Bitcoin Holds Steady Near $96.5K as Market Weighs Competing Forces – Markets and Prices Bitcoin News

BTC continues to trade within a tight range as investors monitor the macroeconomic landscape and gauge conflicting market signals.

Conflicting Market Pressures See BTC Stabilizing at $96.5K

Bitcoin (BTC) is maintaining a cautious upward trajectory, trading at $96,540.34 at the time of reporting. This marks a modest 0.25% increase over the past 24 hours and a 1.75% gain over the past week. Despite recent fluctuations, BTC remains within a relatively narrow range, with a 24-hour price span of $93,388.83 to $96,695.38, signaling ongoing consolidation in the market.

Trading Volume Surges as Market Activity Picks Up

Bitcoin’s 24-hour trading volume has seen a notable spike, rising 38.59% to $37.05 billion. This increase suggests growing participation from traders, yet the price remains constrained, reflecting a tug-of-war between bullish and bearish sentiment. Meanwhile, bitcoin’s total market capitalization stands at $1.91 trillion, up slightly by 0.22% from yesterday.

“Bitcoin’s swift rebound after hitting a two-week low is in keeping with the price inertia we’ve seen since December,” said Neil Roarty, cryptocurrency analyst at Click Out Media. “Both bulls and bears remain hesitant, and as a result, bitcoin continues to trade within a relatively tight band.”

Bitcoin Dominance Slightly Slips as Altcoins Regain Ground

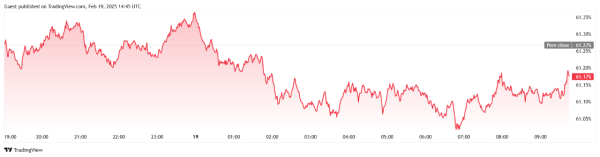

BTC’s market dominance has declined slightly by 0.22% over the past 24 hours, now standing at 61.12%, according to Trading View. This shift suggests that some capital is rotating into alternative cryptocurrencies, despite lingering negative sentiment in the broader market in the wake of the ever-deepening Libra memecoin debacle.

Futures Open Interest Rises, But Liquidations Highlight Risk

In the derivatives market, BTC futures open interest has climbed by 0.37% to $61.93 billion, according to Coinglass, indicating a moderate increase in speculative positioning. However, liquidation data highlights continued volatility. Over the past 24 hours, total bitcoin liquidations reached $93.48 million, with long positions accounting for $74.22 million and short liquidations totaling $19.26 million. The imbalance suggests that overleveraged bullish traders have faced setbacks amid BTC’s choppy price action.

Institutional Moves Add to Market Uncertainty

Adding to the market’s mixed signals, Strategy announced a proposed $2 billion private offering of convertible senior notes yesterday, with proceeds potentially earmarked for bitcoin acquisitions. As the largest corporate holder of BTC, Strategy’s planned investment could inject further buying pressure into the market, counteracting recent bearish sentiment.

“Negative sentiment towards crypto following Milei’s questionable endorsement of the Libra memecoin has been balanced by news that bitcoin’s biggest bull, Michael Saylor of the world’s largest corporate crypto holder Strategy, is eyeing up further purchases,” Roarty remarked.

Bitcoin Market Outlook

Bitcoin’s recent price action suggests that the market remains in a holding pattern, with neither bulls nor bears able to assert dominance. Despite increased trading activity and institutional interest, BTC has yet to break decisively out of its multi-month range.

“What’s it going to take to break us out of this three-month holding pattern?” Roarty asked. “Probably a more decisive commitment to interest rate cuts from the Federal Reserve. Until then, expect bitcoin price action to continue ebbing and flowing,” he added.