From Cash to Gold: What the Reddit Community Thinks About Bitcoin's Changing Identity

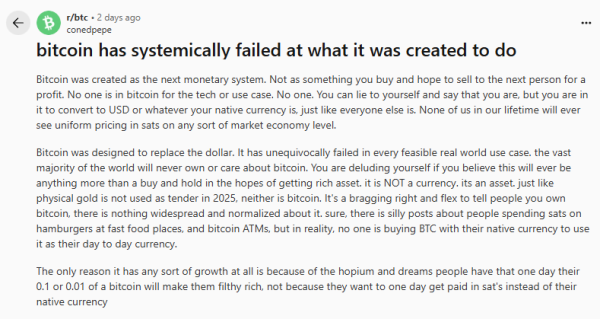

Recently, a debate erupted in the Bitcoin Reddit community about whether Bitcoin had changed its roots. The assertion that the cryptocurrency had “systemically failed at what it was” generated hundreds of comments, revealing a rift between those who consider Bitcoin “digital gold” and those who still want it to become a true currency.

Once envisioned as a peer-to-peer electronic cash system capable of replacing the US dollar, Bitcoin is now widely viewed as an investment asset rather than a means of payment. For many, this shift represents not an evolution, but a betrayal of Satoshi Nakamoto's vision.

Source: Reddit (r/BTC)

Source: Reddit (r/BTC)

What Bitcoin was and what it is today

When the Bitcoin whitepaper was published in 2008, its purpose was clear: to create a form of digital money that people could send directly to each other, without banks. It promised a future where money could be sent directly, without banks, governments, or intermediaries, representing a free and independent financial system.

But fast forward to today: It seems most people don't spend their bitcoins; they hoard them.

One Reddit member captured this perfectly, stating, “Bitcoin was designed to replace the dollar. It has clearly failed in every conceivable real-world use case… It's an asset, like gold, not a currency.”

Others noted that large financial institutions, such as crypto banks and major mining companies, now own vast amounts of Bitcoin. Instead of distributing power among all users, a few large institutions have concentrated significant control, which contradicts Bitcoin's original decentralized vision.

Another user went even further, writing, “Banks won't allow peer-to-peer cash, but they're fine with BTC as 'digital gold.' That should remind you of something.”

Many argue that Bitcoin's success in price has come at the expense of its soul.

However, not everyone in the community agrees with this opinion, as some defend Bitcoin's evolution, arguing that it is still achieving its goal, but in a different way.

Related: Central banks are increasing their gold reserves; Deutsche Bank says Bitcoin could follow suit.

Contrasting point of view

Proponents of Bitcoin's current development argue that criticism of its inability to serve as a common currency misunderstands its basic architecture. Its structure makes small but frequent transactions slow and expensive, which is why tools like the Lightning Network (a second-layer solution on the Bitcoin blockchain) were built on its foundation.

The Lightning Network allows people to send Bitcoin almost instantly for very low fees and is becoming increasingly popular, especially in parts of the world like Latin America and Africa.

In fact, the volume of cryptocurrency transactions in these regions may be the main argument in favor of using Bitcoin as a payment system. For example, according to the analytics company Chainalysis, in the year ending June 2025, individuals and businesses in sub-Saharan Africa conducted over $205 billion in cryptocurrency transactions. Moreover, Bitcoin dominates these transactions.

It appears that Bitcoin as a payment system is much more widespread in regions with underdeveloped infrastructure and struggling economies. Where the national currency has depreciated or is experiencing high inflation, cryptocurrencies and Bitcoin are becoming a desirable solution.

On the topic: The evolution of cryptocurrency payments: from stablecoins to seamless transactions in in-app games

Bitcoin in 2025 and its next phase

The launch of spot Bitcoin ETFs in early 2024 led to a massive influx of institutional capital. Companies like BlackRock, Fidelity, and others now collectively hold over one million BTC, fueling concerns about centralization.

Related: BlackRock Prepares Tokenized ETFs Backed by $10 Billion Bitcoin Trust

While payment channels continue to grow, the growth does not appear to be rapid enough to dispel the notion that Bitcoin is not meant for spending—at least among some members of the community.

Furthermore, concerns about inflation, restrictive monetary policy, and the emergence of central bank digital currencies (CBDCs) are pushing investors toward Bitcoin as a strategic hedging tool, thereby cementing its status as “digital gold.”

Reddit, once the center of Bitcoin idealism, is now becoming a venue for more critical discourse. Younger generations of cryptocurrency users are increasingly drawn to the dynamic ecosystems of networks like Solana and Ethereum, which are perceived as more innovative and active than Bitcoin's methodical development.

Evolution or failure?

Whether Bitcoin's change is a step forward or a setback depends on one's point of view.

From a payment technology perspective, their usefulness has perhaps diminished, given that fees are often high and most stores do not accept payments directly.

On the other hand, if you think of it as a new form of money, Bitcoin has exceeded all expectations, establishing itself as the world's first accepted, non-government-backed store of value.

Bitcoin's essence was always more ideological than technical, embracing the concept of individual autonomy and challenging centralized financial control. But as it integrated into the very systems it sought to replace, this idealism began to fade.

However, this may not mean failure, but rather a natural growth from a currency of resistance to a foundation of financial independence.

Ultimately, regardless of which side of the Reddit community you take, Bitcoin may not become the new dollar, but it has successfully become the new gold. Read also: JPMorgan analyst predicts gold-to-Bitcoin “baton swap”

Source: cryptonews.net