Bitcoin Hashrate Reaches Record High Amid Miner Selloff

Bitcoin's network computing power has set new records, even as miners increase BTC sales to cope with falling profits.

The strength of the Bitcoin network reached historic levels in early April, even as miners increased their Bitcoin (BTC) sales to ensure their viability. On April 5, the hash rate reached an unprecedented 1 sextillion hashrates per second on a daily basis, according to data from BitInfoCharts.

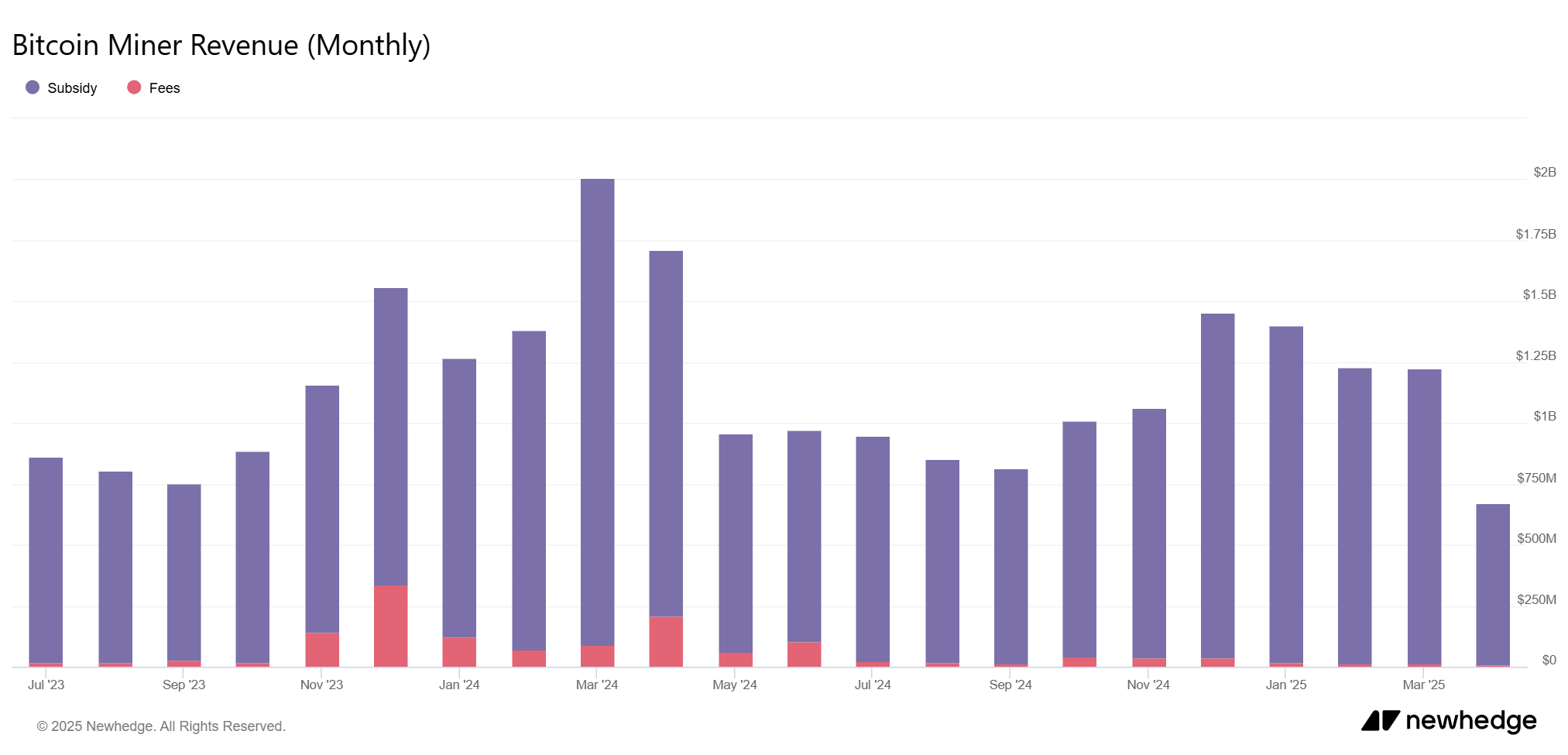

Bitcoin Miner Revenue (Monthly) | Source: Newhedge You might also like: Miners Benefit from US Bitcoin Strategic Reserve | Opinion

Bitcoin Miner Revenue (Monthly) | Source: Newhedge You might also like: Miners Benefit from US Bitcoin Strategic Reserve | Opinion

However, despite the growth in hashrate, miner revenues remain under pressure. In March, Bitcoin miner revenues were down nearly 50% compared to March 2024, to around $1.2 billion, according to data from blockchain analytics platform Newhedge.

Miners are rewarded from two sources: block subsidies and transaction fees. With the latest halving in April, which reduced the reward to 3.125 BTC per block, fees have become more significant. However, due to low fees and frequent empty blocks, miners are facing shrinking margins.

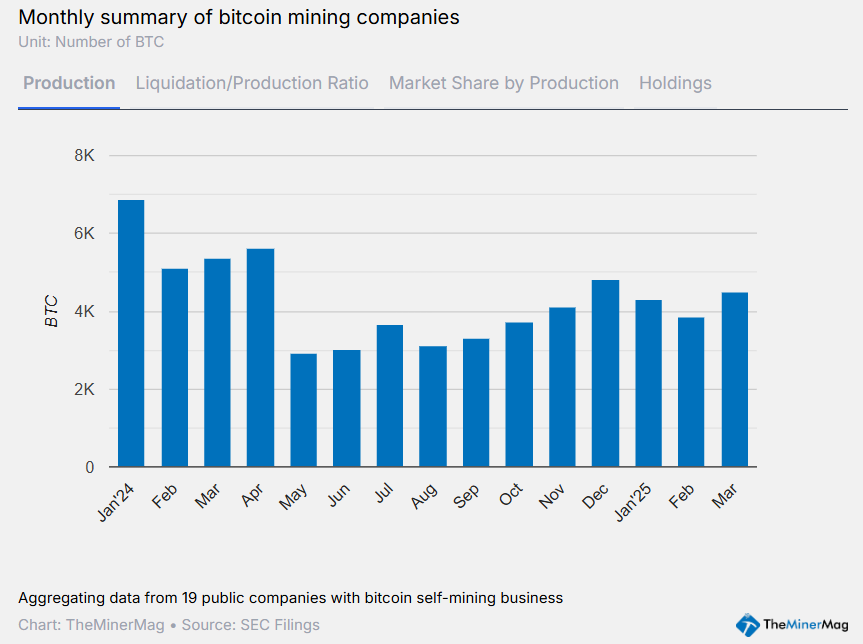

Amount of BTC mined by public miners | Source: TheMinerMag

Amount of BTC mined by public miners | Source: TheMinerMag

According to TheMinerMag, public miners sold more than 40% of their Bitcoin output in March, the highest amount since October 2024. The report notes that the increase in selling “indicates that miners may be responding to declining profits amid persistently low hashrate levels and growing uncertainty over the trade war.”

Some companies have gone even further. According to the report, HIVE, Bitfarms, and Ionic Digital sold out “more than 100% of their inventory in March,” while others, like CleanSpark, appear to be adapting their strategy.

Read more: BTC mining hashrate hits ATH, adding to pressure on US miners under tariff pressure

Source: cryptonews.net