TeraWulf’s Multi-Billion Dollar HPC Deal Backstopped by Google – A Blueprint for Future Hyperscaler Deals

Google has committed $3.2 billion to support TeraWulf’s HPC agreement with Fluidstack, potentially acquiring a ~14% stake. Could this signal a trend of hyperscale cloud providers collaborating with Bitcoin miners to meet energy and infrastructure demands?

TeraWulf Secures Landmark HPC Partnership

This guest analysis is provided by Bitcoinminingstock.io, a comprehensive resource for Bitcoin mining equities, educational materials, and market intelligence. Authored by Cindy Feng of Bitcoinminingstock.io, the original piece was published on August 22, 2025.

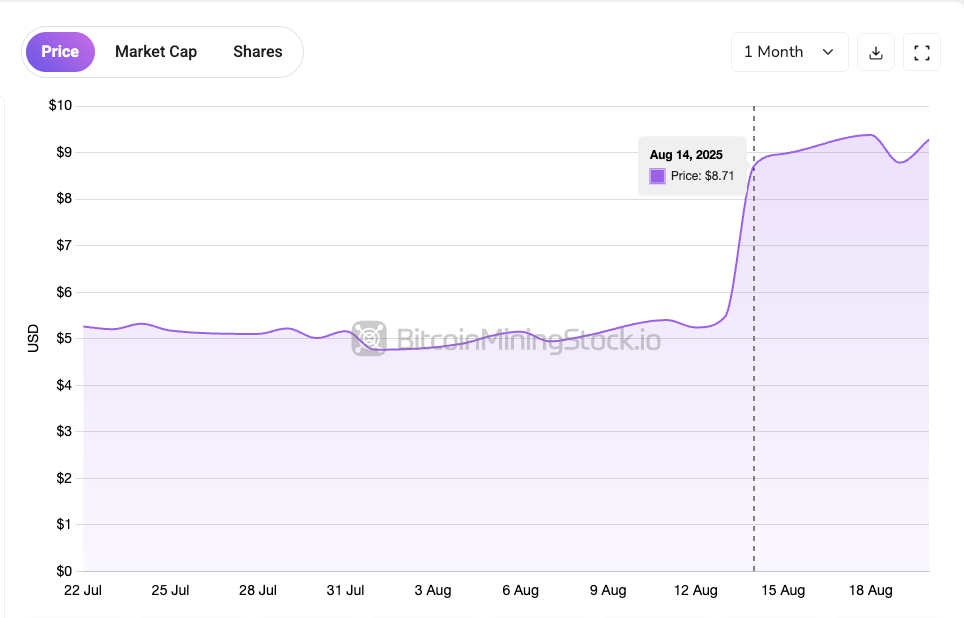

Another substantial high-performance computing agreement within the Bitcoin mining sector has materialized. Mirroring Core Scientific’s 2024 collaboration with CoreWeave, TeraWulf’s recent announcement sparked a ~60% stock surge as investors reacted to the multi-billion revenue potential. While financial projections dominate headlines, Google’s unprecedented involvement stands out. The tech giant has guaranteed $3.2 billion for the partnership and may secure up to 14% ownership via warrant conversions. This groundbreaking move marks the first instance of a top-tier hyperscaler engaging directly with a Bitcoin mining firm. Though not a traditional customer, Google’s backing reinforces industry speculation: cloud leaders increasingly value miners’ energy resources and data center capabilities.

$WULF shares jumped nearly 60% post-HPC agreement disclosure.

$WULF shares jumped nearly 60% post-HPC agreement disclosure.

TeraWulf’s arrangement gains heightened significance as it establishes a replicable framework for competitors, particularly those with expanded power networks and facilities. Below, key components of the agreement are analyzed alongside considerations for evaluating future hyperscaler-miner collaborations.

TeraWulf and Fluidstack: $6.7B Guaranteed Revenue with $16B Potential

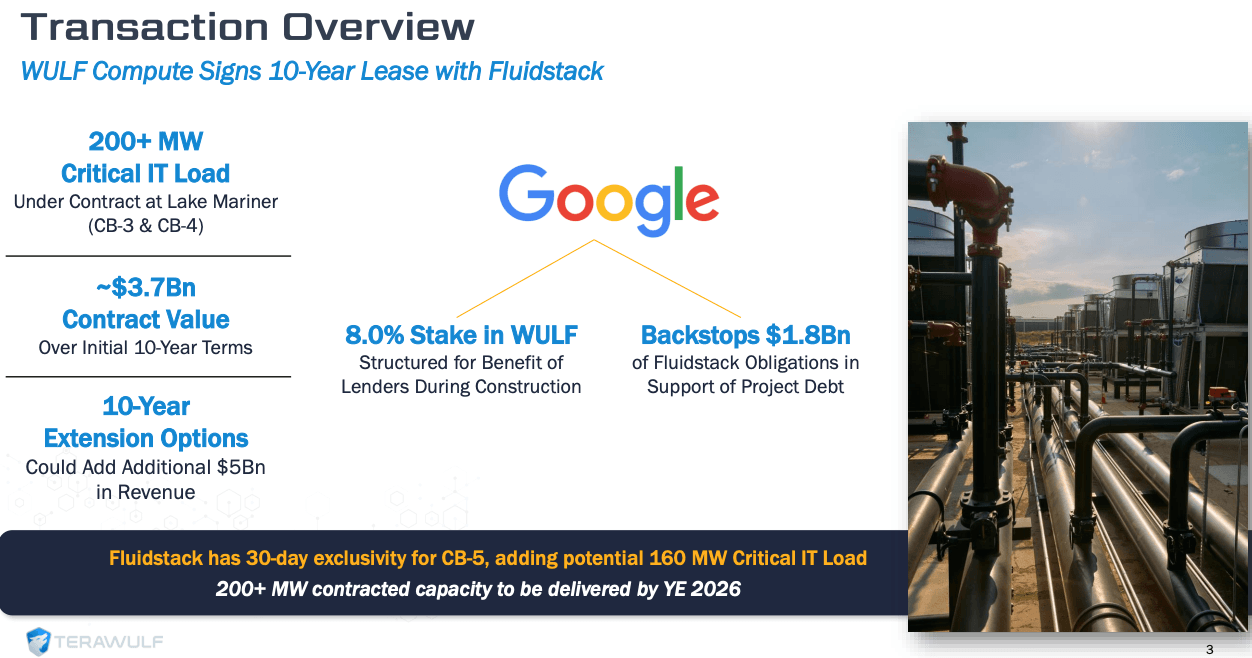

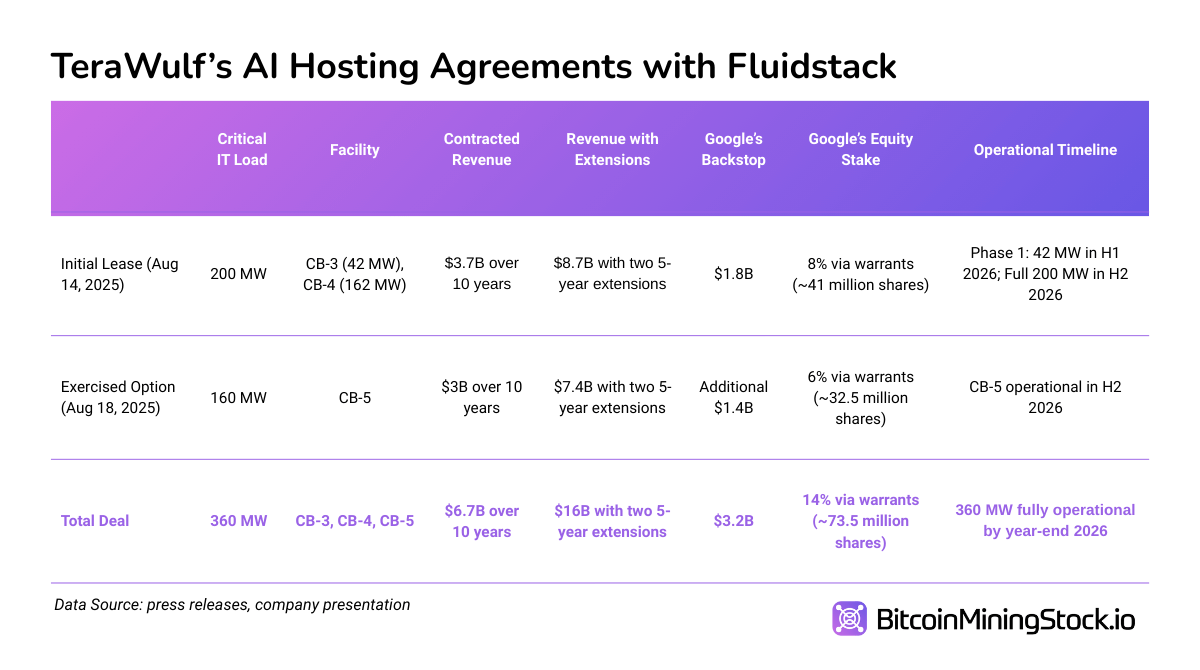

On August 14, 2025, TeraWulf revealed a decade-long HPC hosting contract with Fluidstack, covering 200+ MW at its New York-based Lake Mariner complex. The base term is projected to yield $3.7 billion, potentially rising to $8.7 billion with extensions.

Key terms of the 10-year lease (Source: TeraWulf presentation).

Key terms of the 10-year lease (Source: TeraWulf presentation).

The colocation model requires clients to supply hardware while TeraWulf delivers scalable power and customized data center space (CB-3/CB-4). Critical IT infrastructure for Fluidstack is slated for mid-2026 activation.

By August 18, 2025, Fluidstack expanded the partnership by securing CB-5, adding 160 MW. Total contracted capacity now reaches ~360 MW at Lake Mariner, translating to $6.7 billion in baseline revenue and up to $16 billion with renewals.

This follows TeraWulf’s 2024 alliance with G42 subsidiary Core42 for 72.5 MW at the same site. Combined commitments now exceed 420 MW for HPC infrastructure—surpassing its current 250 MW Bitcoin operations—signaling a strategic evolution toward dual-purpose infrastructure provision.

Google’s Dual-Role Engagement: Capital Assurance & Strategic Alignment

Google’s participation elevates TeraWulf’s deal beyond typical partnerships. The company has pledged $1.8 billion in lease obligation guarantees for initial project financing, increasing to $3.2 billion post-expansion. Notably, Google also underwrites Fluidstack’s termination protections for six years, stabilizing revenue streams and facilitating funding access.

In return, Google gains warrants for ~73.5 million TeraWulf shares. Full conversion would grant a 14% equity position, positioning Google among TeraWulf’s largest investors. Though non-dilutive initially, these warrants demonstrate strategic alignment with TeraWulf’s growth trajectory.

Beyond financial backing, Google’s endorsement enhances market confidence in TeraWulf’s infrastructure value, potentially catalyzing direct hyperscaler collaborations that redefine industry dynamics.

“The Google-backed $1.8 billion guarantee substantially strengthens our credit position, allowing access to scalable, cost-effective capital matching our expansion goals,” stated CEO Paul B. Prager during Q2 earnings.

HPC Expansion Financing: Asset-Light Strategy

TeraWulf adopts a capital-efficient approach for Fluidstack’s infrastructure, with clients bearing GPU/compute cluster costs—a move minimizing upfront hardware investments.

Prepaid hosting fees further support cash flow during construction, mirroring data center industry practices: secure long-term contracts to finance growth.

To accelerate development, TeraWulf initiated an upsized $850 million convertible note offering (from $400 million) on August 18. $743.2 million will fund CB-5 and related infrastructure, utilizing low-interest (1.00%) convertible debt to preserve liquidity while meeting aggressive 2026 timelines. Capped call provisions reduce dilution risks amid WULF’s strong price performance (55% YTD as of August 19, 2025).

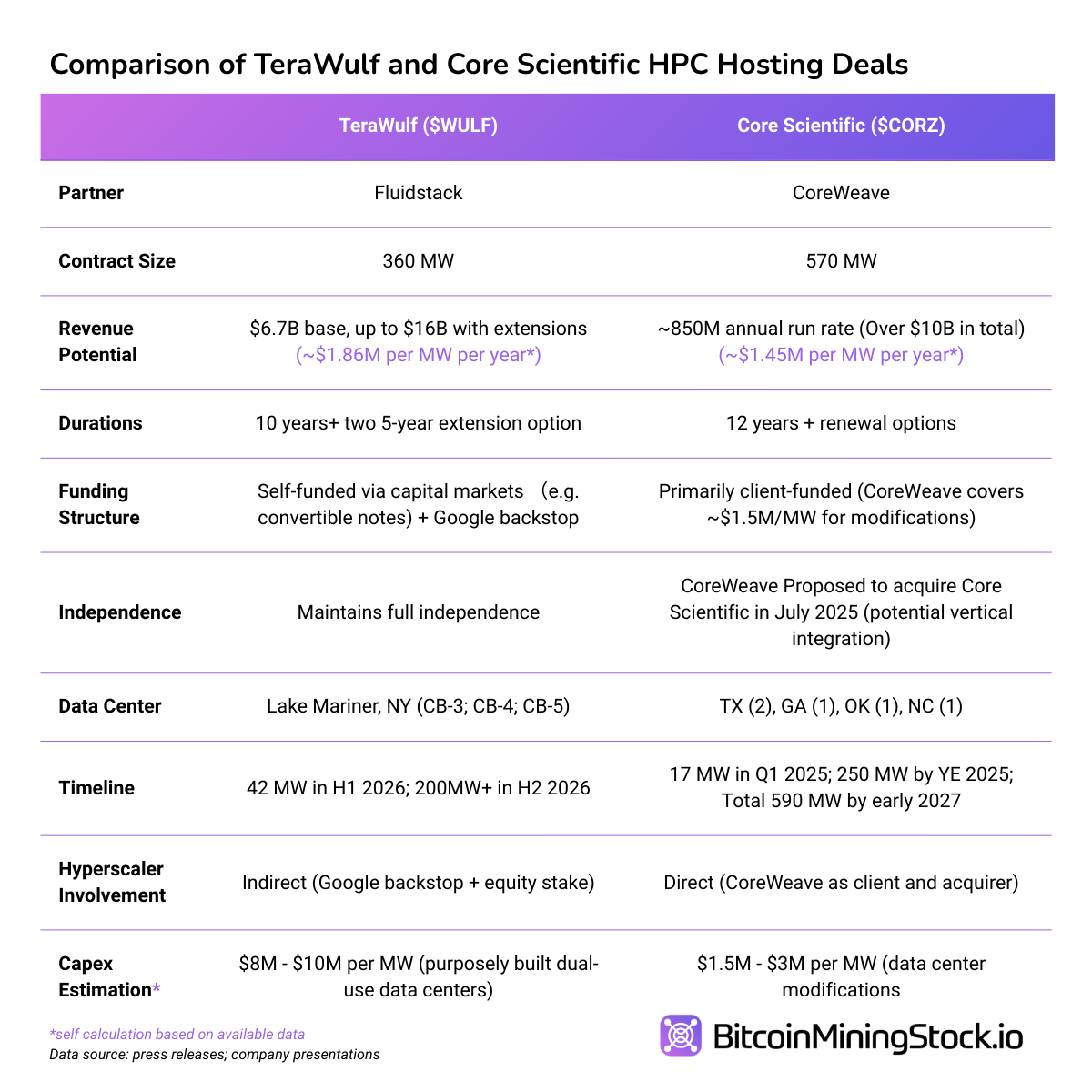

Contrasting Core Scientific’s Approach

While Core Scientific leverages scale and capital expenditure advantages, TeraWulf’s agreement offers greater revenue potential and hyperscaler validation through Google’s involvement—a sector first that may influence investor sentiment and future partnerships.

Conclusion

Though later to HPC hosting than some competitors, TeraWulf demonstrates that strategic execution outweighs early entry. From its 2024 Core42 pact to the 2025 Fluidstack deal, the company has transitioned from pure-play mining to hybrid infrastructure services. Unlike peers promoting AI transitions without concrete results, TeraWulf quietly secured one of the sector’s largest HPC contracts. Institutional ownership now exceeds 55%, reflecting confidence in its investor-aligned communication strategy that frames Bitcoin mining as a commodity business with transparent economics.

Google’s $3.2 billion guarantee and potential equity stake provide more than funds—they validate TeraWulf’s model, potentially attracting clients and investors. This partnership blueprint offers lessons for miners: align with strategic allies, articulate value in institutional terms, and optimize financing for repeated execution.

With HPC demand rising, operators who adapt infrastructure and messaging practically—without exaggeration—could secure future hyperscaler alliances. Partnerships with AWS, Microsoft, Meta, or Oracle may soon transition from improbable to achievable.

Source: cryptonews.net