Keith Owen Gunden sold all his Bitcoin, worth $1.3 billion.

One of the richest early Bitcoin whales, Owen Gunden, sold his entire position in the first cryptocurrency. This occurred amid a retreat of retail traders and active accumulation of BTC ETFs by institutions.

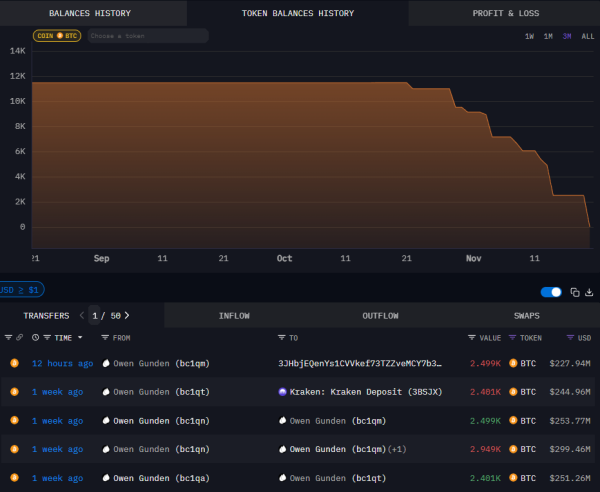

On November 20, a wallet identified by Arkham as belonging to Gundeen transferred the final 2,499 BTC, worth $228 million, to the Kraken crypto exchange.

In total, since October 21, the investor has sold 11,000 BTC worth approximately $1.3 billion, thereby liquidating all of his savings, experts note.

On the topic: Bitcoin whale activity peaks this year — Santiment

Transaction history for a wallet linked to Owen Gounden. Source: Arkham.

Transaction history for a wallet linked to Owen Gounden. Source: Arkham.

Gunden is ranked eighth among the richest people in the crypto industry with a net worth of approximately $561 million, according to the Arkham Crypto Millionaires list.

This whale was one of the first arbitrage traders. He traded on exchanges like Tradehill and the now-defunct Mt. Gox. This is how he made his fortune in digital gold.

Institutions are taking over the BTC ETF sector.

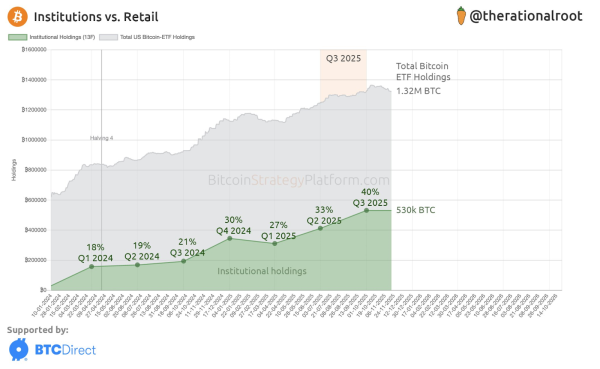

Meanwhile, institutional investors continue to buy US spot Bitcoin ETFs despite market fears that the bull market may be ending.

On November 19, the share of institutional investors in exchange-traded funds based on the first cryptocurrency jumped to 40%, wrote analyst Root in X. By comparison, this figure stood at 27% in the second quarter, when 1,119 companies participated in the accumulation.

Source: H.

Source: H.

According to Root, the 40% figure is based on reports from large institutional investors and is a conservative estimate. This is because only organizations with more than $100 million in assets are required to disclose this information.

Meanwhile, institutions continue to hold their positions despite massive selling by other investors. According to Farside Investors, $2.8 billion has been withdrawn from ETFs since the beginning of November.

On the topic: Glassnode has identified a resistance level for Bitcoin to exit correction mode.

Source: cryptonews.net