Opinion: Bitcoin Entering 'Capitulation Mode' With $92,000 Target?

Main:

-

If the correction continues, the gap on the CME at ~$92,000 could become a benchmark.

-

Short-term holders are plunging into deep negative territory.

On November 4, Bitcoin (BTC) suffered a new wave of losses, bringing prices to an October low of $104,000. The daily decline exceeded 3%, according to Cointelegraph Markets Pro and TradingView.

BTC/USD Hourly Chart. Source: Cointelegraph/TradingView.

BTC/USD Hourly Chart. Source: Cointelegraph/TradingView.

“The first cryptocurrency is in free fall. There's no strong support below $100,000. This means we're likely to see a retest,” commented analyst Ted Pillouse.

BTC/USDT daily chart. Source: Ted Pillouse.

BTC/USDT daily chart. Source: Ted Pillouse.

The expert drew attention to the unfilled gap in futures on the Chicago Mercantile Exchange (CME) near $92,000, just below the 2025 annual opening.

“If the rate leaves the $100,000 zone, expect a correction to develop towards $92,000,” he added.

Daily chart of Bitcoin futures on CME. Source: Cointelegraph/TradingView.

Daily chart of Bitcoin futures on CME. Source: Cointelegraph/TradingView.

On the topic: Analysts have announced the conditions for a Bitcoin rally above $115,000.

Not the best combination

Trader Daan Crypto Trades warned that BTC/USD has lost its “major support” of recent weeks.

“We are now approaching the lower boundary of the range where the price made its initial higher low after the rebound following the liquidation on October 10th,” the report said.

The expert noted that in addition to “massive” selling by whales, US stocks have become less optimistic while the US dollar is strengthening, which is a headwind for the cryptocurrency.

“It's not the best combination at the moment,” he concluded.

Four-hour chart of the BTC/USDT perpetual contract. Source: Daan Crypto Trades.

Four-hour chart of the BTC/USDT perpetual contract. Source: Daan Crypto Trades.

On the topic: Glassnode discovered obstacles to Bitcoin's growth.

Capitulation mode

The successful selling pressure has heightened concerns among recent buyers who are facing mounting paper losses.

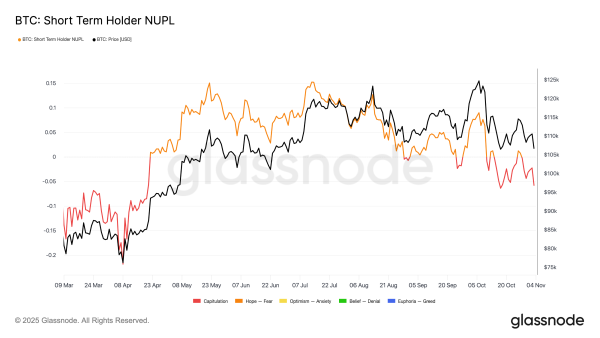

According to Glassnode, the Short-Term Holders' Net Unrealized Profit/Loss (NUPL) indicator (STH) has returned to the “capitulation” zone.

At the time of writing, the metric was -0.058, close to its lowest since April.

“Historically, such periods of stress and STH capitulation have meant attractive asset accumulation opportunities for patient investors,” the experts noted.

STH-NUPL dynamics. Source: Glassnode.

STH-NUPL dynamics. Source: Glassnode.

On the topic: Bitcoin ends October with a decline for the first time in seven years. What's next?

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net