What's Happening to Bitcoin in October: On-Chain Analysis

Bitcoin typically rises in October: over the past ten years, BTC has more often than not ended October in positive territory, particularly in 2017 and 2021, when its value increased by 49% and 40%, respectively.

However, this situation could change this year. Recent weak performance in the crypto market, the Fed's monetary easing putting pressure on the dollar, and waning institutional interest create an uncertain outlook for BTC in October 2025.

A bullish October risks reputation

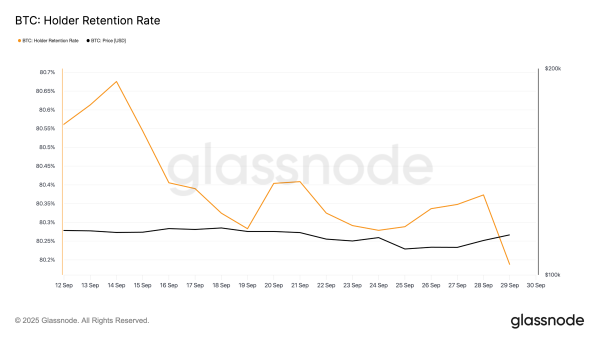

According to Glassnode, Bitcoin's retention rate has decreased by 1% since September 14, reaching 80.17% at press time. The retention rate measures the percentage of addresses that maintain their BTC balance for 30 consecutive days. A decrease suggests that holders are losing confidence and moving their coins to exchanges to sell.

Bitcoin holding rate. Source: Glassnode

Bitcoin holding rate. Source: Glassnode

This trend could lead to reduced demand and make BTC more vulnerable to sharp price fluctuations in the coming weeks.

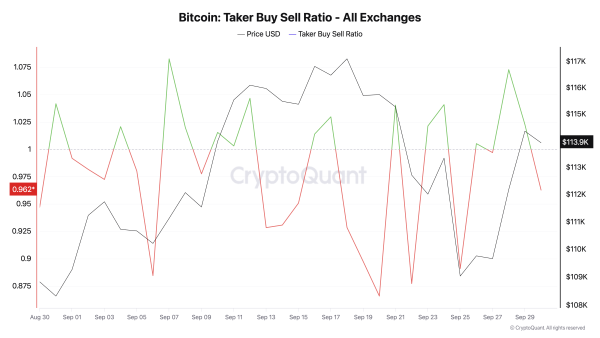

The derivatives market is leaning towards a bearish scenario.

The buy-sell ratio in the derivatives market remained below one in September, confirming bearish sentiment. According to CryptoQuant, it stands at 0.95 at the time of publication. This metric reflects the ratio of buy and sell volumes in the futures market. Values below one indicate that more traders are selling assets to avoid losses.

Bitcoin's bid-ask ratio. Source: CryptoQuant

Bitcoin's bid-ask ratio. Source: CryptoQuant

For BTC, the persistent bearish sentiment in derivatives markets suggests that sellers are in control and strengthening the downtrend. If selling pressure persists and the ratio doesn't rise above one anytime soon, October is unlikely to be bullish for Bitcoin.

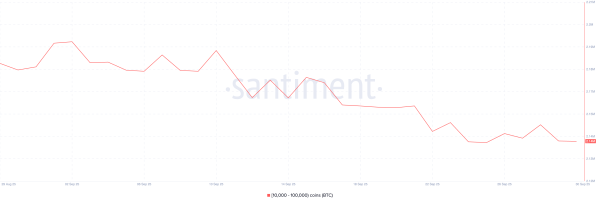

Whale activity is declining

A decline in interest from large investors is increasing pressure on BTC. According to Santiment, investors holding between 10,000 and 100,000 BTC have reduced their holdings by 50,000 coins over the past week.

BTC supply distribution. Source: Glassnode

BTC supply distribution. Source: Glassnode

Historically, large investors have played a key role in BTC's rally, providing liquidity and momentum for growth. Their lack of activity increases the risk of a downturn.

BTC balance on the brink – $107,000 or $119,000 next?

At the time of publication, BTC is trading at $113,968. If the bearish trend continues in October, the coin could test support near $111,961. If the sell-off intensifies, the price could fall to $107,557.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

If macroeconomic conditions improve and interest in BTC resumes, it may attempt to break the resistance at $115,892 and reach $119,367.

Earlier, an analyst explained why one shouldn't rejoice at Bitcoin's rise to $114,000.

Source: cryptonews.net