Crypto adoption: Will the Global South become a growth engine?

Cryptocurrencies are more visible worldwide than ever before. Since the 2024 US presidential election, when Bitcoin became a campaign issue, the industry has entered the mainstream. The approval of spot ETFs, the growing presence on Wall Street, and treasury strategies of large corporations have given this development additional impetus. Instead of a niche, we are observing an asset and user class that ranges from private investors to institutions and is increasingly becoming a part of the global financial infrastructure. But what about the global level? In which countries is crypto adoption the most, and which are surprisingly strong?

Crypto worldwide

The analysis firm Chainalysis investigated this issue in its “2025 Global Adoption Index.” The report's findings: India ranks first in all subcategories in 2025—regardless of whether it's DeFi, institutional activity, or centralized services. This means that crypto has firmly established itself in one of the world's most populous countries and is not only seen as a playground for an elite but is used by broad sections of the population.

Close behind is the US, where the institutional side will be the focus, especially in 2025. Spot Bitcoin and Ethereum ETFs have had a lasting impact on the market and helped to increase the popularity of crypto. Treasury firms, especially MicroStrategy in the Bitcoin segment and Bitmine in the Ethereum space, have also provided additional visibility.

While Michael Saylor is considered a figurehead for Bitcoin, Tom Lee is one of the leading voices for Ethereum. This institutional momentum is supported by a crypto-friendly political climate, with the US President openly supporting the industry. Furthermore, the Genius Act strengthens the regulatory framework for further growth. However, one difference remains: In the retail segment, i.e., smaller transactions via centralized services, the US ranks only tenth – everyday use is therefore not yet as strong as in Asia or Africa.

At the same time, the Global South has established itself as a growth engine. Countries like Pakistan, Vietnam, and Nigeria are driving adoption that is driven more by the population than by institutional capital. There, crypto is less speculation than an alternative to weak currencies and a lack of banking structures. The dynamic is thus shifting away from traditional financial centers and toward markets where demand stems from broader society.

Buying Cryptocurrencies – Guide & Providers 2025. In our free BTC-ECHO guide, we show you how to invest safely and step by step in cryptocurrencies. We also explain what to look out for when buying coins and tokens. Get the Buying Cryptocurrency Guide now.

APAC as a growth engine

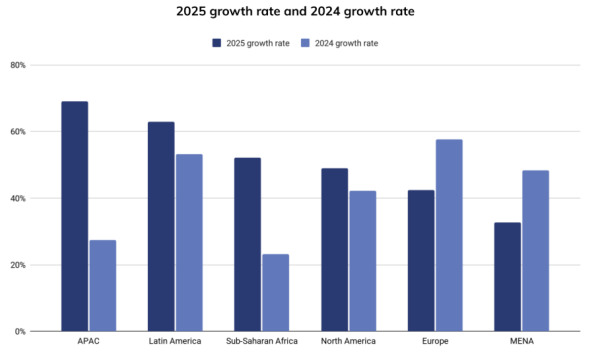

The global shift becomes even clearer when looking at individual regions. The Asia-Pacific region (APAC) is a major growth driver in 2025: The on-chain value increased by 69 percent within twelve months – from $1.4 trillion to $2.36 trillion. This increase was primarily driven by India, Vietnam, and Pakistan, which form the foundation of this development.

By comparison, Latin America grew by 63 percent during the same period, and Sub-Saharan Africa by 52 percent. North America grew by 49 percent, Europe by 42 percent, and the MENA region by 33 percent. In absolute terms, Europe and North America continue to dominate, with over $2.2 trillion and $2.6 trillion, respectively. However, the momentum clearly lies in the Global South. Here, crypto is being pushed into the markets from the bottom up, while in the industrialized countries, the institutional track sets the tone.

Stablecoins on the rise

Stablecoins will continue to be a central element of crypto infrastructure in 2025. The two heavyweights, USDT and USDC, continue to dominate on-chain transaction volume. Between June 2024 and June 2025, USDT consistently moved over one trillion US dollars per month, peaking at $1.14 trillion in January 2025, while USDC moved between $1.24 and $3.29 trillion per month during the same period. This underscores both tokens' role as the backbone of global payments in the crypto ecosystem.

What's exciting, however, is the growth of smaller stablecoins. EURC, for example, increased its monthly volume from around $47 million in June 2024 to over $7.5 billion a year later—an increase of almost 89 percent. PYUSD also saw a sharp increase, from around $783 million to just under $4 billion. At the same time, major payment service providers such as Stripe, Mastercard, and Visa are integrating stablecoin solutions, further accelerating the transition to the mainstream.

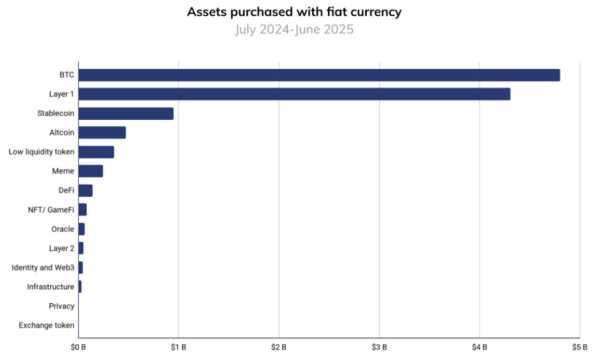

Bitcoin remains the gateway to the crypto world

A look at so-called fiat onramping, the exchange of traditional fiat currencies such as US dollars or euros for digital assets, shows that Bitcoin is and remains the most important gateway to the crypto scene. Between July 2024 and June 2025, more than $4.6 trillion in fiat money flowed into BTC. This makes Bitcoin more than twice the volume of the next largest category, Layer 1 tokens excluding BTC and ETH, at $3.8 trillion. Stablecoins followed with $1.3 trillion, and altcoins with around $540 billion.

Geographically, the US dominates with more than $4.2 trillion, followed by South Korea with over $1 trillion, and the European Union with just under $500 billion. Bitcoin's dominance in terms of entry is notable: In the UK and the EU, 47 and 45 percent of all fiat purchases were for BTC, respectively, while markets like South Korea are more diversified. This demonstrates that Bitcoin remains the primary entry point worldwide, despite regional differences in investor behavior.

Two worlds, one trend

A global perspective on crypto adoption in 2025 makes it clear: Growth is broad-based and two-pronged. On the one hand, the US dominates with institutional inflows, spot ETFs, and an increasingly clear regulatory framework. Bitcoin has long since arrived on Wall Street there. On the other hand, countries like India, Pakistan, and Vietnam are setting the pace through everyday use by broad sections of the population. The momentum is thus increasingly shifting to the Global South.

Recommended Video Fed Decision: Why These Solana Coins Can Profit Now!

Sources

- Chainalysis report

Eine Quelle: btc-echo.de