Bitcoin News: BTC Strength Amid Nasdaq Slide Impresses, But Potential Basis Trading Explosion That Catalyzed COVID Crash Is Risky

Bitcoin Price Stability Under Threat from Possible 'Basis Trading Explosion' That Catalyzed the COVID Crash

Market volatility threatens $1 trillion in underlying Treasury bond trading, with a potential explosion likely to trigger a global surge in demand for cash.

Author: Omkar Godbole | Edited by: Sam Reynolds Updated: April 6, 2025, 15:28 Published: April 6, 2025, 08:46

What you should know:

- Bitcoin's stability amid Nasdaq wobbles points to its potential as a safe-haven asset, although bond market risks remain.

- A potential collapse in the $1 trillion Treasury bond trade could spark a global rush to cash, leading to a sell-off in all assets, including Bitcoin.

- A similar situation was observed in mid-March 2020, when the underlying trading volume amounted to $500 billion.

Bitcoin's (BTC) recent stability amid tariff-fueled turmoil on the Nasdaq has raised concerns among market participants about its potential as a safe-haven asset.

However, bulls should keep a close eye on the bond market, which could see similar dynamics to the COVID crash of March 2020.

The Nasdaq, a Wall Street tech index that is known to be positively correlated with bitcoin, has fallen 11% since President Donald Trump announced retaliatory tariffs on 180 countries on Wednesday, exacerbating trade tensions and prompting retaliatory measures from China.

Other US indices and global markets also suffered losses amid sharp falls in risk currencies such as the Australian dollar and a decline in gold prices.

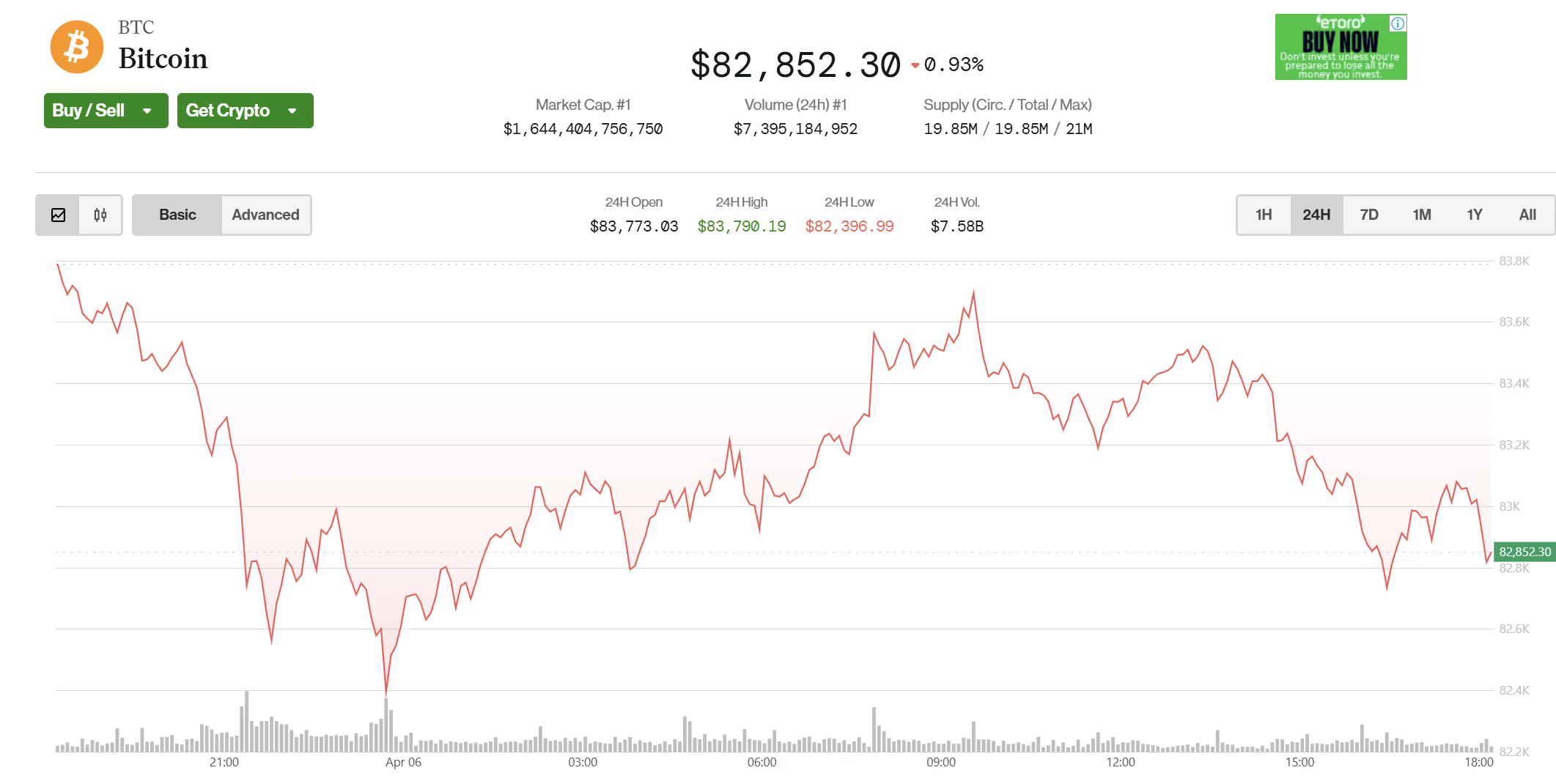

Overall, BTC remains stable, trading above $80,000, and its resilience is seen as a sign of its emergence as a macro hedge fund.

“The S&P 500 is down about 5% this week as investors brace for trade-induced profit headwinds. Meanwhile, Bitcoin has shown impressive resilience,” David Hernandez, a crypto investment expert at 21Shares, said in an email to CoinDesk. “After a brief dip below $82,000, it quickly recovered, solidifying its status as a macro hedge amid macroeconomic stress. Its relative strength could continue to attract institutional investment if overall market volatility persists.”

The feeling of stability could quickly turn into a self-fulfilling prophecy, cementing BTC's position as a safe-haven asset for years to come, as MacroScope notes in X.