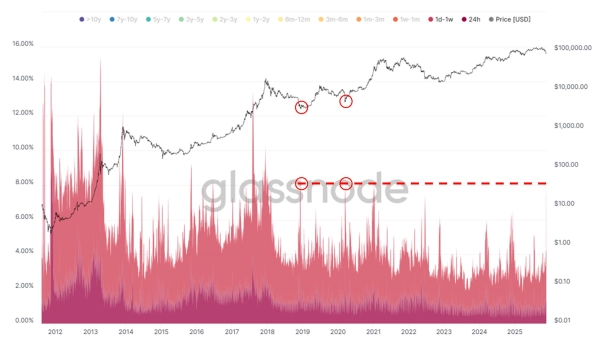

Analysts note that more than 8% of bitcoins changed hands in a week.

During the latest market downturn, there was a historic change in Bitcoin ownership, while the broader crypto market remained tied to uncertainty over a possible US Federal Reserve rate cut in December.

“Over the past week, more than 8% of Bitcoin's total supply has changed hands, making the current market crash 'one of the most significant on-chain events' in Bitcoin history,” said Joe Burnett, analyst and director of Bitcoin strategy at Semler Scientific. “During previous significant supply swings, Bitcoin traded around $5,000 in March 2020 and around $3,500 in December 2018,” Burnett wrote in a post on Tuesday.

Both cases marked a local bottom before the accumulation phase, which eventually led to new historical highs.

“However, up to half of the current Bitcoin supply movement could be due to the Coinbase wallet migration announced on Saturday,” Burnett added.

Figure 1. Source: Joe Burnett.

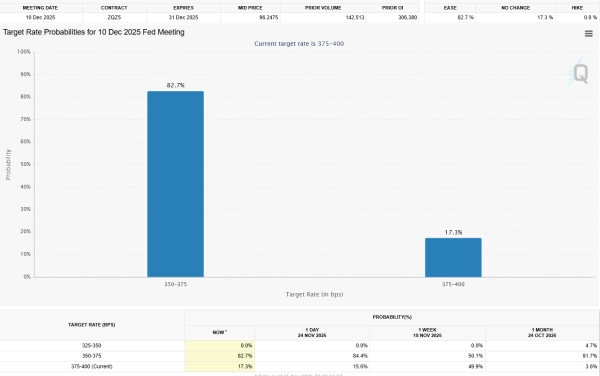

Bitcoin and cryptocurrency markets are teetering on the brink of a breakup ahead of the Federal Reserve's December interest rate decision.

“Meanwhile, Bitcoin's price and investor sentiment remain on edge due to mixed news about December's interest rate cut decisions,” says Nick Pakrin, digital asset analyst and co-founder of educational platform The Coin Bureau. “However, it's clear that the Fed holds the key to the end of the year in the market, and its next rate decision will determine whether we see a Santa Claus rally or a crash. As we approach December 10th, I expect market turmoil to continue, and the Fed's press conference will certainly make traders nervous.”

Expectations for an interest rate cut at the Federal Reserve's December 10 meeting have shifted dramatically over the course of the week.

Figure 2. Probability of an interest rate cut. Source: CMEgroup.com.

Markets are pricing in an 82% chance of a 25 basis point rate cut, up from 50% a week ago, according to CME Group's FedWatch tool.

According to Pakrin, rising expectations of an interest rate cut were the main factor that contributed to Bitcoin's recovery from $81,000 to $87,000.

Source: cryptonews.net