Bitcoin (BTC) price posts worst first quarter in a decade, casting doubt on cycle dynamics

Bitcoin Posts Worst First Quarter in Ten Years, Raising Questions About Current State of Cycle

BTC fell 11.7% in the first quarter of 2025, its lowest since 2015, as investors sold off assets amid economic uncertainty.

Author: Francisco Rodriguez | Edited by: Aoyon Ashraf April 6, 2025, 5:00 PM

Key points:

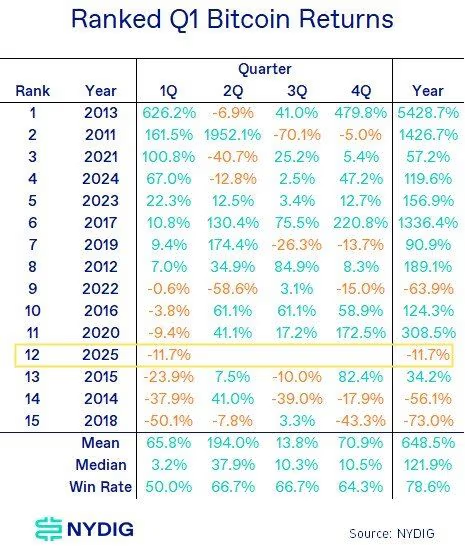

- Bitcoin's 11.7% decline in the first quarter ranked 12th out of 15 and was the worst first quarter since 2015, according to NYDIG Research.

- This fact has sparked debate about the current stage of the cryptocurrency market cycle.

- Uncertainty in tariff policy and profit-taking were the main reasons for the sell-off.

Bitcoin just posted its worst first quarter in a decade, falling 11.7% as markets tried to sort out the new administration's economic agenda.

This result ranked 12th out of 15 first quarters, according to NYDIG Research.

The decline raises a familiar question in the crypto community: Has the cycle ended? The last time Bitcoin had such a bad start to a year was 2015, during the long slide following the 2013 peak and Mt. Gox collapse, according to NYDIG. Prices then recovered modestly for the rest of the year before a sharp rally in 2016.

In the first quarter of 2020, BTC fell 9.4% amid a market sell-off caused by fears over the COVID-19 pandemic, but then recovered to end the year up more than 300%. In other years with negative first-quarter returns, such as 2014, 2018, and 2022, Bitcoin ended the year with sharp declines, coinciding with the end of previous bull cycles, the research note noted.

This time, the situation is uncertain. Cryptocurrency prices have soared since Donald Trump won the US election in November, when he campaigned on a platform of cryptocurrency. While the sector has received more regulatory clarity under the Trump administration, and the US Securities and Exchange Commission (SEC) has dismissed several lawsuits against crypto firms, not everything is rosy.

Last week, Trump announced his retaliatory tariffs against virtually every country in the world, causing a massive $5.4 trillion collapse in the U.S. stock market in just two days. It sent the S&P 500 to its lowest level in 11 months and sent the Nasdaq 100 to its lowest level in

Источник