Bitcoin price faces a major challenge, hovering around $108,000

Bitcoin (BTC) continues to struggle to recover after failing to sustain momentum above key support levels. The crypto king's inability to recover from its losses highlights growing structural weakness in the market.

Recent data points to increasing bearish sentiment, as multiple on-chain metrics show deteriorating investor confidence.

The whale who accurately predicted the October crash is now betting on another Bitcoin crash.

Bitcoin may face some resistance

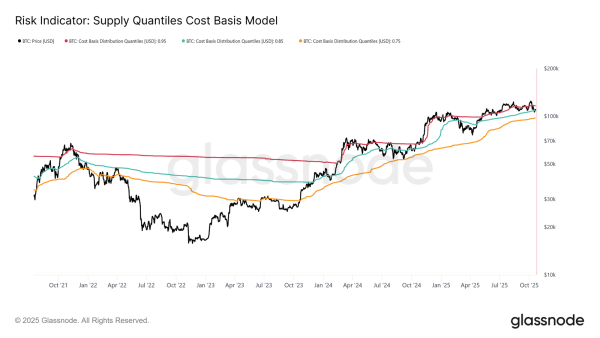

The Supply Quantiles model indicates a strengthening bearish bias in the short-term outlook for Bitcoin. This framework tracks supply price levels by quantiles—specifically, 0.95, 0.85, and 0.75—representing the proportions of supply that are in the red. Bitcoin is currently trading below the short-term supply price of $113,100, reflecting the stress recent buyers are facing amid ongoing market difficulties.

Even more concerning, BTC remains below the 0.85 quantile at $108,600. Historically, a loss of this level has hinted at structural weakness and subsequent broader corrections. Further down the line, if this pattern continues, Bitcoin could test the 0.75 quantile near $97,500. This alignment suggests sellers may dominate in the near term as market strength continues to weaken.

Bitcoin supply quantiles. Source: Glassnode

Bitcoin supply quantiles. Source: Glassnode

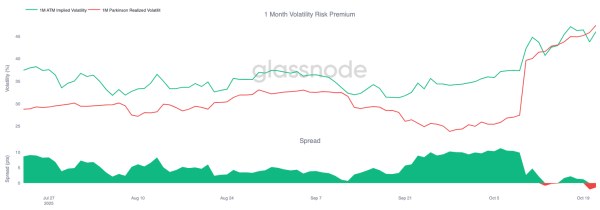

Bitcoin's macroeconomic momentum is showing cracks as volatility conditions shift. The one-month volatility risk premium—the difference between implied and realized volatility—has turned negative for the first time in four months. This signals the end of the stable low-volatility phase that previously favored passive income strategies for options sellers.

With the return of volatility, short-gamma positions are facing increased pressure. This shift from complacency to reactivity suggests that more significant swings may lie ahead, potentially intensifying Bitcoin's ongoing struggle to regain stability above key technical levels.

Bitcoin Volatility Risk Premium. Source: Glassnode

Bitcoin Volatility Risk Premium. Source: Glassnode

Bitcoin price may fall

At press time, Bitcoin is trading at $108,772, holding slightly above the $108,000 support. However, repeated failures to recover above this level highlight the fragility of market sentiment and the constant hesitation of both institutional and retail participants. Furthermore, the lack of active buying suggests that confidence in a short-term recovery remains limited.

At the same time, if the bearish momentum continues, Bitcoin's price could fall below $108,000 and test $105,585 or even $105,000. Such a decline would exacerbate investor losses and confirm short-term downside risks, thereby strengthening the current corrective phase.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if Bitcoin holds support at $108,000 and bounces, it could lead to a rally to $110,000. A sustained move above this resistance would pave the way for a rally to $112,500, potentially invalidating the bearish scenario.

Source: cryptonews.net