How the Fed's Next Rate Decision Could Affect Bitcoin

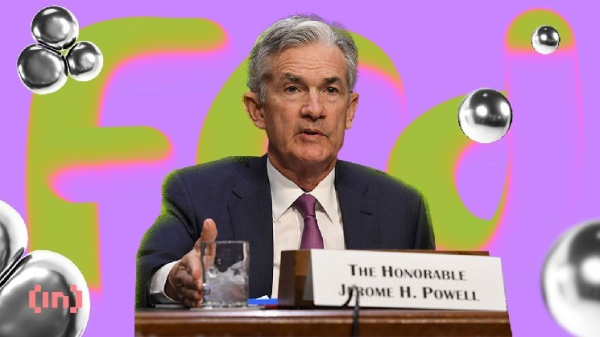

In September, the Federal Reserve will make another decision on the key interest rate. Crypto community members are expecting it to be lowered, as the changes could increase the investment attractiveness of crypto

Fedor Ivanov, Director of AML/KYT Analytics at the Shard provider, told how exactly Bitcoin might react to one or another Fed rate decision in September.

It now feels like a future rate cut is already priced into Bitcoin in one way or another. The cryptocurrency's recent rise has been driven largely by institutional demand, especially after Bitcoin hit an ATH above $124,000. Such demand is a leading indicator — companies are buying in advance based on their own valuations.

It is believed that Trump will eventually push through the Fed Chairman, and the rate will be lowered anyway. But it is not worth expecting it to be lowered by more than 0.25%, so it is unlikely that anything will change. A short-term increase in quotes is possible against the background of speculative demand, followed by a rollback, as usually happens.

What will be said at the press conference is more important. If Powell says that although he has lowered the rate, he should not expect more for now, a further decline is possible. For now, the support level is seen as the current level of $112,000, then $108,000, and then $100,000. If the rate is lowered and a signal is given for its further easing, then we can expect active growth to $125,000 and higher due to the resumption of institutional money inflows.

If the rate is not reduced, then Bitcoin may return to the level of $100,000 from the current one. However, the probability that the price will fall further seems low, since many consider this level as an opportunity to enter the asset “cheaply”.

Source: cryptonews.net