Gold at Record Highs, Bitcoin Falling: Why 'Digital Gold' Failed During the Crisis

The sharp collapse in the crypto market on October 10, which wiped out more than $19 billion, has called into question one of the main investment theses of recent years.

Gold stormed to new records above $4,000, while Bitcoin collapsed along with other risk assets. This divergence has reignited the debate over whether BTC can still be considered a safe haven asset.

What is a “depreciation rate”?

The idea that united investors in gold and Bitcoin was simple: amid rising government debt, inflation, and geopolitical tensions, fiat currencies were losing value. Under these conditions, investors were seeking “hard assets” to protect their capital. JPMorgan analysts even dubbed this trend a “debasement trade.”

The Strength Test Bitcoin Failed

The events of October 10th put this theory to the test. Amid rising global tensions, including the escalating trade war between China and the US, investors did indeed rush to safe havens. But their choice was clear.

- Gold has soared to record highs, up nearly 6% in a week and 60% year-to-date.

- Bitcoin , on the other hand, has collapsed, losing 8% in a week to trade at $111,207 at the time of writing.

“Bitcoin is following other risk assets… it's not a safe-haven asset like gold. The world is abandoning the dollar standard and returning to the gold standard,” said longtime Bitcoin critic Peter Schiff .

His opinion is shared by many traders, who now see Bitcoin as more closely tied to tech stocks than an inflation hedge. “The 'depreciation bet' is more of a meme than a real movement,” one trader noted at X.

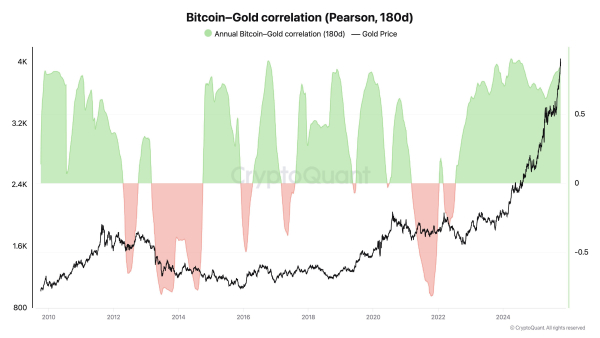

Bitcoin and Gold Correlation. Source: Ki Young Joo on X

Bitcoin and Gold Correlation. Source: Ki Young Joo on X

BTC supporters are not giving up

However, Bitcoin supporters believe that drawing conclusions from one sell-off is premature.

Paolo Ardoino , CEO of Tether, argues that both gold and Bitcoin remain relevant as long-term stores of value.

“Bitcoin and gold will outlast any other currency,” he wrote, emphasizing that the two assets play complementary roles.

On-chain data also supports this idea. Ki Young Ju , CEO of CryptoQuant, noted that the correlation between BTC and gold remains high.

“The connection between BTC and gold is strong; the idea of digital gold is still alive. The demand for a hedge against inflation hasn't disappeared,” he said.

Thus, the market is divided. For short-term investors and skeptics, the recent crash has proven that Bitcoin remains a volatile risk asset. For long-term supporters, this is merely a temporary divergence that does not negate BTC's fundamental value as a store of value with a limited supply.

Whether demand for non-fiat assets manifests itself through Bitcoin, gold, or both depends on the investor's time horizon and risk appetite. Gold offers centuries-old legitimacy, while Bitcoin offers digital mobility but also significantly greater volatility.

Source: cryptonews.net