Bitcoin Market Cycle Reflects Structural Similarities to 2015–2018, Says Glassnode – Markets and Prices Bitcoin News

Bitcoin’s current bullish trajectory exhibits striking similarities to the 2015–2018 market cycle, as illuminated in a recent Glassnode report co-authored by analysts Cryptovizart and Ukuria OC.

Bitcoin’s ‘Calm Before the Storm’: Data Reveals 2015-Like Countdown to Price Explosion

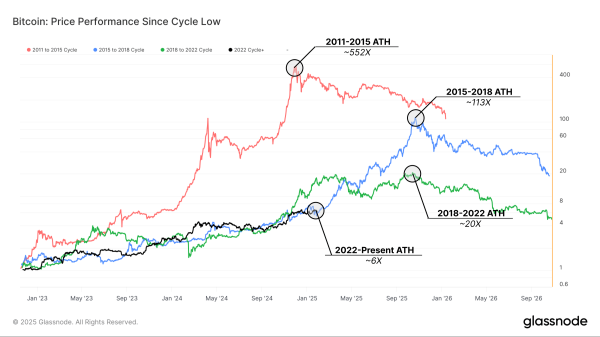

The leading cryptocurrency’s price gains have moderated progressively across successive cycles, signaling an evolution toward a more seasoned market, the latest Glassnode study notes. Retracements in this cycle closely mirror those observed between 2015 and 2017, with corrections consistently hovering near Fibonacci thresholds of 10.1% to 23.6%. Historical precedents hint at bitcoin approaching a pivotal inflection point, akin to prior bull-market acceleration stages.

Capital inflows, measured via realized capitalization, have expanded 2.1-fold this cycle—a marked contrast to the 5.7-fold peak of its predecessor. Glassnode further observes this growth pattern aligning with mid-2010s trends. Metrics imply euphoric investor behavior remains subdued, leaving room for additional market escalation.

Centralized exchange reserves have dwindled to 2.7 million BTC since mid-2024, down from 3.1 million. The analysts attribute this not to scarcity pressures but to migration toward ETF custodians—particularly Coinbase-managed wallets. When combining exchange and ETF holdings, the aggregate supply remains steady near 3 million BTC, challenging narratives of imminent scarcity.

The report explains that historically, bull markets thrive when veteran investors gradually transfer assets to newcomers. Glassnode reveals 1.1 million BTC shifted from long-term to short-term wallets during bitcoin’s climb past $100,000. This dynamic highlights the critical role of fresh capital in maintaining upward price trajectories.

While bitcoin’s macro trend remains decidedly bullish, Glassnode cautions that intense distribution phases often precede periods of waning demand. Should historical rhythms persist, the market may ultimately pivot toward accumulation-driven stability rather than speculative trading frenzies.