Bitcoin has entered a consolidation range of $86,250-$88,000 ahead of Thanksgiving in the US.

On Wednesday, November 26, the Bitcoin (BTC) price continues to “work through” the boundaries of the $86,250-88,000 corridor in anticipation of the emergence of new catalysts.

BTC/USD Hourly Chart. Source: TradingView.

BTC/USD Hourly Chart. Source: TradingView.

The release of US macroeconomic statistics on producer prices and private sector payrolls from ADP yesterday increased the likelihood of a Federal Reserve rate cut in December from 80.9% to 84.9% and ruled out a return to recent lows, given the optimism on Wall Street.

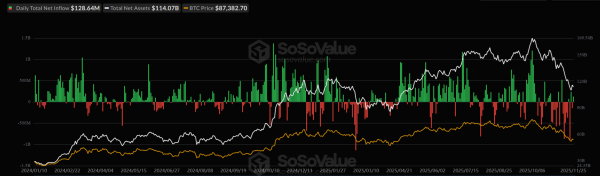

The recovery in inflows into exchange-traded funds ($128.6 million at the end of the previous day) also provided support to the bulls.

Source: SoSoValue.

Source: SoSoValue.

Fresh drivers are needed to generate new upward momentum. Investors are monitoring tweets from on-chain analysts regarding major players transferring their coins to centralized exchanges. Comments from Fed officials could also influence the price action, given the lack of consensus on continued policy easing in December.

Today at 13:30 UTC the US will release a report on jobless claims and outdated data on the dynamics of prices of personal consumption goods.

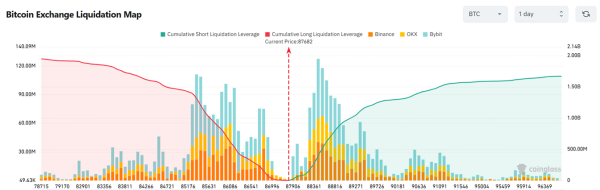

According to Coinglass, if the price exceeds $89,000, short positions worth $958 million could be liquidated. A similar fate awaits long positions if the price breaks below $86,000. The volume of forced liquidations in this case would be $768 million.

Bitcoin liquidations map on centralized exchanges. Source: Coinglass.

Bitcoin liquidations map on centralized exchanges. Source: Coinglass.

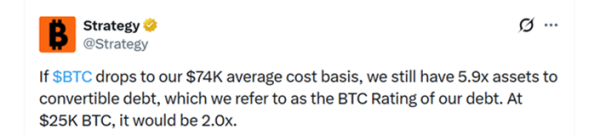

Strategy reported maintaining solvency even if the stock price falls to $25,000. In this case, assets would more than double the convertible debt. At $75,000, this metric would drop to 5.9x.

Source: Strategy.

Source: Strategy.

On the topic: Bitcoin is forming a bottom in the $84,000–$90,000 region — Glassnode

On-chain painting

CryptoQuant presented an analysis of the leading cryptocurrency's positioning relative to its realized price across various timeframes.

“If support at $85,500 holds, the price could move on to test the $90,000–$92,000 range and then challenge resistance at $95,000–$99,000. If it falls below $85,500, the price could return to $84,000–$86,000,” the commentary reads.

Source: CryptoQuant.

Source: CryptoQuant.

On the topic: Bitcoin at $87,000 – a buying opportunity or a dead cat bounce?

Opinions

Bitfinex noted that November has historically been a positive month for digital gold. The average return this month is 40.8%, according to Coinglass. To date, losses for November have reached 20.4%. In other words, “seasonality has not been confirmed.”

Analysts believe there are now two possible paths: either a “significant recovery in demand” or the market will be forced into a “longer and potentially deeper accumulation phase.”

According to Michael van de Poppe, founder of MN Trading Capital, a price drop below $85,500 will lead to a retest of the $80,800-$82,000 zone. Continued consolidation within the current range will allow us to expect a move toward $90,000-$92,000 in the coming days.

Source: Michael van de Poppe.

Source: Michael van de Poppe.

“For me, this is a critical area to hold on to,” the specialist emphasized.

Source: Michael van de Poppe.

Source: Michael van de Poppe.

On the topic: Bitcoin will hold $80,000 — Arthur Hayes

Source: cryptonews.net