Bitcoin miner Foundry hits 0.07% jackpot mining eight consecutive BTC blocks

Foundry USA recently surprised observers by securing eight consecutive Bitcoin blocks in succession, a sequence that became prominent across explorer platforms and social media channels. Accounting for nearly one-third of the network’s computational power, the pool’s extended success—while improbable—remained statistically feasible.

Overview

- Foundry USA sequentially mined blocks 910,500 through 910,507, drawing widespread visibility across crypto trackers and discussions.

- Given its approximate 36% share of Bitcoin’s total mining capacity and 30% dominance among active pools, the likelihood of such a streak stood near 0.008%, or 1 in 12,000.

- This event highlights how major mining pools can temporarily dominate block production, reigniting debates about centralization risks in Bitcoin’s ecosystem.

An unusual series of eight sequential Bitcoin blocks captured the crypto community’s focus as blockchain explorers repeatedly displayed a single entity’s involvement. Foundry USA’s uninterrupted streak—evident across eight consecutive entries—stood out as an unmistakable anomaly that swiftly dominated online conversations.

Scale influences outcomes

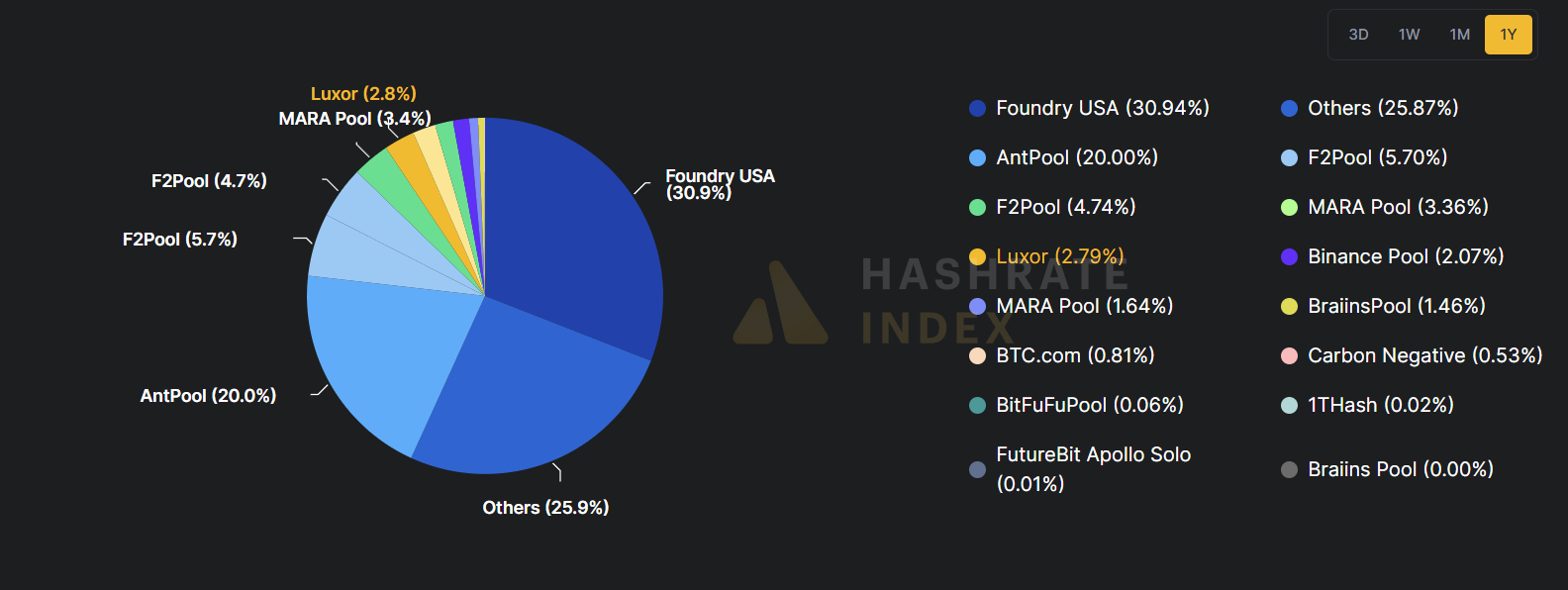

By late 2024, Foundry USA commanded approximately 36.5% of Bitcoin’s global hashrate, equating to 280 exahashes per second (EH/s). This supremacy established it as the world’s leading mining collective, outpacing rivals such as Antpool and Luxor Pool.

Mining pools by their share | Source: Hashrate Index

Mining pools by their share | Source: Hashrate Index

Current metrics position Foundry USA as a leading public mining entity, contributing roughly 31% of total pool activity according to Hashrate Index. This proportion suggests the pool typically claims three of every ten blocks mined. Its substantial market presence contextualizes the streak as remarkable yet mathematically plausible.

- A straightforward probability assessment using a 30% pool dominance indicates an eight-block sequence occurs once in approximately 12,000 attempts.

This rarity underscores statistical chance rather than systemic control, resembling favorable odds for a major participant rather than network manipulation.

Fee dynamics during the sequence

The event coincided with widespread observations of diminished transaction fees and sparsely filled blocks. Data showed fees frequently hovering near minimal satoshi-per-byte rates, with many blocks containing limited transactional data.

Further reading: Bitcoin miners could pivot to AI for higher returns, Galaxy Digital proposes

Under these conditions, mining revenue relied predominantly on fixed block subsidies rather than transaction fees. A pool capturing multiple consecutive blocks would accrue standard rewards repeatedly without significant supplemental fees.

Each successive block maintained standard structural components:

- block headers;

- coinbase transactions;

- selected transactional payloads.

The distinctive factor within blockchain records was consistent attribution to a single pool across sequential blocks, creating a visible pattern across tracking tools that fueled discussions.

Previous patterns and responses

Historical instances show comparable community reactions when mining pools approached substantial network influence. Earlier Bitcoin eras witnessed similar scrutiny during periods of concentrated mining power, often triggering operator adjustments or public debates about decentralization.

Foundry USA’s eight-block streak is deeply concerning. Even seasoned Bitcoin advocates feel uneasy.

My consistent message: Excessive centralization plagues Bitcoin. A handful of entities control mining and market dynamics,… pic.twitter.com/OOYo17X9Rn

— Jacob King (@JacobKinge) August 18, 2025

The visual repetition of one pool’s name across multiple blocks evoked concerns about power consolidation, despite mathematical assurances of probability. Such events underscore persistent anxieties about mining centralization within ecosystem discourse.

As noted by CoinMetrics engineer Parker Merritt, concentrated pool dominance remains a critical Bitcoin governance issue. Dominance by two major pools (Foundry & AntPool) increases potential risks like transaction filtering or network interference.

Explore additional content: Bitcoin mining confronts rising energy needs and diminished fee revenue

Source: cryptonews.net