Bitcoin has lost key support at $107,000.

November 11th began with market participants' attention drawn to the gap that formed in the futures market over the weekend. Against this backdrop, investors began talking about a reversal in the Bitcoin (BTC) price.

Hourly chart of the BTC/USD pair. Source: TradingView.

Hourly chart of the BTC/USD pair. Source: TradingView.

CME Gap in Focus Amid BTC Correction

Bulls failed to reclaim a key support level overnight. A double top may now form on the hourly chart. This occurred because traders failed to hold the $107,000 level as support.

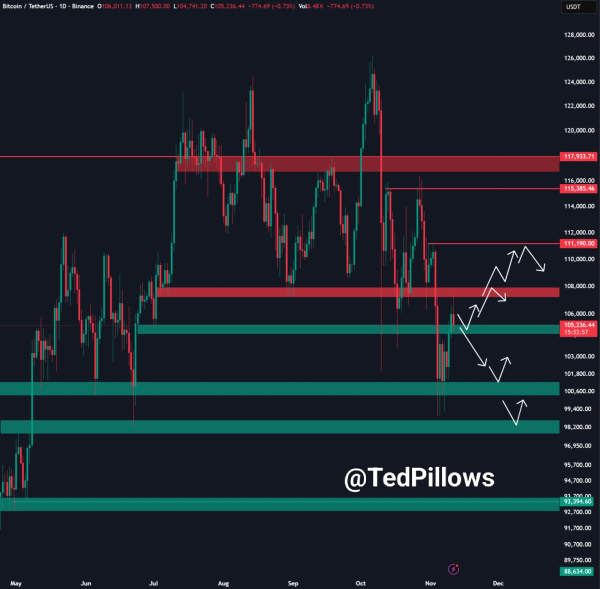

“Bitcoin faces resistance at $107,000-$108,000,” wrote investor Ted Pillowes.

On the topic: Glassnode has recorded the first signs of Bitcoin's recovery after the October crash.

BTC/USDT hourly chart. Source: Ted Pillouse.

BTC/USDT hourly chart. Source: Ted Pillouse.

The expert noted that the latest gap in the CME Group Bitcoin futures market remains below the spot price.

“The next key support is around $104,000, where there's also a CME gap. Bitcoin typically forms a bottom on Tuesday, meaning we could see the CME gap fill, followed by a rebound,” he suggested.

On the topic: Strategy bought an additional 487 BTC at the bottom without selling MSTR shares.

Hourly chart showing a gap in CME Bitcoin futures. Source: TradingView.

Hourly chart showing a gap in CME Bitcoin futures. Source: TradingView.

Trader Daan Crypto Trades placed the bulls' failed attempt to turn resistance into support in the context of broader difficulties in the crypto market.

Meanwhile, renowned analyst Michael van de Poppe described the situation as “quite normal” for Bitcoin.

“The big question now is: Will Bitcoin hold $103,000? Will it hold $100,000 and form a double-bottom test?” he asked.

The expert believes that “if neither happens,” the next target will be between $90,000 and $93,000. This scenario will delay the cryptocurrency's potential recovery.

On the topic: Bitcoin at $250,000 in three months would be a “worst-case scenario.”

BTC/USD daily chart. Source: Michael van de Poppe.

BTC/USD daily chart. Source: Michael van de Poppe.

Selling pressure from early investors

Trading firm QCP Capital has identified key conditions for sustained growth in the BTC price. Bulls need more favorable macroeconomic conditions to combat sellers at higher levels.

“A sustained recovery in the spot market, supported by positive macro news and stable ETF inflows, could reignite demand,” the experts concluded.

Analysts also added:

“However, a rally above $118,000 will likely face renewed selling pressure from early investors. Until supply from long-term holders diminishes, the most likely medium-term scenario is a sideways Bitcoin price movement.”

QCP cited ongoing redistribution by long-term investors into Bitcoin above the $100,000 level.

On the topic: Robert Kiyosaki said he expects Bitcoin to reach $250,000 and gold to reach $27,000.

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net