Bitcoin's empty mempool raises concerns about network security

Bitcoin mempool activity has hit record lows and miner fees have fallen significantly, prompting some in the crypto community to express concerns about the long-term viability of the world's most valuable blockchain.

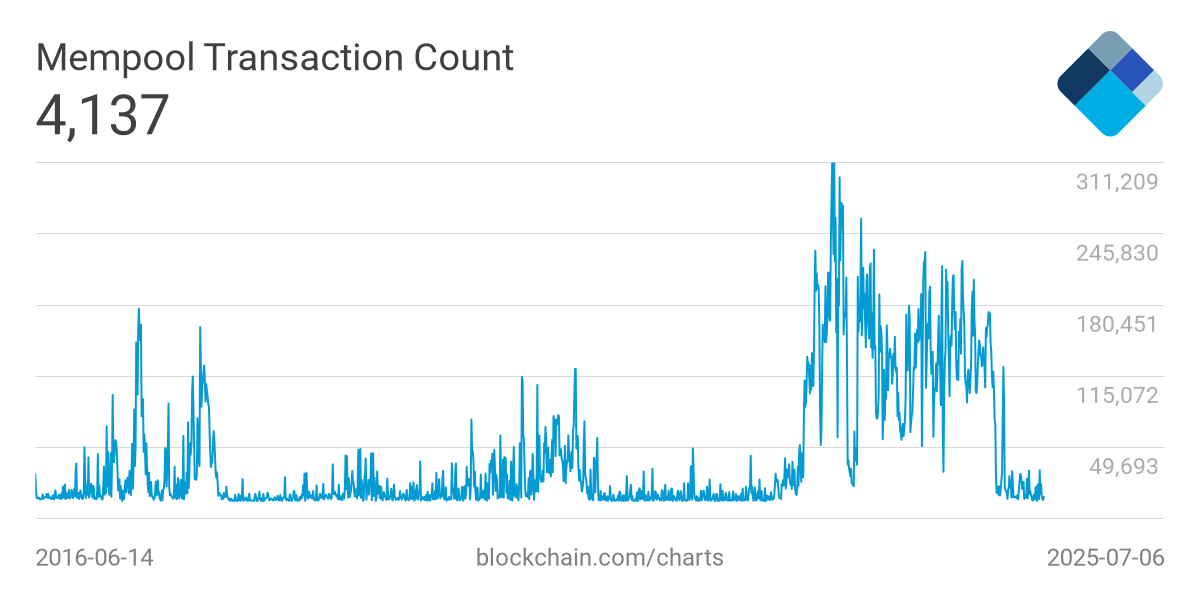

According to Blockchain.com, at the time of writing, there are only a few thousand unconfirmed transactions remaining in the Bitcoin mempool, significantly fewer than the hundreds of thousands seen during periods of peak demand, such as the post-halving Rune minting frenzy. Fee revenue currently represents less than 0.5% of total miner revenue, significantly lower than during previous bull markets.

“In simple terms, almost all of the real Bitcoin users have left. And the price has reached all-time highs,” said Joel Valenzuela, Dash’s head of business development, in a post on X. “We are facing a major crisis. Either the Bitcoin network will go bankrupt, undergo significant changes, or the asset will be completely taken over by custodial systems run by governments and institutions.”

Expected BTC transactions

Expected BTC transactions

The mempool is a queue of pending Bitcoin transactions that acts as a buffer when transaction demand exceeds block capacity. Users set fees to encourage miners to include their transactions in the next block. Fees increase as activity increases. However, when the mempool is empty, competition for block space disappears, resulting in lower fee revenue for miners.

Revenue decline for mining companies

With the mempool empty, miners are already feeling the pressure. Ethan Vera, COO of Luxor Technologies, a company that provides infrastructure for bitcoin mining, told The Defiant that bitcoin’s long-term security depends on either higher fees or a steady increase in price.

“We believe that continued investment in infrastructure and hashrate production is essential to the security of Bitcoin,” Vera added, emphasizing that “as block rewards decrease, it is critical that the price of Bitcoin increases and/or transaction fees increase…”

“So while low transaction fees are not a concern in the short term, they are important in the medium to long term, and miners should encourage more projects to use the block space and conduct transactions at the L1 level,” Vera said.

Others point to changes in user behavior patterns and protocol usage. For example, as doggfather, CEO of Doggfather Analytics, explained to The Defiant, retail investors are simply “not yet ready or willing to participate in this cycle, as they prefer to invest in ETFs and similar indirect instruments (such as exchange-traded bonds in other jurisdictions).”

Network security threat

Another factor contributing to the mempool being depleted is the lack of non-financial transaction activity. As doggfather noted, with the end of ordinals and fungible tokens like BRC-20 and runes, demand for the blockchain has plummeted.

“The mempool was overcrowded and fees were high when hot ordinals or rune coins were mined. The most famous block was created after the fourth halving at block 840,000. The fee for that block alone was 37,626 BTC ($2,402,245). Everyone was eager to get their Rune ticker first and willingly paid huge fees,” he said.

BTC Miner Market Share

BTC Miner Market Share

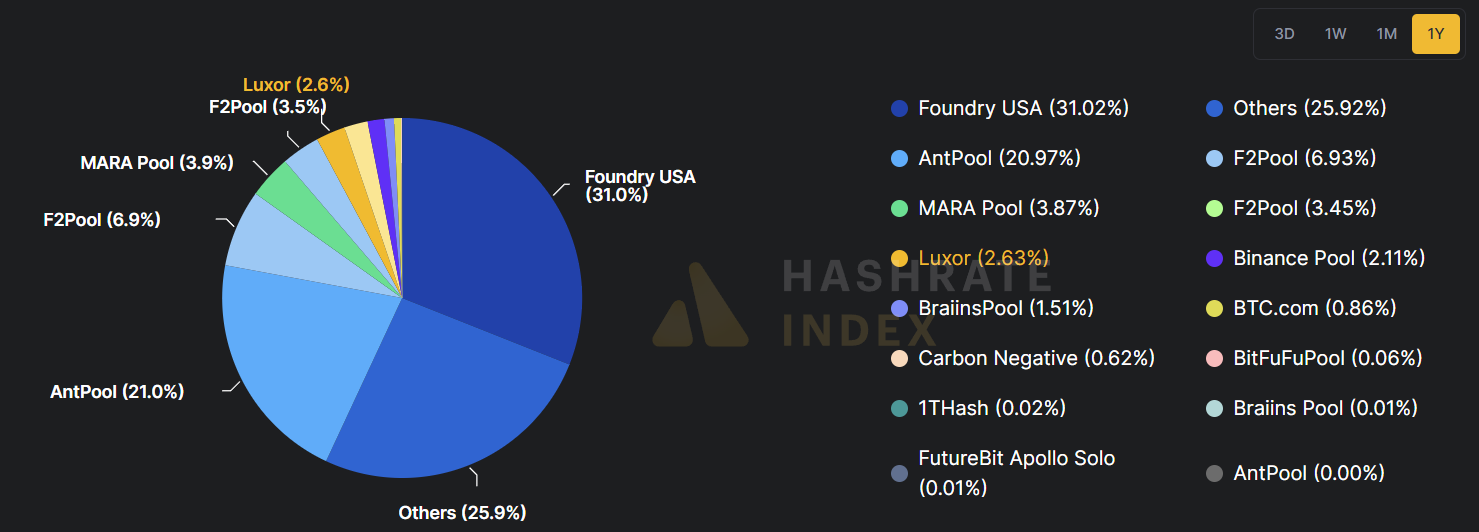

But the problems go much deeper than just usage. “Miners’ revenue from fees is currently a tiny fraction of a percent, which puts security at risk,” said Nishant Sharma, head of the Doma Protocol developer ecosystem. “What’s more, mining is centralized: the five largest pools, including Foundry and AntPool, control more than 60% of the blocks.”

Sharma highlighted grassroots mining as a potential way to combat centralization. He described a new mining pool model that charges no fees to participating miners, offers payouts via the Lightning Network, and is designed to allow small home miners to compete with dominant pools.

Source: cryptonews.net