Robert Kiyosaki explained the Bitcoin correction as a liquidity crisis.

Robert Kiyosaki, author of the bestselling book “Rich Dad Poor Dad,” told his 2.8 million X followers that he does not intend to sell Bitcoin (BTC) and gold amid the correction.

“The bubble is bursting in all markets,” he noted.

According to him, the decline in quotes is due to a global liquidity shortage.

“The reason for the market collapse is that the world is short of cash,” the investor emphasized.

Kiyosaki anticipates the so-called “Great Seal,” drawing on Lawrence Lepard's thesis that governments may resort to large-scale emission to cover growing debts.

“A massive issuance is about to begin… this will make gold, silver, Bitcoin and Ethereum more valuable… while fake money will become worthless,” he wrote.

Kiyosaki recommended that those in urgent need of funds consider selling some of their assets. He said panicky decisions are often driven not by convictions but by a lack of liquidity.

Related: Investors withdrew $866 million from a Bitcoin ETF

Kiyosaki to buy more Bitcoin after crash

In his next post, the entrepreneur reaffirmed his long-term position.

“I'll buy more Bitcoin when the crash ends,” he said, recalling that the digital gold supply is limited to 21 million coins.

Kiyosaki also encouraged the creation of “Cash Flow Clubs” based on his board game, emphasizing that learning together helps avoid mistakes.

Meanwhile, influencer Mister Crypto noted that the popular market sentiment index has fallen to 16, the “extreme fear” zone. The latter is seen by many as a possible entry point.

The Fear and Greed Index has dropped to 16. Source: Mister Crypto, Alternative.

The Fear and Greed Index has dropped to 16. Source: Mister Crypto, Alternative.

Santiment warns against jumping to conclusions

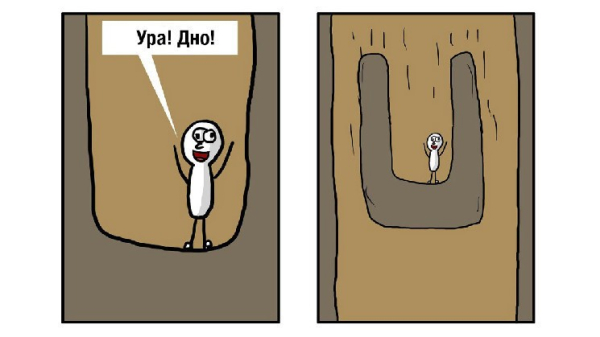

Santiment analysts are urging traders to exercise caution amid social media reports of a supposed market bottom. The company noted that such optimism often precedes further declines.

Historically, a bottom most often forms when market participants expect a subsequent decline rather than a rebound.

Source: cryptonews.net