XRP Price Analytics: Faces $3.04 Resistance as RSI Neutral, MACD Turns Bullish

Token Stabilizes Above $2.98 Support Following $273M Volume Surge in Tuesday Trading

By Shaurya Malwa, CD AnalyticsUpdated Aug 28, 2025, 5:47 a.m. Published Aug 28, 2025, 5:47 a.m.

Key Highlights:

- XRP gained approximately 9% weekly, hovering near the $3.00 threshold.

- Gemini’s XRP-rewards Mastercard collaboration with WebBank, offering 4% cashback, propelled its app ranking past Coinbase.

- Daily institutional inflows into XRP-linked products hover around $25 million, contributing market liquidity.

Market Context

- XRP prolonged its late-August rally, advancing nearly 9% weekly while oscillating near the $3.00 mark.

- Gemini’s WebBank-partnered XRP rewards card launch elevated its U.S. iOS app position above Coinbase.

- Institutional investment in XRP products averages $25 million per day, enhancing market stability.

- Analysts eye potential upward breakouts, with long-term technical objectives near $27 if consolidation resolves bullishly.

Price Movement Overview

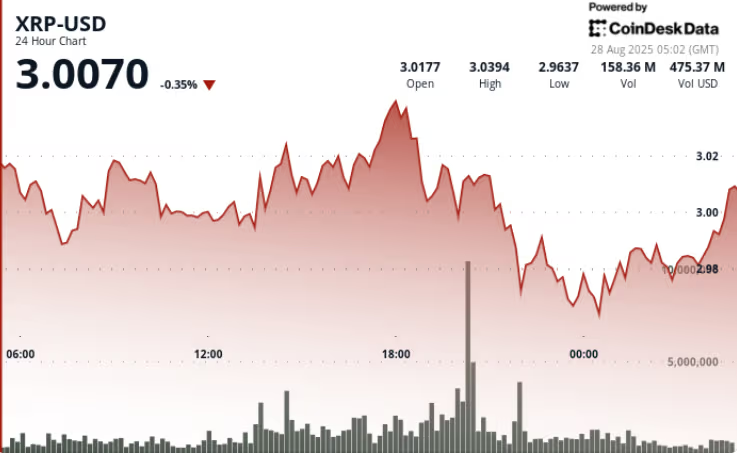

- Over the 24-hour period ending August 27 at 04:00 GMT, XRP fluctuated between $2.95 and $3.05, settling at $2.98 with a 1.3% daily dip.

- Peak trading occurred at 20:00 GMT, witnessing 273.15 million volume — quadruple the 62.47 million average — as prices briefly hit $3.05 before retreating.

- During the final hour (03:04–04:03 GMT), XRP stabilized between $2.97 and $3.08, with repeated holds above $2.975 support.

- Notable volume jumps of 1.31M at 03:59 and 1.19M at 03:07 GMT aligned with brief pushes toward $2.99 resistance.

Technical Indicators

- Support: The $2.975–$2.98 zone remains a critical baseline after repeated successful holds.

- Resistance: Upside attempts face firm barriers at $3.02–$3.04 amid persistent selling pressure.

- Momentum: RSI hovering mid-50s signals neutrality; MACD histogram edges toward a possible bullish crossover.

- Volume: A 273M peak highlights institutional engagement but reflects profit-taking near resistance.

- Patterns: Tight trading near $3.00 indicates accumulation, with bullish potential if $3.04 resistance breaks.

Trader Focus Areas

- Bullish scenarios target $3.20 upon clearing the $3.02–$3.04 barrier.

- Bearish triggers include a drop below $2.96, followed by $2.94 support.

- Market participants gauge whether Gemini’s card adoption boosts retail XRP demand.

- Sustained institutional inflows exceeding $25M daily remain pivotal for upward momentum.