Cantor Soars 130% As FOMO Traders Enter CEP Amid Bitcoin SPAC Frenzy

Cantor Surges 130% As FOMO Traders Invest In Stocks Amid Bitcoin SPAC Frenzy

Investors Flock to Cantor Equity Partners Amid Expected Merger with Twenty One Capital

James Van Straten, AI Boost | Edited by Parikshit Mishra Updated April 24, 2025, 8:45 PM Published April 24, 2025, 12:49 PM

What is important to know:

- Market cap still lags behind domestic BTC exposure: Twenty One plans to manage over 42,000 BTC, the third-largest government treasury.

- After the conversion, the ownership stake is mostly held by insiders, with public shareholders retaining only 2.7% but having the ability to gain significant leverage to drive BTC higher.

Shares of Cantor Equity Partners (CEP) surged 55% on Tuesday and are up another 15% in pre-market trading to trade below $19.

The company's rise in value was driven by investor optimism about a proposed merger with Twenty One Capital, a dedicated bitcoin (BTC) investment vehicle backed by Tether, Bitfinex and SoftBank.

Led by Strike CEO Jack Mallers and Brandon Lutnick, Twenty One Capital is seen as a public proxy for Bitcoin, potentially holding over 42,000 BTC at launch and using metrics like Bitcoin Per Share (BPS) and Bitcoin Revenue Rate (BRR) to value shares in BTC.

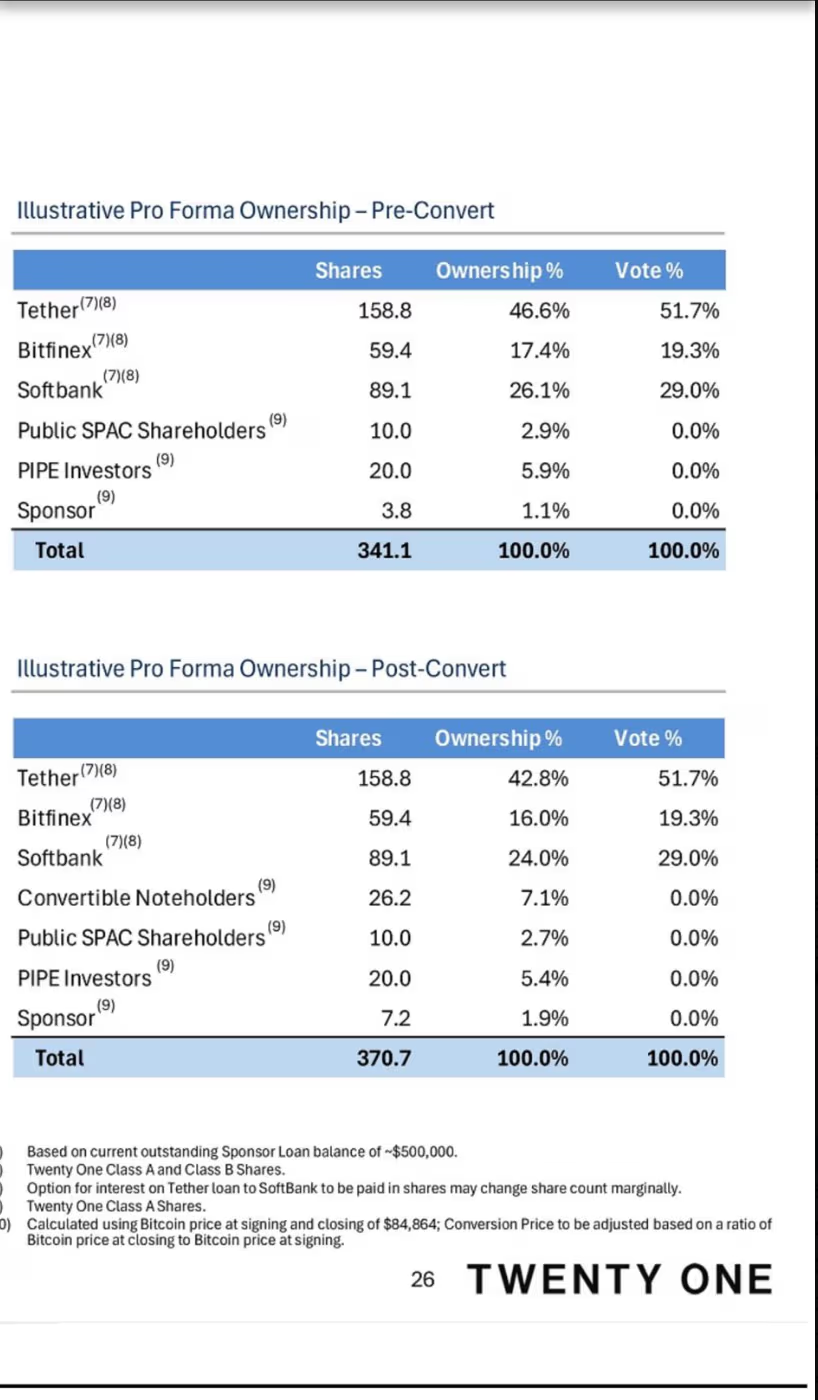

According to the latest shareholding tables, Tether will control 42.8% of the equity and 51.7% of the voting rights, while Bitfinex and SoftBank will own 16.0% and 24.0% of the company, respectively, after the conversion. The SPAC’s public shareholders will retain only 2.7% ownership, highlighting the significant dilution but suggesting significant upside if BTC rises.

With BTC trading at around $94,000 and the entity holding roughly $4 billion in BTC, investors are re-evaluating CEP as a high-yield bet on institutional adoption of bitcoin. The shares are set to relist under the ticker “XXI” once the merger is complete.

Disclaimer: This article or parts of it were generated by AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI policy.