The US government shutdown is almost over. How has this affected Bitcoin?

Republicans secured the 60 votes needed to pass a funding bill that brought the government shutdown closer to an end.

“Once passed, the bill will go to the House floor for a vote. Hopefully, we'll have it up and running by Wednesday,” said Republican Senator Markwayne Mullin.

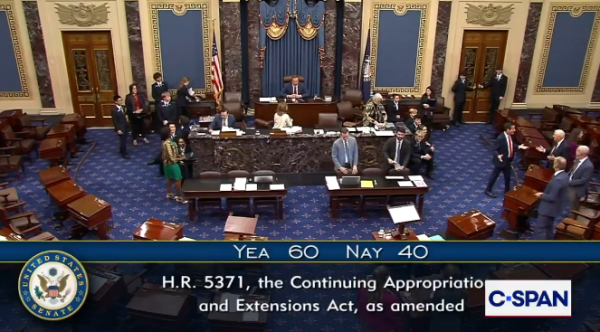

The funding bill has been passed to the House of Representatives. Source: C-Span.

The funding bill has been passed to the House of Representatives. Source: C-Span.

Now it all depends on the House of Representatives. If they pass the bill, it will be sent to President Donald Trump for approval.

Related: Bitcoin's rise after the US shutdown doesn't guarantee a reversal — 10x Research

The shutdown was not only record-breaking in length, but also devastating: according to CNN, over a million federal workers were left without pay.

Government agencies involved in the crypto industry, such as the Securities and Exchange Commission and the Commodity Futures Trading Commission, have been forced to operate with minimal staff.

Other sectors, especially air travel, also experienced disruptions. The government shutdown led to a severe labor shortage, leading airports across the country to cancel, delay, and reduce daily flights.

On the topic: Robert Kiyosaki said he expects Bitcoin to reach $250,000 and gold to reach $27,000.

Bitcoin recovered above $106,000

Amid intense speculation about the end of the government shutdown, the price of Bitcoin (BTC) has surged. After falling to $99,300 on Friday, the leading cryptocurrency rose 6.7% to reach around $106,000 in morning trading on November 11.

At the time of writing, the coin has corrected to $105,138, according to CoinGecko.

According to Santiment, the “BTC” ticker became the most popular symbol on social media in the past few days on Monday. Investors are likely returning to bullish sentiment thanks to positive news from the US.

“BTC is trending due to the recent price rise above $106,000, optimism around the resolution of the US shutdown, and bullish market sentiment,” the experts noted.

Analysts also predict Bitcoin will rise to $150,000 by the end of the year. They believe the coin's value is supported by its role as a store of value and its stability, which makes Bitcoin comparable to digital gold.

Along with the first cryptocurrency, the top five trending crypto assets included Starknet (STRK), Uniswap (UNI), Monero (XMR), and XRP (XRP), which attracted attention due to technological developments, price growth, and partnerships.

On the topic: The US government shutdown has increased demand for stablecoins — Bitfinex

Source: cryptonews.net