Why Donald Trump Introduced Tariffs in 2025

In early April 2025, Donald Trump shocked the world by announcing comprehensive import tariffs for almost all trading partners. Basic duties were introduced on all imports, and for a number of countries, the rates increased several times. Financial markets responded with a fall, analysts began talking about the risk of a recession, and the crypto community is trying to understand the consequences for Bitcoin and other digital assets.

We figure out what exactly happened, why Trump and his administration took such a radical step, and what the consequences will be.

What tariffs did Trump impose in 2025 and how did the markets react?

In the first months of 2025, Donald Trump implemented a series of protectionist measures. Already at the end of January, the US President threatened 25% tariffs on all imports from Colombia, demanding cooperation in deporting migrants.

In March, the US reinstated metal tariffs – 25% on steel and 10% on aluminum for a number of countries. The European Union condemned these steps and prepared $26 billion in retaliatory measures against US exports of these same goods. However, Trump did not stop there.

On April 2, 2025, the US President signed an executive order introducing a “basic” 10% duty on all imported goods. This measure affected 185 countries — almost the entire world. An exception was made only for a small circle of partners like Canada and Mexico.

In addition to the basic tariff, Washington also introduced targeted higher rates for a number of countries. For example, imports from China are subject to a general duty of about 54%. The rate for the European Union was set at 20%, for Japan – 24%, for India – 27%. A separate blow was the new 25% duty on the import of cars and auto parts.

As a result, the weighted average rate of U.S. tariffs soared from about 2.4% in early 2025 to more than 20-25% after the April orders—the highest in more than 100 years.

To impose such massive tariffs, Trump even declared an economic emergency, citing a threat to national security, a move that allowed him to bypass Congressional approval of the tariffs.

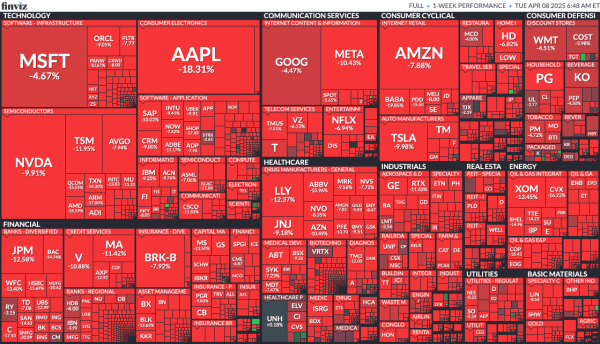

Global financial markets responded to the American tariff attack with sharp volatility. In the first days after Trump's announcements, stock indices fell noticeably:

- S&P 500 lost more than $5 trillion in market capitalization;

- NASDAQ – down about 6% (worst daily decline since March 2020);

- The Dow Jones industrial average lost about 4% on the day.

A chain reaction has begun in Europe and Asia: Japan's Nikkei has fallen by ~8% in a week (a record drop in 5 years), and stocks in South Korea, India and other countries with large export sectors have fallen sharply.

Tariff news also caused unrest in the raw materials markets – oil prices fell by more than 3%, metal futures slumped due to expectations of industrial downturns. Significantly, the US food price index began to rise in April, reflecting new costs for importers.

At the same time, there was a flight to safe havens: gold prices set a new historical high, and Treasury yields fell, reflecting demand for stable assets.

Governments in the major economic blocs responded to the US moves with condemnation and promises to reciprocate – China promised immediate retaliatory tariffs on American goods, and the EU also announced its readiness to introduce retaliatory duties in mid-April.

Who is behind the tariffs?

Donald Trump’s tariff policy is the result of a team united around a common idea of protectionism. To understand why the tariffs in 2025 have become so large and aggressive, it is important to understand who is shaping this policy, what goals they pursue, and what views are being promoted within the White House.

Peter Navarro

The main ideologist of Trump's new tariff attack is Peter Navarro, the president's senior adviser on trade and industry. According to Politico, even in his first term (2017–2020), Navarro was the main supporter of tariffs: he lobbied for tariffs against China and other countries. In the new administration, he is effectively the architect of Trump's tariff policy.

Navarro's motivation is ideological. He is a staunch protectionist, viewing the chronic U.S. trade deficit as a threat to the economy and even national security. Navarro also promotes tariffs as a source of budget revenue, pointing out that they could bring the country up to $600 billion a year.

Jamison Greer

Jamison Greer, the new head of the Office of the Trade Representative (USTR), plays a central role in implementing the tariff strategy. He is a veteran of Trump’s trade wars: in his first term, he served as Robert Lighthizer’s right-hand man, negotiating NAFTA/USMCA and tariff wars with China. In 2025, Greer was promoted to chief negotiator and was confirmed by the Senate.

Greer’s motivation is largely professional. As a trade lawyer and Lighthizer associate, he shares the “hard bargaining” philosophy: tariffs are seen as leverage to force partners to “play fair” and correct imbalances that harm the United States.

Politico noted that Greer is more of a technocrat than a charismatic leader and does not have a strong, trusting relationship with Trump. Nevertheless, for now he is the key executor of the new US administration's tariff campaign.

Howard Lutnick

Howard Lutnick, the new Commerce Secretary, has become one of the main conductors of Trump’s tariff strategy. In fact, Lutnick oversees the work of the Trade Representative and sets the tone for tariff decisions.

It’s an unusual choice: Lutnick is a former Cantor Fitzgerald executive with no government experience. But as a longtime Trump ally, he quickly embraced Trump’s “trade war” as his own. In March 2025, Lutnick vigorously defended the imposition of 20% tariffs on the European Union, calling them a fair response to the EU’s barriers.

In addition to the fair trade slogan, Lutnick is also pushing Trump's radical fiscal idea: replacing some domestic taxes with external tariffs, funding the state through import duties. Politico observers noted that Lutnick is trying to sit on two chairs: speaking the language of economic nationalism that Trump understands, while remaining acceptable to Wall Street.

Scott Bessent

Scott Bessent, the new Treasury secretary, though not a trade official, has also become an important figure in Trump’s tariff policy. Bessent is a Wall Street financier and a newcomer to the administration.

Bessent’s role is to ensure tariffs are justified financially and to keep an eye on their impact on the market and budget. At the Senate hearing, he supported Trump’s course, explaining that tariffs have three goals: to stop unfair trade agreements, to fill the budget, and to force countries to comply with U.S. demands.

When the tariffs sent stock markets reeling, Bessent calmly declared that the administration was prepared to tolerate volatility and would not back down. On the other hand, as an economist, Bessent is keen to avoid over-shocking the economy. According to the WSJ, behind closed doors, Bessent urges the president to be more careful, such as making tariffs selective or introducing them gradually, fearing a surge in inflation.

Kevin Hassett

Kevin Hassett chairs the White House National Economic Council (NEC) and is a key adviser to Trump on economic policy. He also held the same position in the first Trump administration.

Hassett is known for his more traditional, “pro-market” views. He occupies a tricky position on tariffs: on the one hand, as a member of the administration, he publicly supports Trump’s rhetoric. On the other, he is a voice of moderation within the administration. According to Politico, he, along with Bessent, is one of the “Wall Street-oriented” figures on the team. He is concerned about inflation and the retaliation of other countries.

Whether Hassett's or Navarro's vote carries more weight with the president will largely determine whether tariffs will remain a tool for negotiating pressure or turn into a long-term isolationist policy for the United States.

Why does Trump need a trade war with the whole world?

The question that analysts and experts are now trying to answer is why Donald Trump took the most aggressive tariff step in decades. The official rhetoric speaks of economic justice and protecting American industry, but there are deeper and more contradictory motives behind this. We have collected key versions and expert assessments to understand what the president was really guided by.

Bringing Manufacturing Back to the US and Fair Trade

The Trump administration argues that decades of globalization have hollowed out the American manufacturing base, leaving the United States with chronic trade deficits. Massive import tariffs are seen as the solution. The main arguments in this narrative are:

- Reducing imports should reduce the trade deficit. Trump has repeatedly said that the US is “losing billions of dollars” because of this imbalance;

- Bringing factories back to America is a key Trump promise, especially to his Rust Belt working class and farming base, and he is beginning to make it happen with tariffs.

Some experts, however, are not so optimistic and warn that rising prices for raw materials and components could hit American manufacturers harder than the benefits of protecting the market.

In addition, according to Trump, many countries take advantage of the United States: they impose high tariffs on American goods, create other barriers, or manipulate their currencies, while maintaining free access to the U.S. market. In this context, the new tariffs are positioned as a “mirror” response to such practices.

This position is supported by representatives of a number of industries. For example, American farmers complain that their products have been forced out of foreign markets for years by discriminatory rules, but Trump has set about solving this problem. Similar notes are heard in industry: for example, metallurgists thank the president for the fight against dumping and subsidies from foreign competitors, which “weakened production in the United States.”

Protecting national security and economic independence

Trump didn’t just impose tariffs, he did so by declaring an economic emergency. The White House has openly linked the trade imbalance to a security threat: the administration believes that the trade deficit undermines the U.S. defense industrial base and makes the country dependent on imports of critical goods.

The logic goes something like this: If America depends on China for electronics or on foreign suppliers for steel, it is vulnerable to conflict. So tariffs are also a self-sufficiency strategy, designed to bring back production of essential goods in the name of national security.

Moreover, American hawks see tariffs as an economic weapon against China — a blow to Beijing’s exports as it seeks technological and military dominance. And all this is unfolding against the backdrop of growing bipartisan wariness of China in Congress.

Tariffs as a leverage in negotiations

Many analysts view Trump's tariffs as a pressure tool, designed not so much to be permanent as to force trading partners to make concessions at the negotiating table.

The experience of his first term supports this version. Trump was not afraid to jeopardize existing agreements – for example, he withdrew from NAFTA, but then signed an updated agreement (USMCA) on his own terms. In relations with China, he escalated tariffs to force Beijing to agree to a “phase one” deal in 2020.

Now the stakes are much higher: almost all countries are subject to tariffs at once. And this has had an effect: immediately after the announcement of the new tariffs, many partners rushed to request negotiations. Vietnam, having learned about the impending 46% tariffs, agreed to discuss a trade deal with the United States that same day. The Prime Minister of Japan requested an urgent call with Trump, and the leaders of Israel and Taiwan personally went to Washington to obtain special conditions or exceptions for their countries.

For the administration, this is a double win:

- strengthening direct influence on trade in place of multilateral WTO rules;

- the opportunity to negotiate maximum concessions from partners – from access to markets to geopolitical loyalty.

Politically, it fits into the “America First” slogan, which implies a shift in international policy toward protectionism and isolationism.

Electoral goals and playing to the crowd

The massive 2025 tariffs could be driven by Trump's desire to shore up his domestic political support by fulfilling his campaign promises and rallying the electorate around economic nationalism.

From the point of view of electoral tactics, the timing is well chosen – the new tariffs were announced immediately after the elections, at the beginning of the term, when there are several years until the next expression of will and the support of voters is strong. This gives time to show results or at least mitigate the negative consequences of the trade war before leaving the White House.

Moreover, by bringing the foreign trade confrontation to the forefront, the president is shifting attention to the external “culprits” of economic woes. It is no coincidence that Trump called the day of the tariff announcement “Liberation Day” — presenting his actions as a liberating mission for the country.

But such grandstanding comes with risks. While tariffs may support the short-term, analysts warn of a “race against time”: If goods become more expensive and jobs are lost due to retaliatory measures, political support could evaporate.

Pressure on the Federal Reserve

Among the more non-trivial interpretations is the suggestion that Trump may be pursuing macroeconomic goals by trying to influence US monetary policy.

By announcing global tariffs, Trump triggered a collapse on the stock exchanges – in the first two days, the S&P 500 lost about $5 trillion in capitalization, investors rushed into bonds, fearing a recession. Some analysts associate this cooling of the markets and the threat of an economic slowdown with a change in the Federal Reserve System (FRS) policy. Thus, according to CNBC, the chances of a rate cut in September jumped from 50% to 100% against the backdrop of the announcement of new tariffs.

Trump, for his part, increased public pressure on the regulator: having just introduced the tariffs, he once again advised the “slow-moving Fed to lower the rate. On social networks, the president's supporters distributed a video of his statement, where he allegedly “deliberately crashes the market in order to lower interest rates” and even Trump himself reposts such videos.

MarketWatch called the new rate plan a “nightmare for the Fed,” expecting a price hike and a tough choice for the regulator. However, the same publication indicated that Trump is probably right about the interest rate.

It is worth noting that there is no official confirmation of such a plan. However, if it is true, then such a strategy is playing with fire: if the Fed does not soften policy, the tariff shock itself could drive the economy into a crisis.

Ideological conviction and stubbornness

ABC News believes that the main reason for the tariff war is Trump's long-standing protectionist ideology, which he has adhered to for decades.

Back in the 1980s, businessman Trump was loudly indignant about the trade deficit with Japan and the US “charity” towards its allies. In 1987, he published an open letter in major newspapers demanding that America defend its interests more firmly. Trump said roughly the same thing when he announced new tariffs in the White House Rose Garden.

It is known that many economic advisers, including former head of the NEC Gary Cohn, left him during his first term precisely because of disagreements over tariffs. Their places were taken by like-minded people or silent performers.

In effect, Trump’s personal faith in protectionism has become public policy. The idea that only tariffs will make America great again has been a thread running through Trump’s career, from his early interviews to his second term in the White House.

Personal motives and impulsiveness of the president

Finally, the most critical version links the 2025 tariff decision to Trump's personality. Supporters of this interpretation believe that the large-scale trade war is largely a product of the president's impulsive management style and personal motives. Their arguments boil down to the following:

- Trump is known for his impulsiveness and penchant for taking drastic steps, sometimes against the advice of experts. As the Guardian reported, the president waved a placard with figures, declaring: “It couldn’t be simpler,” even though his calculations left economists stunned. For him, the demonstration of strength and determination was more important than the academic correctness of the plan;

- the personal motive could be a simple grudge and a desire to punish. Trump has repeatedly expressed hostility towards the leaders of allied countries, accusing them of ingratitude. Massive tariffs could become a kind of act of retaliation;

- Critics point to the irrationality and adventurism of such a move. Many economists directly call the 2025 tariff war reckless. For example, Deutsche Bank noted the “lack of a deep strategic plan” behind this action.

Finally, we cannot rule out an element of personal self-promotion and ambition – Trump is trying to make an important historical step that would inscribe his name in textbooks, and tariffs seemed like a suitable tool. He loves superlatives and records: “This is the largest trade step in a lifetime,” “an economic revolution” – these phrases emphasize the scale of the event in his eyes.

Of course, reducing everything to personality traits alone would be an oversimplification. Even Trump's most drastic moves often contain a grain of rationality and political calculation. However, this version emphasizes that the human factor could have played a major role.

When asked, “Still MAGA?” — that is, is Trump making America great again — many analysts are at a loss. However, the president and his supporters are determined — in their eyes, the US just needs to endure the shock and wait for foreign manufacturers to “bend over” and agree to new rules. Whether this risky game will work out — the coming months will show. In the meantime, the global economy is balancing on the brink of a trade war and trying to assess the new realities.

What does the tariff war mean for the crypto industry?

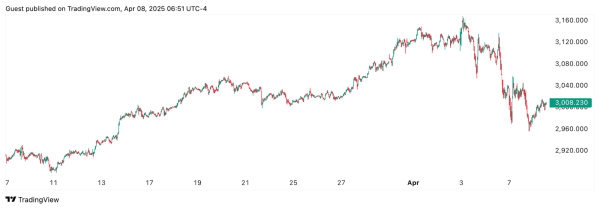

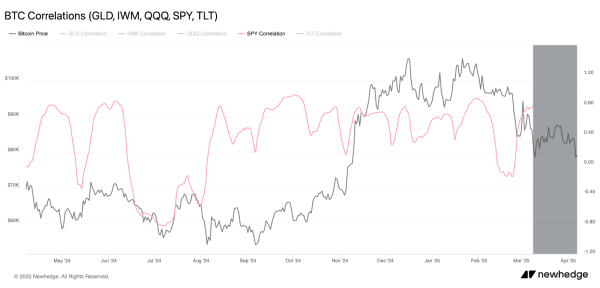

The crypto market's reaction to these events was mixed. On the one hand, the sharp flight of investors from risks in early April also affected digital assets. This is due to the fact that stock market volatility has historically affected cryptocurrencies, as some investors view them as risky assets. Thus, against the backdrop of the opening of the trading session in the US on April 7, Bitcoin fell below $75,000.

However, there is an alternative narrative in the crypto community – the trade war and the subsequent response of regulators can create conditions for a new bullish trend in cryptocurrencies. The main ideologist of this version was BitMEX co-founder Arthur Hayes. In his opinion, Trump's actions will provoke problems in the global economy, which the authorities will solve with the help of a money printer – and this is good for Bitcoin.

Some analysts expect that increased economic uncertainty will increase demand for non-state-controlled assets such as gold and bitcoin. At the same time, skeptics warn that cryptocurrencies, including bitcoin, are still far from being a “safe haven.” In the spring of 2025, the correlation between bitcoin and the stock market increased again, so in the event of a full-scale recession, digital assets could fall along with the rest of the market.

Many remember how in 2020-2021, it was the unprecedented stimulus from the authorities against the backdrop of the COVID-19 pandemic that became the fuel for one of the most powerful bull runs in the history of the crypto industry. Now history may follow a similar trajectory: if tariff escalation pushes regulators to new injections, the limited supply and autonomous nature of Bitcoin as “digital gold” will again come to the fore. And then the trade war, which began as a blow to the markets, may turn out to be the trigger for the next bull cycle.

Источник: cryptocurrency.tech