Peter Brandt shorts Bitcoin

A “megaphone” pattern has formed on the chart of the leading cryptocurrency, which typically foreshadows a price decline, according to technical analyst Peter Brandt.

Do others besides me find it a bit awkward intellectually/emotionally when you hold opposite positions in accounts designed to trade different systems/time frames?

As an investor I have owned Bitcoin for years

As a swing trader I am now short $BTC futures based on megaphone pic.twitter.com/bZZDwbypSh— Peter Brandt (@PeterLBrandt) October 30, 2025

Based on his observations, the expert opened a short position in Bitcoin futures. He also emphasized his long-term belief in digital gold and continued to hold it in his portfolio.

At the time of writing, the leading cryptocurrency is trading at around $110,000. Over the past 24 hours, the coin's price has fallen by 0.3%.

Binance BTC/USDT hourly chart. Source: TradingView.

Binance BTC/USDT hourly chart. Source: TradingView.

On October 30, the price of Bitcoin fell to $106,000. According to Santiment, this has dampened investor confidence in a speedy market recovery. Many expect a correction to below $100,000.

😨 Bitcoin's dip to $107K Thursday has led to a high amount of sub-$100K $BTC price predictions. In this chart:

🟦 $50K-$100K Calls

🟥 $150K-$200K CallsMarkets move opposite to the crowd's expectations, therefore a relief rally is probable while FUD is peaking like it is now. pic.twitter.com/slCuZALuE8

— Santiment (@santimentfeed) October 30, 2025

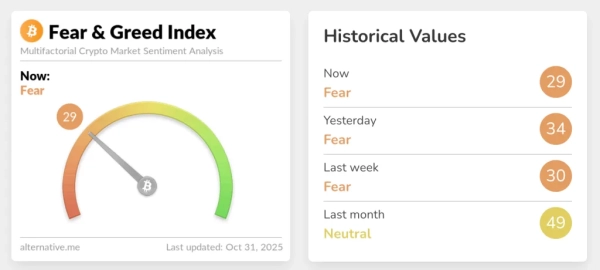

The Fear and Greed Index is at 29, signaling a predominance of pessimism. The indicator has dropped five points in the past 24 hours.

Source: Alternative.me.

Source: Alternative.me.

Glassnode analysts previously indicated the possibility of a decline to $88,000. To avoid this scenario, the leading cryptocurrency needs to consolidate above $113,000, they noted.

However, according to Santiment experts, the market “often moves contrary to the expectations of the majority.”

“The current peak in pessimism is setting the stage for a recovery rally—a classic case of extreme fear preceding a trend reversal,” the experts added.

Why can't the market recover?

On October 29, the Federal Reserve cut its key rate for the second time in a row by 25 basis points, to 3.75-4%. Ahead of the FOMC meeting, analysts predicted a new Bitcoin rally.

The following day, US President Donald Trump, whose decisions significantly influence the crypto market, announced a reduction in trade tariffs on imports from China.

At the same time, trading in spot exchange-traded funds based on a number of altcoins has begun in the United States.

However, neither the leading cryptocurrency nor the broader crypto market responded to any of the positive news. According to analysts at XWIN Research Japan, one of the main factors behind this behavior was a decline in institutional demand.

Why the Market Fell Despite All the Good News

“The sell-off was not irrational. After weeks of exuberance, speculative momentum cooled. Institutional demand weakened, monetary clarity blurred, and geopolitics grew complicated.” – By @xwinfinance pic.twitter.com/uDncPGyw48

— CryptoQuant.com (@cryptoquant_com) October 31, 2025

Experts pointed to the Coinbase Premium Gap indicator, which reflects the price difference between Coinbase and other exchanges. The indicator has fallen into negative territory.

“This traditionally indicates a reduction in buying activity on the part of American institutional investors. Historically, a negative premium often precedes short-term market corrections,” explained XWIN Research Japan.

Additional reasons include:

- lack of guarantees of further reduction of key rates – Federal Reserve Chairman Jerome Powell is not confident that the regulator will continue to ease monetary policy;

- ongoing geopolitical uncertainty – negotiators between China and the US describe the agreements reached as a “temporary truce.”

Trader Miles Deutscher added that additional pressure is being exerted by corporate treasuries, which have begun selling assets to stabilize the NAV . Demand for spot Bitcoin ETFs has also weakened.

Chart of inflows and outflows into spot Bitcoin ETFs. Source: SoSoValue.

Chart of inflows and outflows into spot Bitcoin ETFs. Source: SoSoValue.

He cited “Black Saturday” on October 11 as a key factor, which undermined confidence in the crypto industry and scared off retail investors.

However, analysts at XWIN Research Japan described the current correction as “normal.” They said the medium-term outlook looks optimistic.

What's next?

MN Trading founder Michael van de Poppe believes that Bitcoin needs to break $112,000 to begin a new rally and potentially reach its ATH .

#Bitcoin needs to break $112K and that's the crucial level before a new ATH.

Mentioned it before, and it's still valid.

I do think we'll see a new ATH in November.

However, it did hit support. If this level is lost for Bitcoin, then we're looking at a sweep of $103K or even… pic.twitter.com/XJQRo5CAvV

— Michaël van de Poppe (@CryptoMichNL) October 30, 2025

“At the same time, the asset has indeed reached a support level. If it breaks through this boundary, the next target level will be $103,000 or even lower,” he warned.

But van de Poppe expects digital gold to hit a new all-time high in November.

Bitcoin ended October in the red for the first time since 2018. As analyst Crypto Rover pointed out, the last time the leading cryptocurrency experienced a similar situation in November, it fell 36%.

Last time October closed red for Bitcoin, November saw a 36.57% drop.

Should we be worried this time? pic.twitter.com/WCm6FZuOZa

— Crypto Rover (@cryptorover) October 31, 2025

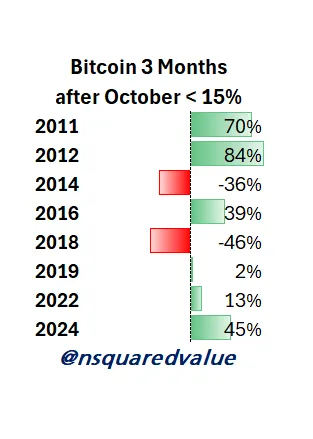

Investor Timothy Peterson disagreed with this interpretation. He said that “a weak October doesn't mean anything,” but more often than not, growth “actually slows.”

Source: X/Timothy Peterson.

Source: X/Timothy Peterson.

“Bitcoin's average three-month return after a weak October is 11%, and after a strong October, it's 21%,” he noted.

As a reminder, an analyst using the pseudonym Crypto Dan predicted the end of the correction and the beginning of a rally in altcoins.

Source: cryptonews.net