Bitcoin’s Path to $1.5M: Ark Invest’s Ultra-Bullish BTC Roadmap – Markets and Prices Bitcoin News

Bitcoin could soar to $1.5 million by 2030, Ark Invest’s Big Ideas 2025 report predicts, citing surging institutional adoption, resilient market demand, and its growing role as “digital gold.”

Ark Invest’s Bold Bitcoin Price Predictions

Ark Investment Management (Ark Invest) unveiled its “Big Ideas 2025” report earlier this month, highlighting key technological and financial trends expected to shape the future. Covering innovations in artificial intelligence, robotics, energy storage, blockchain technology, and digital assets, the report emphasizes how these disruptive forces could drive exponential growth.

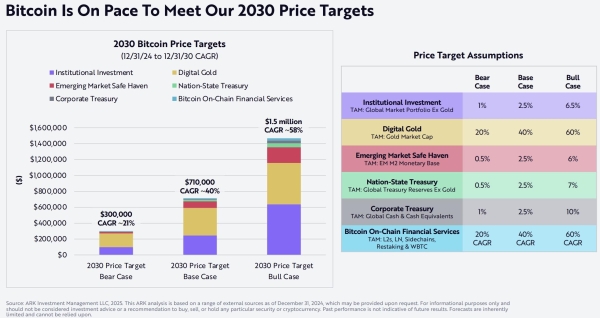

One of its most significant insights is the firm’s bullish stance on bitcoin, which it sees as a transformative financial asset gaining mainstream acceptance. Ark outlines three potential price scenarios for bitcoin by 2030: a conservative bear case of $300,000, a base case of $710,000, and an aggressive bull case predicting a staggering $1.5 million per bitcoin. These forecasts are based on increasing institutional adoption, bitcoin’s growing role as “digital gold,” and its integration into corporate treasuries and nation-state reserves.

In previous years, Ark made similar projections, maintaining its bullish outlook on bitcoin with a forecast of around $1.5 million per BTC by 2030. CEO Cathie Wood has reiterated this estimate, emphasizing bitcoin’s increasing institutional adoption and its role as a unique asset class.

Bitcoin’s resilience in 2024 is a focal point of the Big Ideas 2025 report, particularly its ability to absorb large sell-offs without significant price drops, Ark explained. The German government’s sale of 50,000 BTC and the Mt. Gox creditor repayments of over 109,000 BTC tested the market, yet bitcoin’s price climbed from $53,000 to $68,000, reflecting strong demand. Additionally, bitcoin’s aggregate cost basis reached an all-time high of $40,980 per BTC, indicating increased investor confidence.

Institutional interest remains a major driver of bitcoin’s projected growth. The report details the expanding presence of bitcoin on corporate balance sheets, with the total value rising from $11 billion in 2023 to $55 billion in 2024. Moreover, the introduction of spot bitcoin exchange-traded funds (ETFs) in the U.S. marked a historic milestone, attracting over $4 billion in inflows on the first day of trading. With the 2024 halving further tightening supply, Ark anticipates continued long-term appreciation in bitcoin’s value.