BTC Suffered 4 Consecutive Losses on Monday. Book Open on Will It Be a 5th

What's next for Bitcoin after four consecutive Monday drops?

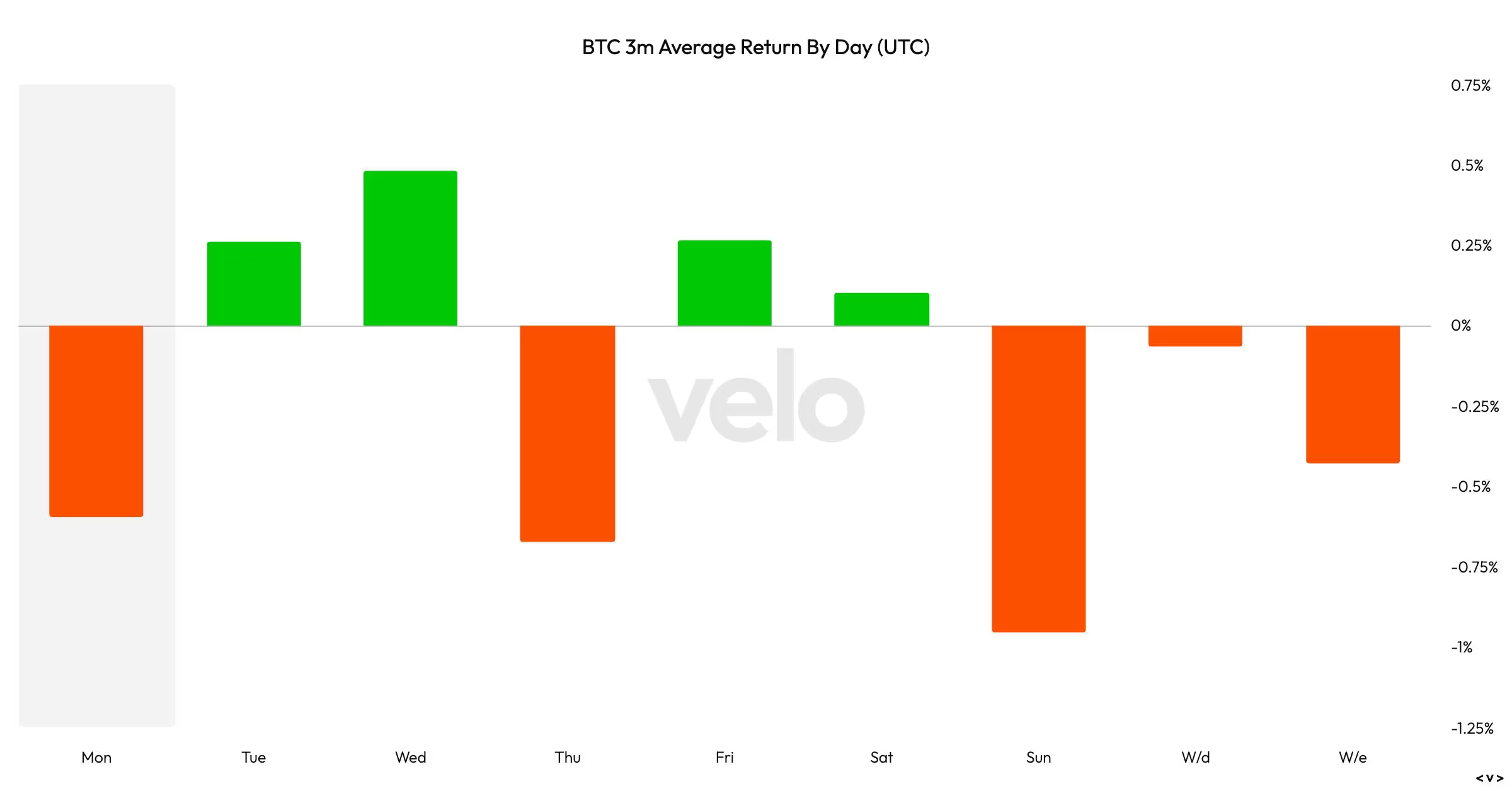

Over the past three months, weekends have performed worse than weekdays due to global uncertainty.

James Van Straten | Edited by Sheldon Rebeck Updated March 17, 2025, 15:40 UTC Published March 17, 2025, 11:45 UTC

Key points:

- Bitcoin has posted losses for the fourth Monday in a row, while the S&P 500 has posted three.

- Over the past three months, Mondays and Sundays have proven to be some of the worst days for the largest cryptocurrency.

Bitcoin (BTC) investors are hoping to overcome a string of four Monday losses.

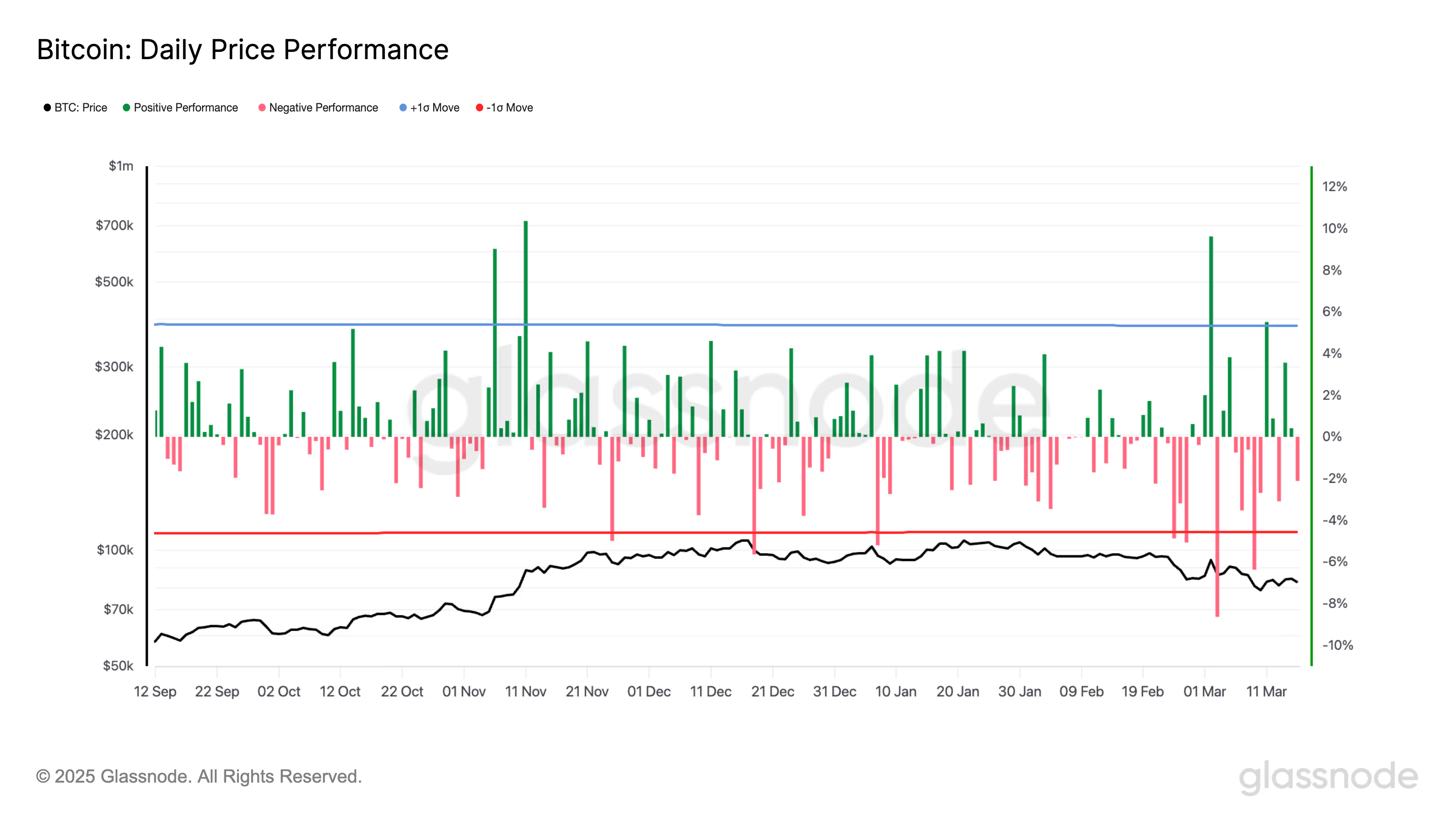

The world's largest cryptocurrency has seen significant price volatility over the past weekend, driven by macroeconomic uncertainty including geopolitical tensions, tariffs and rising global bond yields. The jitters from the weekend appear to have carried over into Monday.

Velo data shows that Mondays and Thursdays have been the worst days of the week over the last three months. However, Sunday stands out as the worst day, with an overall average price decline of 1%. Overall, weekends perform slightly worse than weekdays in terms of performance.

According to Coinglass, Bitcoin has been on a downward trend for the past four Mondays. It lost 0.31% on February 17, 4.6% on February 24, 8.5% on March 3, and 2.6% on March 10. That left its value down 30% from its all-time high in late January, which coincided with a 10% drop in the S&P 500.

The S&P 500 also suffered three consecutive Mondays of losses. It was not trading on February 17 due to a holiday in the United States.

Bitcoin is trading just 1.4% higher in the last 24 hours, while S&P 500 futures are slightly negative. What happens next is anyone's guess.