Opinion: Bitcoin is signaling a bottom.

Main:

-

A drop in Bitcoin's MVRV to the 1.8-2.0 range indicates a local bottom, which historically precedes price growth.

-

Selling pressure can clear the market of excess leverage and set the stage for a trend reversal.

Bitcoin (BTC) fell 11% from November 3rd to 4th, falling below $100,000 for the first time in four months. This resulted in more than $1.3 million in long-term liquidations and coincided with profit-taking by long-term holders and capitulation by new buyers.

BTC/USD daily chart. Source: TradingView.

BTC/USD daily chart. Source: TradingView.

Several key metrics indicate that a decline to $98,000 could be a local bottom and create a favorable moment to enter the market.

The MVRV index signals a possible market bottom.

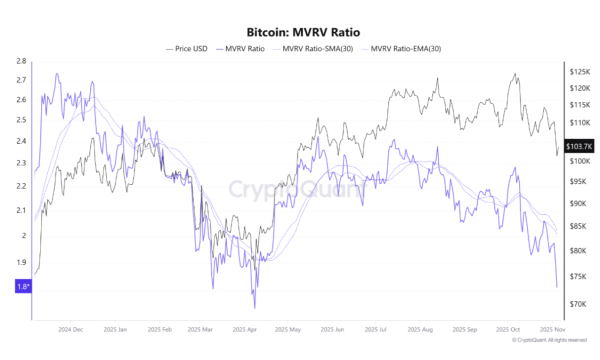

According to XWIN Research Japan analyst at CryptoQuant, the market-to-realized value (MVRV) ratio of the leading cryptocurrency has dropped to levels that previously corresponded to the formation of local lows.

“The indicator is currently hovering around 1.8. This is the lowest since April 2025 and a possible sign of a bottom. This means the market price is approaching the average investor purchase price, forming an accumulation zone,” the analyst wrote.

The last time MVRV dropped this low was in mid-April, when the BTC/USD pair bottomed at $74,500, before rallying 50% to reach an all-time high of $112,000 on July 9.

On the topic: A “crazy” wall of orders above $105,000 was built against Bitcoin bulls — opinion

“Historically, when the MVRV falls into the 1.8-2.0 range, it often coincides with the formation of intermediate-term lows or the beginning of recovery phases,” he added.

Bitcoin's MVRV. Source: CryptoQuant.

Bitcoin's MVRV. Source: CryptoQuant.

If history repeats itself and Bitcoin shows similar growth, the price could rise to $150,000 – about 50% higher than the current level of $98,500.

The market may reverse after capitulation

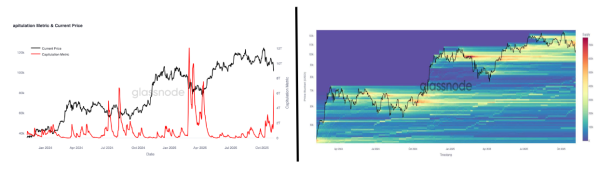

On November 4, short-term holders with unrealized losses began to capitulate as the leading cryptocurrency fell below $100,000.

According to Glassnode, investors holding assets with large unrealized losses “often capitulate near local lows.”

Such selling marks a turning point, as panic selling wipes out speculative leverage and clears the market, setting the stage for new growth, analysts say.

On the topic: Bitcoin's bull run hasn't started yet — Samson Mow

Glassnode's Capitulation metric shows that the current capitulation level is comparable to the $50,000 lows recorded on August 1, 2024, and the $74,500 lows recorded in April 2025.

Bitcoin capitulation metric and underlying price distribution heatmap. Source: Glassnode.

Bitcoin capitulation metric and underlying price distribution heatmap. Source: Glassnode.

Historically, fear-fueled sell-offs have exhausted weak players, opening up opportunities for strong holders to accumulate assets at low prices and thereby lay the foundation for future growth, analysts say.

On the topic: opinion – why has Bitcoin broken through the key $100,000 support and is at risk of going lower?

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net