Peter Brant has proposed a formula for successful Bitcoin investment.

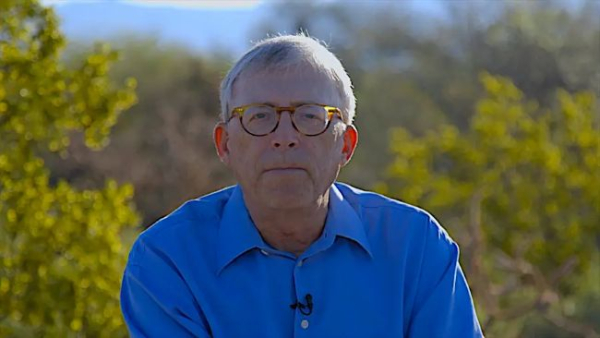

Well-known trader and CEO of Factor, Peter Brandt, shared his opinion on the structure of a balanced investment portfolio that includes Bitcoin on the social network X.

Well-known trader and CEO of Factor, Peter Brandt, shared his opinion on the structure of a balanced investment portfolio that includes Bitcoin on the social network X.

Brant appealed to a younger generation, arguing that Bitcoin should be a key element of an investment strategy in today's environment, and proposed a simple formula: 10% in Bitcoin—the only significant digital asset in the crypto market that protects against the devaluation of fiat currencies; 20% in real estate; and 70% in the S&P 500 index via the SPY ETF, with regular purchases.

“This is my recommendation to you if you were my son, daughter, grandson or granddaughter,” Brant said.

A financial industry veteran noted that this model provides asymmetric protection and growth, transforming Bitcoin from speculation into a fundamental component of a balanced investment portfolio.

Brant previously stated that by the end of 2025, the Bitcoin price could be in the range of $120,000 to $150,000, and the probability of a decline in the flagship crypto asset is up to 50%.

Source: cryptonews.net