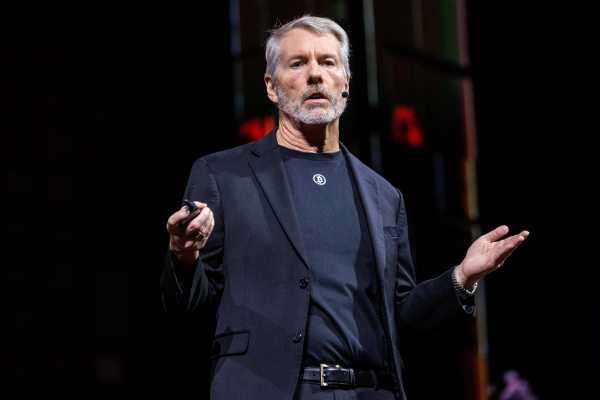

Strategy: Bitcoin giant misses inclusion in the S&P 500

- Disappointment for Michael Saylor: His BTC company, Strategy (formerly MicroStrategy), failed to make it into the S&P 500. The Bitcoin treasury firm actually met the criteria, but was not considered. If included, Strategy would have been the first Bitcoin treasury firm to be included in the benchmark index. Following the S&P decision, the stock fell by nearly 3 percent after hours.

- Strategy currently holds 636,000 BTC, valued at over $70 billion, and is by far the largest corporate holder of Bitcoin. Strategy launched its Bitcoin strategy in August 2020, when it first converted portions of its cash reserves into BTC. It is considered a pioneer in this field. Many companies, including Metaplanet, GameStop, and others, have followed this approach.

- In the second quarter of 2025, Strategy reported operating income of $14 billion and net income of $10 billion, resulting in diluted earnings per share of $32.6.

- Robinhood will be listed for this purpose starting September 22, 2025. The broker is heavily focused on trading crypto assets. The stock (HOOD) jumped 7 percent to over $108 in after-hours trading. The price has already risen by 150 percent this year.

- Robinhood's inclusion underscores the growing importance of crypto-focused companies in traditional financial markets, aided by an increasingly crypto-friendly political environment. Coinbase, the first major crypto exchange, was added to the S&P 500 Index in May 2025. Now Robinhood follows suit as another prominent player.

- The S&P 500 is the most important US stock index and includes the 500 largest publicly traded companies in the United States, making it a key indicator of the development of the American economy.

Recommended Video Bitcoin weak and gold stronger than ever – Is this the opportunity?