Record High Mining Difficulty, Quiet Google Trends – Is This a ‘Mature’ Bitcoin Bull Market?

Bitcoin (BTC) has been steadily setting new all-time highs (ATH) in recent times. At the same time, Bitcoin mining difficulty has also increased and reached a record high, indicating the network is progressing.

Overall, the combination of BTC's ATH, increased mining difficulty, and long-term holders (LTH) behavior paints a bullish picture, although risks remain.

ATH Price, ATH Mining Difficulty

According to Blockchain.com, Bitcoin mining difficulty increased by 7.96% to 126.27 terabytes (T), while the network's average hashrate for the week was 908.82 EH/s. This indicates that miners' computing power is growing, especially as Bitcoin recently surpassed $122,000.

If this trend continues, it could lead to a decrease in the efficiency of miners' operations, especially given the disappointing mining results in June.

Bitcoin Network Difficulty. Source: Blockchain

Bitcoin Network Difficulty. Source: Blockchain

However, an important upcoming change will be the next Bitcoin mining difficulty adjustment, which is expected to decrease by 6.69% on July 27, 2025. This could be a positive sign for miners, improving their operational efficiency.

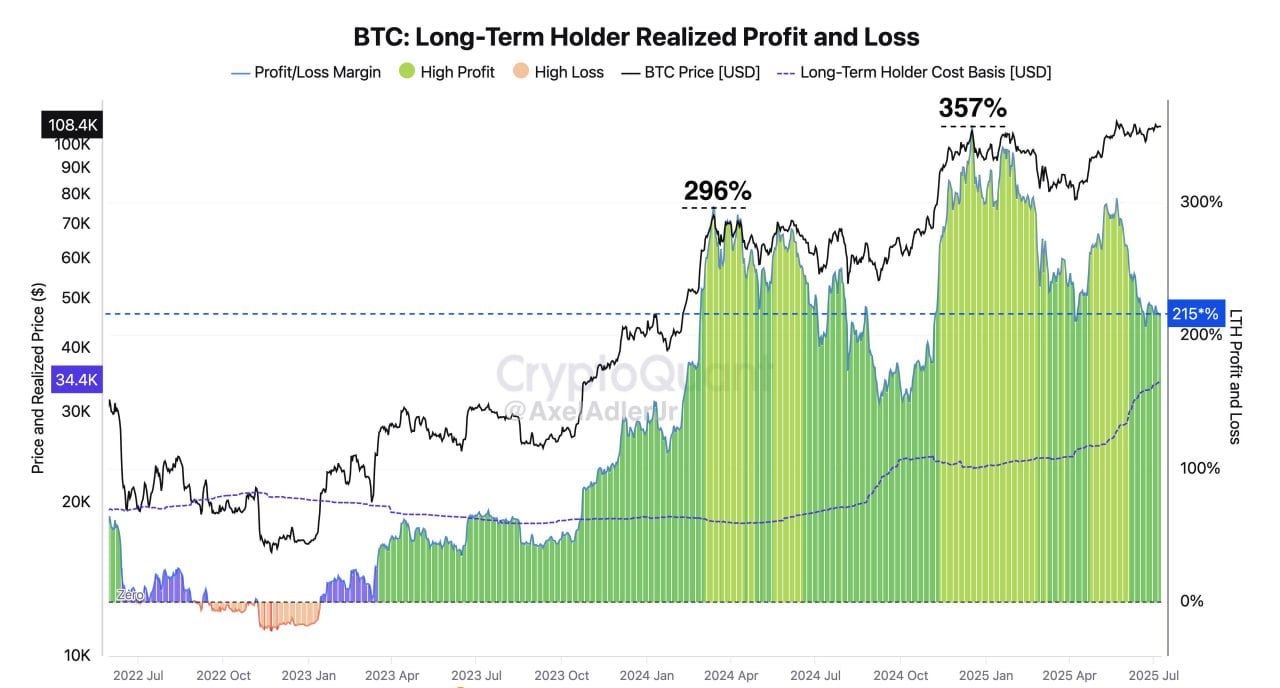

Additionally, a Glassnode chart published by NekoZ on X provides deep insight into the behavior of long-term holders (LTH). Their realized profits have risen to $108,400, with a return rate of 357% in July 2025. Their average cost basis remains significantly lower than the current price.

Long-Term Holders (LTH) Behavior Source: NekoZ

Long-Term Holders (LTH) Behavior Source: NekoZ

This indicates that most LTHs are not going to sell their holdings even if BTC reaches its peak. From 2022 to the present, the chart shows that phases of high profitability (e.g. 296% in mid-2024) are often followed by sustained price increases. This supports the view that the current market is not yet saturated.

However, the low interest in Bitcoin at Google, which remains muted and has not shown significant improvement over previous bull markets, raises questions. It may indicate the maturity of investors who are moving away from the fear of missing out (FOMO) to long-term strategies rather than short-term speculation.

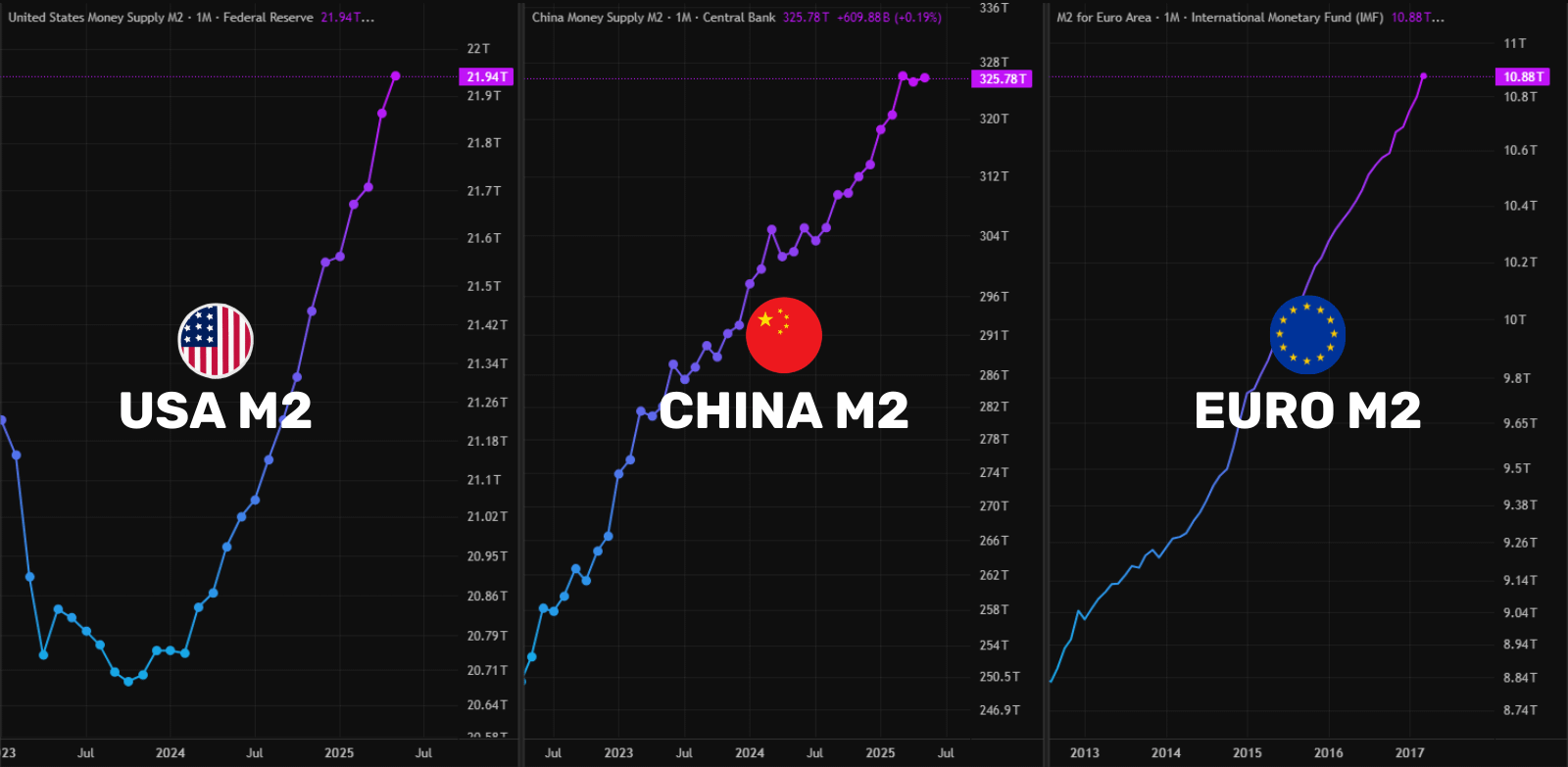

Overall, the synergy between Bitcoin's ATH, high mining difficulty, and LTH holders' behavior creates an encouraging, yet risky outlook. With global liquidity increasing (as M2 in the US, China, and Europe also reached ATH), Bitcoin has significant short-term potential.

Global Liquidity. Source: Rekt Fencer

Global Liquidity. Source: Rekt Fencer

However, investors should closely monitor key metrics such as hashrate, Bitcoin mining difficulty adjustment, and market sentiment to minimize the risks associated with a potential price correction.

Source: cryptonews.net