The Three Biggest Crypto Narratives of the Week

Top topics are constantly changing in the world of cryptocurrency, so it is vital for investors and traders to follow the latest trends. We tell you about three main crypto narratives that can set the tone for the market in the second week of March

Perpetual contracts

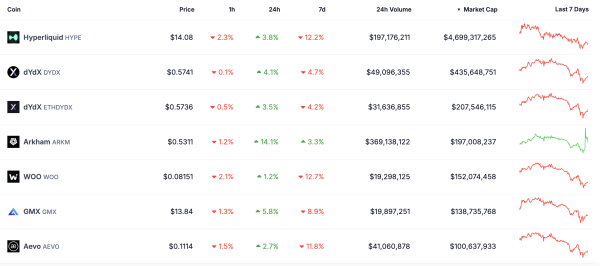

Perpetual contract coins seem poised for a recovery after a tough week. HYPE and WOO have both fallen more than 12% in the last seven days.

Perpetual contract platforms are exchanges where traders can buy and sell futures contracts without an expiration date. They use a funding mechanism to keep the contract prices in line with current market prices, allowing traders to take long or short positions using leverage.

Despite the recent decline in some tokens, the perpetual contracts sector continues to see activity with high trading volumes and fees on key platforms.

Hyperliquid continues to lead the perpetual contracts space, earning an impressive $12 million in fees in the last week. That's more than major DeFi apps like Jito, Maker, Solana, Ethereum, Raydium, and Pumpfun.

However, this level of dominance shows that there is room in the market for new players to challenge its position. Arkham, for example, is up 14% in the last 24 hours, indicating that some traders are interested in alternative projects in the perpetual contracts ecosystem.

Overall, these trends make perpetual contracts one of the top crypto topics of the week.

Coins related to the USA

The largest US-linked coins have suffered significant losses over the past week, with PI down 22.6% and ADA and HBAR down 18.9%. The declines have coincided with a period of general weakness in broader markets.

These cryptocurrencies have strong ties to the US, whether through their founding team or headquarters location. Such projects often attract the attention of regulators or receive support from US institutional investors.

The U.S. stock market has lost $4 trillion after Trump proposed new tariffs. Despite the scale of this correction, a rebound is still possible if investors see the recent decline as an overreaction. This could be positive for cryptocurrencies and lead to a new round of growth.

While the downtrend is still in place, a change in sentiment could allow US-made cryptocurrencies to rebound, allowing them to stabilize and enter a growth phase.

Memcoins

Memcoins remain one of the most volatile segments of the cryptocurrency market, often showing the biggest jumps during periods of growth and the sharpest drops during periods of decline.

This volatility has been particularly noticeable in the past week, with the largest meme coins taking a hit. Dogecoin (DOGE), the largest memecoin by market cap, has fallen more than 17% in the past seven days.

TRUMP is down more than 14%, while PEPE and BONK are down more than 10% over the same period.

If the crypto market starts to recover this week, meme tokens have every chance of becoming growth leaders. These assets, due to their speculative nature, often show impressive results during periods of growth, attracting the attention of retail investors.

If sentiment improves and liquidity returns, coins like DOGE, TRUMP, PEPE, and BONK could quickly gain momentum. This could spark another wave of explosive growth in the memecoin sector.

Источник: cryptocurrency.tech