Tokenized Treasuries Hit $5B as Fidelity Investments Touts RWA Collateral Potential

Tokenized Treasuries Reach $5B as Fidelity Highlights RWA's Potential as Collateral

Cynthia Lo Bessette said using tokenized assets to meet margin calls could help asset managers improve capital efficiency.

Christian Sandor | Edited by Nikhilesh De , 25 Mar 2025 22:16 UTC

What you need to know:

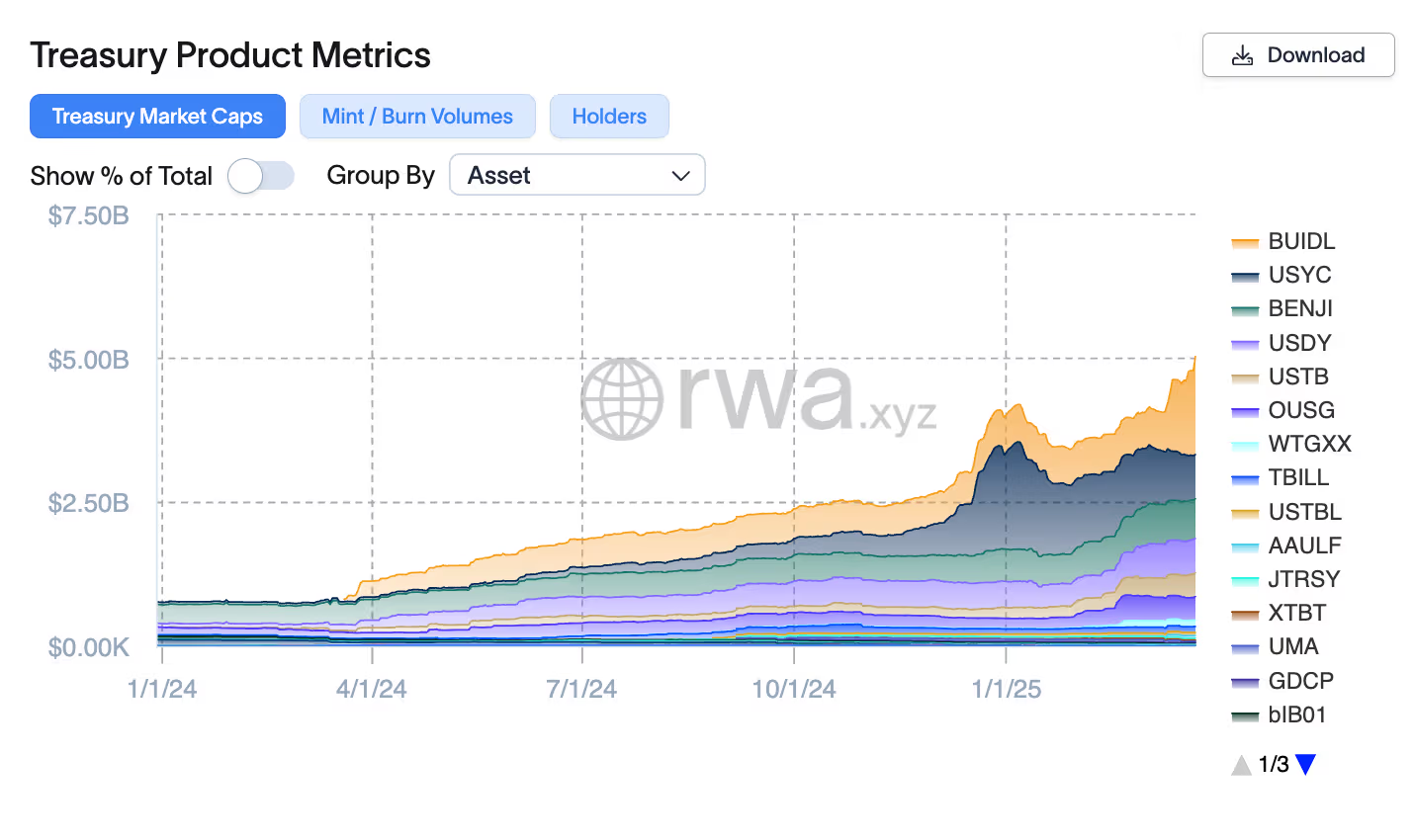

- The market value of tokenized US Treasury bonds has exceeded $5 billion for the first time, according to rwa.xyz.

- This asset class is increasingly being used as a reserve asset for decentralized financial protocols, as well as as collateral in trading and asset management.

- The growth is expected to continue as DeFi protocol Spark aims to raise $1 billion and new players like Fidelity Investments enter the market.

The market value of tokenized US Treasuries surpassed $5 billion for the first time this week, according to rwa.xyz, driven by increased demand for real-world assets (RWAs) based on blockchain.

The asset class has surged by $1 billion in just two weeks, thanks to inflows from major asset manager BlackRock and digital asset leader BUIDL Securitize.

Tokens backed by U.S. Treasury bonds are at the forefront of a tokenization trend that has engulfed many major players in global financial markets and digital asset companies. Fidelity Investments has become the latest major U.S. asset manager to seek tokenized money market funds, filing for regulatory approval last week to launch its Fidelity Treasury Digital Liquidity on the Ethereum blockchain.

“We see tremendous potential in tokenization and its ability to transform financial services by improving transaction efficiency with access to and distribution of capital in markets,” Cynthia Lo Bessette, head of Fidelity Digital Asset Management, said in a statement to CoinDesk.

Tokenized treasuries allow investors to stake their idle funds on the blockchain to generate income, similar to money market funds. They are also increasingly being used as a reserve asset for decentralized finance (DeFi) protocols. Another promising application for these tokens is their use as collateral in trading and asset management.

“When considering various use cases, the placement of a tokenized asset

Источник