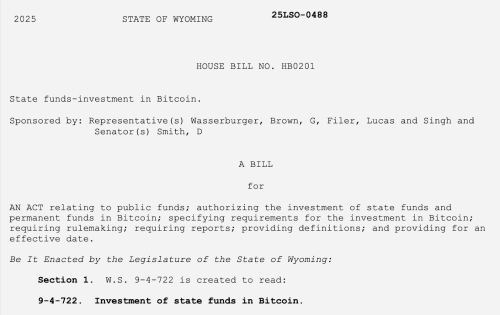

Wyoming Representative Jacob Wasserburger introduced HB0201, the “State Funds-Investment in Bitcoin Act,” on Friday, proposing the creation of a strategic Bitcoin reserve.

Wyoming took its first bold step toward a strategic bitcoin reserve! Thank you Rep. Wasserburger for introducing legislation to allow permanent funds to diversify into Bitcoin. This forward-thinking approach will benefit our state as we lead the nation in financial innovation!

— Senator Cynthia Lummis (@SenLummis) January 17, 2025

Wyoming Senator Cynthia Lummis, one of the first to highlight the proposal, emphasized its potential benefits to the state’s financial strategy.

“This forward-thinking approach will benefit our state as we lead the nation in financial innovation,” Lummis remarked.

As states explore the potential of integrating Bitcoin into public financial strategies, Wyoming’s latest proposal sets a precedent that could influence others, including Massachusetts.

According to Wasserburger, the bill’s sponsor, the proposal aligns with Wyoming’s history of pioneering firsts.

“Wyoming has always been a pioneer—from women’s suffrage to the first national park; from the invention of the LLC to the frontier of digital assets.,” Wasserburger said.

Source: wyoleg.gov

HB0201 authorizes the state treasurer to invest portions of Wyoming’s general fund, permanent Wyoming mineral trust fund, and permanent land fund in Bitcoin, with investments capped at 3% of these funds to balance potential gains with prudent risk management.

To address security concerns, the bill requires robust custody solutions for Bitcoin holdings, emphasizing the protection of private keys and adherence to strict security standards.

The proposal leverages Wyoming’s comprehensive legislative framework, including the Wyoming Special Purpose Depository Institution (SPDI) model, which has gained widespread recognition in the digital asset space.

Since 2018, Wyoming has established itself as a pioneer in Bitcoin-friendly legislation, passing more than two dozen laws supporting digital assets.

These initiatives include recognizing Bitcoin as property and providing regulatory clarity for blockchain companies, solidifying the state’s reputation as a hub for digital innovation.

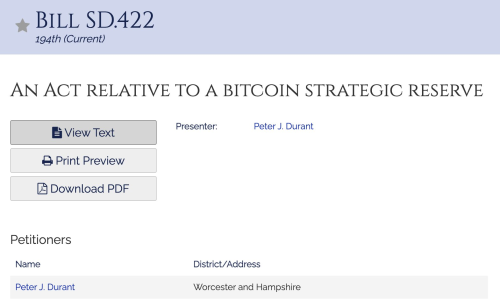

Alongside Wyoming, Massachusetts has also proposed a strategic Bitcoin reserve.

Source: Bitcoin Magazine / X

State Senator Peter Durant, who filed the bill, expressed enthusiasm about advancing legislation that could shape the state’s financial future.

Excited to get to work on this legislation! https://t.co/zT6W3JeGZh

— State Senator Peter Durant (@senpeterdurant) January 17, 2025

Bitcoin, often referred to as “digital gold,” has demonstrated substantial appreciation and resilience over the past decade.

Its decentralized nature and fixed supply align with principles of fiscal independence and economic stability.

As a result, many institutions, companies, and countries have begun incorporating Bitcoin into their investment portfolios.

Wasserburger emphasized the urgency of adopting such measures, stating, “We can’t afford to sit on the sidelines while other states move forward with their own Bitcoin reserve bills.”

Establishing a Bitcoin reserve could help Wyoming mitigate risks associated with inflation and economic volatility while ensuring long-term financial security for its citizens.

The proposal also aligns with Senator Cynthia Lummis’ advocacy for a United States Strategic Bitcoin Reserve.

Lummis’ 2024 draft of the Bitcoin Act, which proposed creating a federal Bitcoin reserve to reinforce America’s financial standing, has laid the groundwork for current legislative efforts.

Elsewhere, momentum for Bitcoin reserves continues to grow. On January 16, Texas Senator Charles Schwertner filed Senate Bill 778 (SB 778) to establish a strategic Bitcoin reserve.

Internationally, the Czech Republic’s central bank is also exploring Bitcoin as a reserve asset, as governments and institutions continue to evaluate the digital asset’s potential.

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…