US ETFs Dominate Bitcoin Trading – CryptoQuant

American Bitcoin ETFs generate up to $10 billion in trading volumes per day and are already competing with the largest exchanges in terms of influence on price formation. Institutional investors continue to actively enter crypto through these instruments.

ETF vs. Exchanges: Who's Winning?

“Bitcoin spot trading volumes through U.S. ETFs have become a significant source of investment exposure to bitcoin,” said Julio Moreno, head of research at cryptocurrency analytics firm CryptoQuant. On active days, these funds regularly generate between $5 billion and $10 billion in daily volume, sometimes surpassing most crypto exchanges.

True, Binance still holds the palm in terms of spot trading volumes. Bitcoin volumes have grown to $18 billion, and Ethereum to $11 billion on peak days. But here's what's interesting: the total daily trading volume of 11 US spot bitcoin funds is now $2.77 billion – about 67% of the daily spot bitcoin volume on Binance ($4.1 billion).

As such, US spot Bitcoin ETFs have become a dominant force in the cryptocurrency market and are demonstrating their key role in price formation and institutional adoption.

Ethereum is on the sidelines for now

With Ethereum, the situation is completely different. ETH spot trading is mostly concentrated on Binance, followed by Crypto.com, while ETFs are only sixth with a measly 4%. Moreno points to “the limited participation of ETFs in ETH spot trading,” which indicates “slower institutional adoption of Ethereum compared to Bitcoin.”

However, recent ETF data shows a different picture.

Unexpected Twist: Ethereum Overtakes Bitcoin

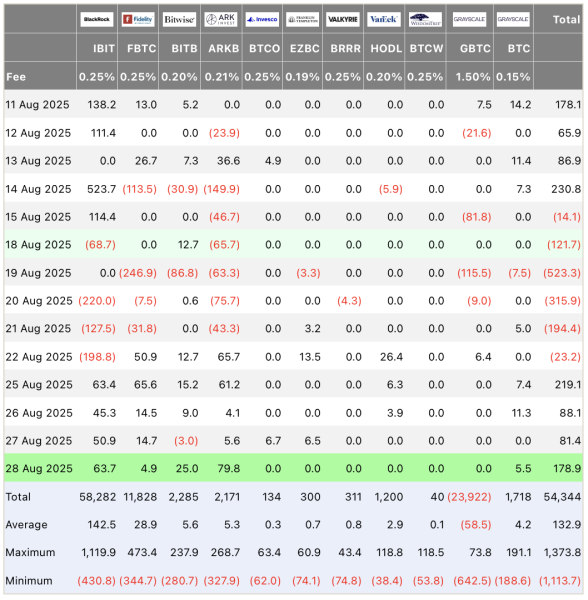

Capital inflows into 11 spot Bitcoin ETFs have slowed this week, with just $571.6 million in the past four trading days. The BlackRock iShares Bitcoin Trust (IBIT) has captured the lion's share of those inflows, up nearly 40%, or $223.3 million, since Monday.

US Bitcoin ETF Flows. Source: Farside Investors

US Bitcoin ETF Flows. Source: Farside Investors

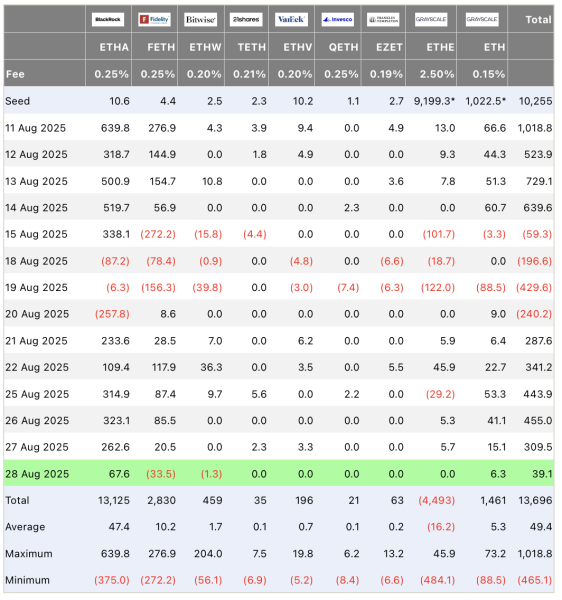

Spot Ethereum ETFs, however, fared much better, with total inflows of $1.24 billion, more than double the Bitcoin funds’ performance over the same four trading days. Ethereum funds haven’t seen a day of net outflows since August 20, and have seen more than $4 billion in inflows this month, representing 30% of total inflows since the products launched 13 months ago.

Funds flow in the US Ethereum ETF. Source: Farside Investors

Funds flow in the US Ethereum ETF. Source: Farside Investors

ETFs appear to be a powerful force changing the structure of the crypto market. Institutional money is flowing through these instruments, creating a new reality for digital assets.

Source: cryptonews.net