Bitcoin: Record options expiration causes BTC price to plummet

- Bitcoin (BTC) and the entire crypto market corrected significantly in the last 24 hours of trading. The BTC price fell to $108,623, back toward its monthly low and thus close to the so-called max pain level in the crypto options market.

- Options are financial derivatives that allow investors to bet on rising or falling Bitcoin prices using so-called calls and puts. At the time of purchase, they speculate on a desired future price development. The max pain price refers to the price of an underlying asset at which the largest number of open options (calls and puts) become worthless on the expiration date.

- For option providers (market makers), this is often the most profitable price because they retain the premium without having to exercise the options. For option buyers, it is the price at which they incur the greatest loss.

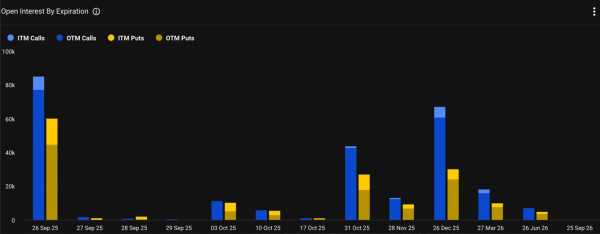

- The recent price decline of the leading crypto currency collided with the highest open interest ever recorded in the options market this Friday morning at 10:00 a.m. (CET).

- Market makers may have had a strong interest in pushing the price close to the max pain price shortly before expiration in order to allow as many options as possible to expire worthless and generate maximum profits.

- Professional investors, in particular, use the options market to speculate on future price increases and corrections. They hope to protect existing Bitcoin spot positions against a price decline. This is called hedging.

- Especially before the release of important economic data and monetary policy-relevant dates, which are expected to increase the volatility of an asset, investors position themselves with a variety of trading strategies in order to hedge against or profit from stronger price movements.

- Increased activity was already recorded last week on the options market Deribit, the largest provider of crypto options. Options traders increasingly bought options to hedge existing spot positions ahead of the key interest rate decision or to speculate on an anticipated surge in volatility following the interest rate decision.

- Such developments in the options market are often a clear sign of increased market uncertainty and the expectation of a larger price move. The recent Bitcoin sell-off may therefore be at least partly attributable to developments in the options market.

- If you want to buy Bitcoin safely and easily, you can do so on the regulated Bison exchange.

Recommended Video Massive breakthrough for stablecoins – billions for crypto?

Sources

- Options on Deribit | Deribit

- Options on Glassnode | Glassnode