Top 10 Miners Control 94% of the Hashrate and Own Over 55,000 BTC

According to the latest data from onchain, the top ten Bitcoin mining pools currently control a whopping 94.2% of the global hashrate, with a combined $6.52 billion in Bitcoin stored in their wallets.

Secret Stashes of the Largest Bitcoin Mining Pools and Their Counterparties

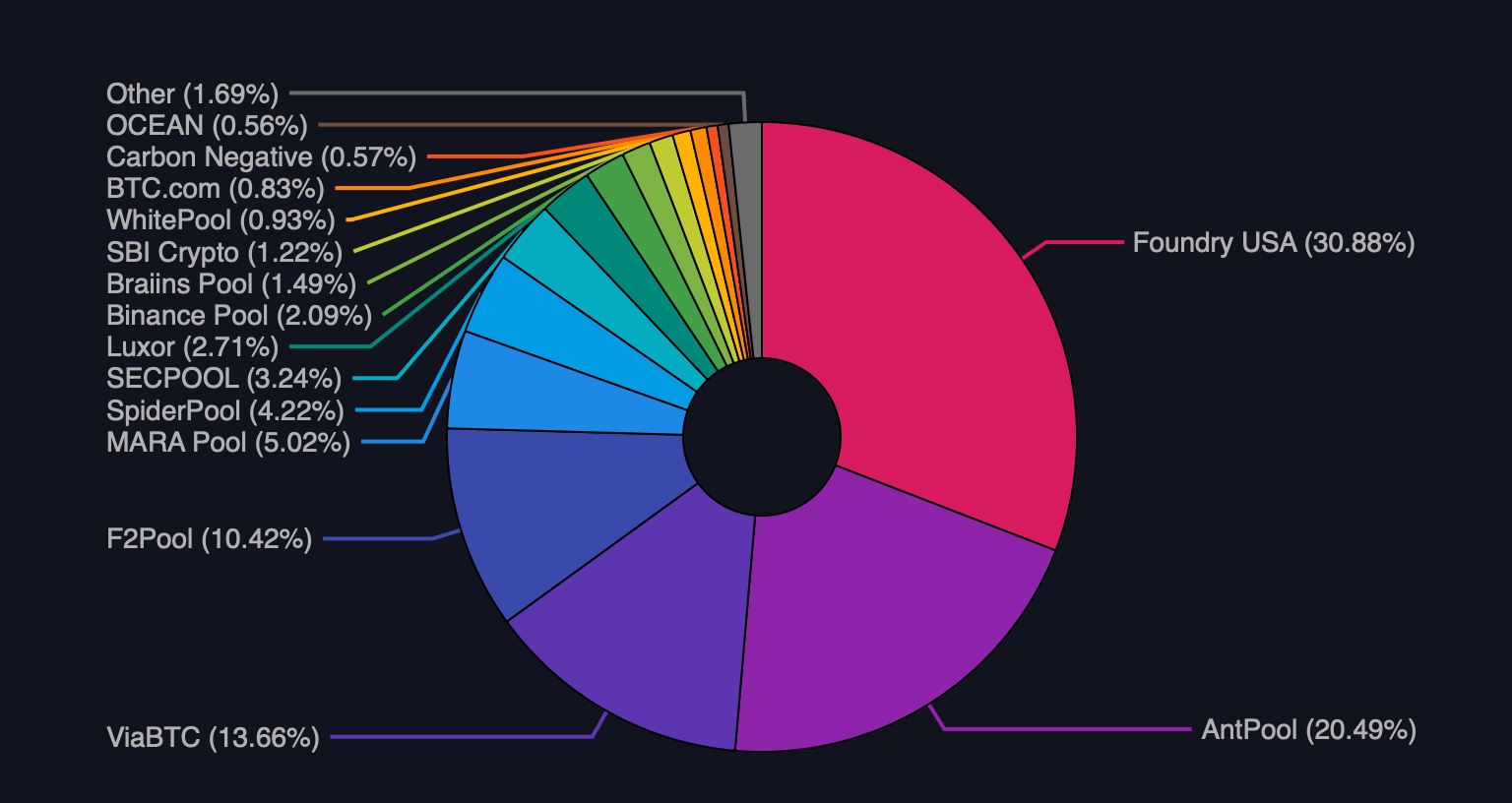

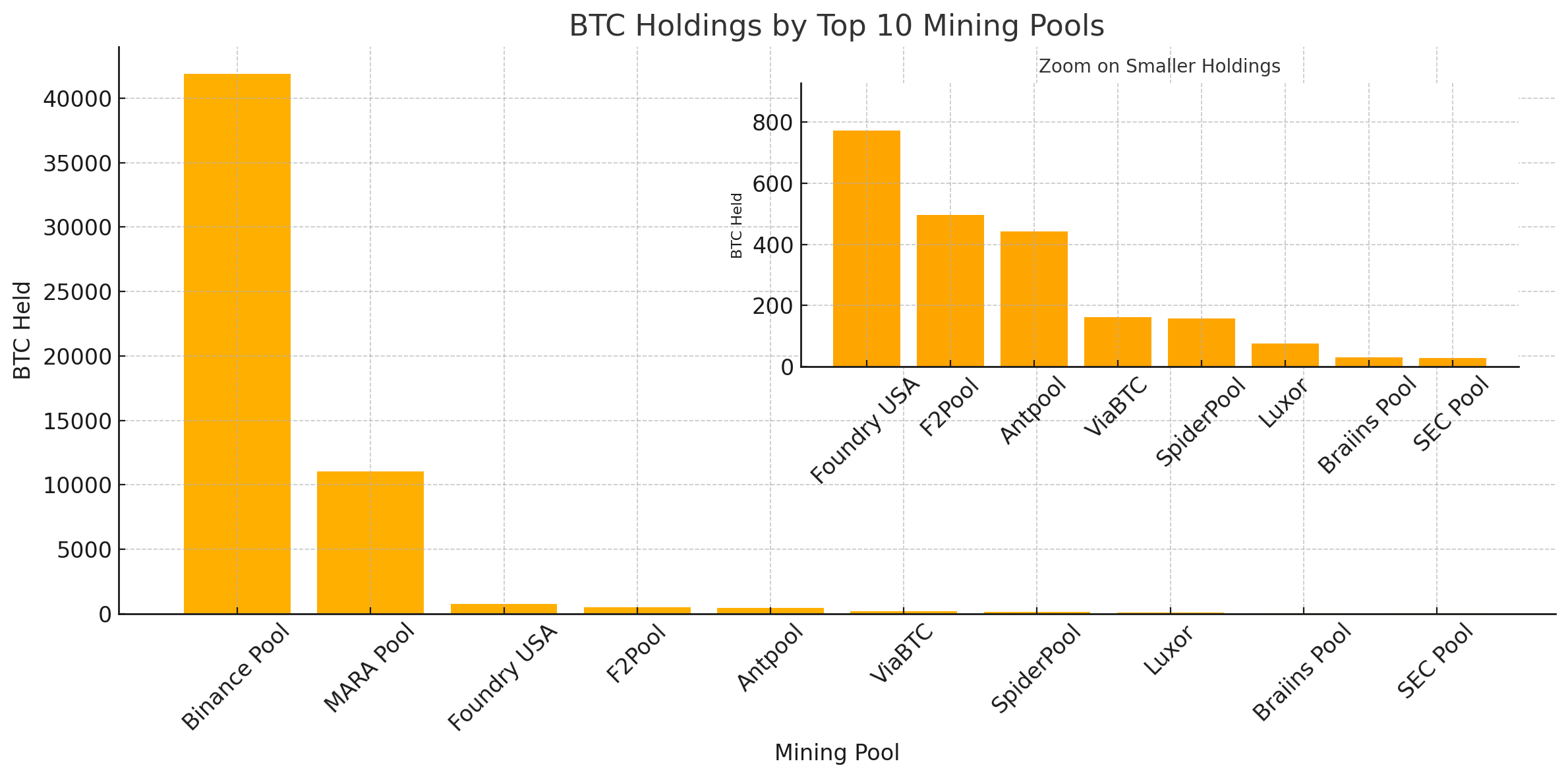

The top ten mining pools by block production volume today are Foundry, Antpool, ViaBTC, F2pool, MARA Pool, Spider Pool, SEC Pool, Luxor, Binance Pool, and Braiins Pool. Foundry holds the top spot with 30.88% of the global hashrate. On-chain data from Arkham Intelligence shows that Foundry wallets currently hold 772,652 BTC, equivalent to $91.2 million — a significant drop from the over 2,000 BTC it held in mid-March 2024.

In terms of counterparties, Foundry frequently interacts with Coinbase. Antpool is the second-largest hashrate provider, controlling 20.49% of the global supply. As of July 30, Antpool holds 441,839 BTC worth $52.15 million, and Coinbase is also its top counterparty. ViaBTC is third with 13.65% of the global hashrate, according to mempool.space statistics, and holds 162,086 BTC worth $19.13 million at the time of writing.

Hashrate distribution as of July 30, 2025 according to mempool.space.

Hashrate distribution as of July 30, 2025 according to mempool.space.

ViaBTC works closely with Coinex, which it owns and supports. The two companies are connected through shared infrastructure and services. F2pool accounts for 10.42% of the total hashrate and holds 495,322 BTC worth $58.46 million in its wallets. F2pool works with two key counterparties: Coinbase and custody company Cobo.

The MARA pool accounts for 5.01% of the total Bitcoin hash power. The company also acts as a Bitcoin treasury, holding a significant 50,000 BTC. MARA’s mining wallets hold 11,034 BTC, worth $1.3 billion. Most of these funds are likely stored in NYDIG Custody, and blockchain data shows that MARA also regularly transacts with Foundry. Spider Pool controls 4.22% of the total Bitcoin hash power and holds 157,994 BTC, worth $18.65 million.

Spider Pool regularly interacts with Coinbase. Next is SEC Pool, which contributes 3.24% of the network hashrate. SEC Pool currently holds around 28,616 BTC worth $3.38 million in its wallets. On-chain activity shows that SEC Pool interacts with both Cobo and Coinbase, although Coinbase appears to be the more active partner. Luxor Technology, which ranks eighth in hashrate, controls 2.71% of the network’s hashrate. Luxor Tech currently holds 75,278 BTC worth $8.91 million. Like many others, Luxor also regularly transacts with Coinbase.

Binance Pool is in ninth place with a relatively small share of 2.09% of the global hashrate. However, Binance Pool wallets tracked by Arkham show an impressive 41,919 BTC under management, which is worth $4.96 billion. Braiins Pool, formerly known as Slush, rounds out the top ten with 1.49% of the global hashrate. Braiins wallets hold 30,983 BTC, which is worth $3.67 million at the current rate. The top ten Bitcoin mining pools currently hold a combined 55,117.77 BTC, which is worth $6.52 billion.

The huge volume of Bitcoin held by these leading miners highlights their dual role as both infrastructure providers and long-term stakeholders. Their combined wealth, running into the billions, makes them some of the most influential economic players in the protocol, in addition to securing the network.

This concentration of assets suggests that these pools are not simply selling block rewards, but are hoarding them for strategic purposes. Some do so openly, others covertly. Whether as treasury reserves, collateral, or institutional leverage, this growing volume of BTC makes miners powerful players in the evolving Bitcoin financial ecosystem.

Source: cryptonews.net