From Binance to Satoshi: These are the richest crypto owners in the world

- The blockchain analytics platform Arkham Intelligence has identified the world's richest crypto owners. Instead of looking at individual wallets, Arkham aggregates related addresses into so-called entities, such as exchanges, DeFi protocols, or companies.

- This provides a clearer picture of who actually controls the largest holdings in the market. The top 10 collectively hold more than $860 billion in assets. With a total market capitalization of around $4 trillion, this represents approximately 20 percent of the market.

- Binance ($209 billion): The world's largest crypto exchange is by far the leader. Its wallets pool not only trading liquidity but also client funds held in escrow.

- Coinbase ($156 billion): The US giant primarily dominates the North American market. The majority of its assets belong to users, demonstrating strong demand from retail and institutional investors.

- Satoshi Nakamoto ($125 billion): The mysterious Bitcoin inventor is said to hold approximately 1.1 million BTC, untouched since the network's creation. This makes “Satoshi” one of the richest individuals in the world.

- BlackRock ($101 billion): The world's largest asset manager secured its place through the massive success of its Bitcoin and Ethereum ETFs, which have channeled billions of client funds into crypto.

- Lido ($70 billion): The leading liquid staking protocol for Ethereum demonstrates how deeply DeFi structures have become entrenched in the market. Lido pools ETH from hundreds of thousands of investors, which is used for staking rewards.

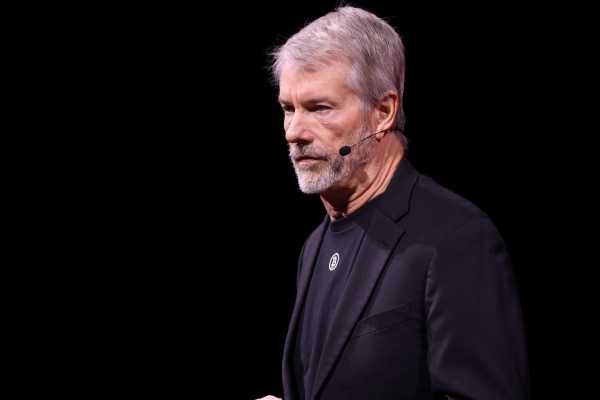

- MicroStrategy ($53 billion): Michael Saylor's firm remains synonymous with Bitcoin treasury strategy. With over 466,000 BTC, MicroStrategy is the world's largest publicly traded Bitcoin holding company. (Editor's note: According to Arkham data, MSTR owns 466,000 BTC; according to its own figures, it owns 638,460 BTC.)

- Fidelity Custody ($47 billion): The US investment giant offers custody for institutional clients. These billions demonstrate how heavily traditional financial players are now invested in crypto.

- Grayscale ($34 billion): Known for its Bitcoin Trust (GBTC), Grayscale has been managing institutional capital in the crypto market for years. Following ETF approval in the US, volumes have restructured but remain enormous.

- Upbit ($33 billion): South Korea's largest exchange reflects the strong Asian crypto appetite. Retail investors in Korea, in particular, are driving trading volume.

- Aave ($32 billion): The leading DeFi lending protocol ranks tenth. Billions of dollars in crypto assets are locked in its smart contracts, demonstrating the growth of lending and interest rate markets on the blockchain.

Recommended Video: Can Dogecoin now push Bitcoin & Altcoins?

Sources

- Report from Arkham Intelligence | Arkham Intelligence

- Holdings of Strategy | Strategy

Eine Quelle: btc-echo.de