An analyst explained why the Bitcoin rally is at risk of derailment.

Bitcoin's rise to new all-time highs may prove less sustainable than it seems. We explore what could break the rally and trigger a BTC correction.

The number of active addresses on the network has decreased. This indicates a discrepancy between the coin's market price and network activity. Weak activity could lead to a price drop to $120,000.

Bitcoin is rising, but network activity is falling.

In a new report, CryptoQuant analyst CryptoOnchain notes that BTC's rise to a new all-time high of $125,708 is likely driven by speculation and not supported by an overall improvement in sentiment.

CryptoOnchain studied user activity on the Bitcoin network and discovered a discrepancy between the price and the number of active addresses. Despite Bitcoin's rise, the daily number of active addresses (14-day moving average) is approaching its lowest level since April 2020. This could be a sign of a volatile bull market.

BTC network addresses. Source: CryptoQuant

BTC network addresses. Source: CryptoQuant

Here's what this means for the coin:

“Usually, sustained price growth is accompanied by increased network activity, indicating an influx of new users and organic demand. If the price rises while activity declines, the upward trend may be due to derivatives trading, leverage, and the actions of a small group of large players, rather than mass participation.”

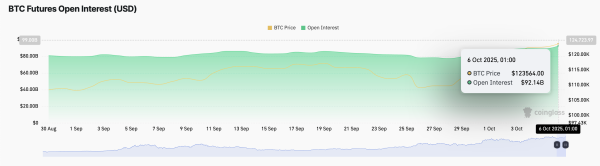

High leverage creates risks

The rise in open interest in BTC futures also confirms the bearish scenario. According to Coinglass, the figure has risen 10% since October 1 and is now at its highest level since the beginning of the year, at $92.14 billion.

Open Interest in BTC Futures. Source: Coinglass

Open Interest in BTC Futures. Source: Coinglass

Historically, rapid increases in open interest in futures during price rallies are associated with overheated markets. When too many traders use high leverage, even small liquidations can trigger sharp corrections, putting BTC at risk of a pullback.

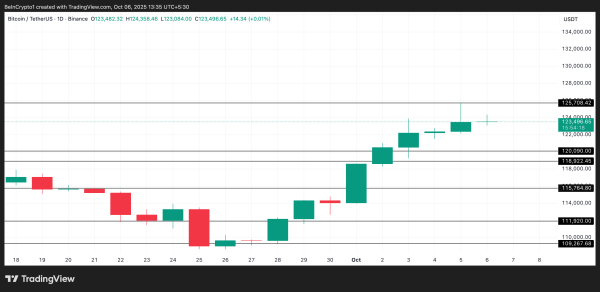

Can BTC stay above $120,000?

According to CryptoOnchain, the current trend is a red flag. If underlying demand continues to decline, the coin could reach $120,090.

“If network activity does not increase along with the price, it is likely that the price lacks strong fundamental support to hold current levels, and the risk of a local price correction increases,” the analyst added.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

However, increased activity on the Bitcoin network will refute the bearish outlook. If new buyers enter the market, they could push BTC to retest its all-time high and potentially breakout.

Read BeInCrypto's special article to find out which cryptocurrencies whales are investing in.

Source: cryptonews.net