Opinion: Bitcoin will overheat at $180,000

The news is being updated

The news is being updated

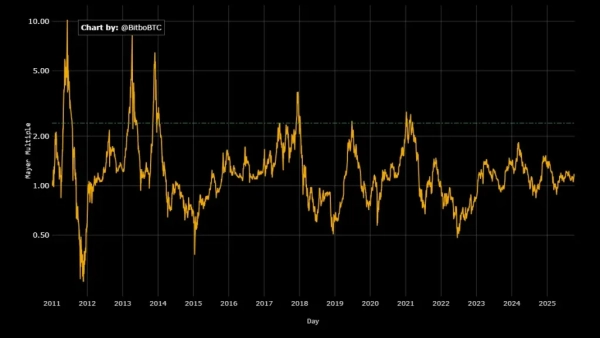

The cryptocurrency market is still far from overbought territory, meaning there's potential for continued rally, according to analyst Frank Fetter, citing data from the Mayer Multiple technical indicator.

Bitcoin is at all-time highs and the Mayer Multiple is ice cold. I like the setup. $BTC pic.twitter.com/I5pNkydV2l

— Frank (@FrankAFetter) October 9, 2025

“Bitcoin is near its ATH , and the Mayer Multiple is simply icy. I like this setup,” the analyst noted.

The metric shows gaps between the 200-day simple moving average (MA) values. These gaps help identify speculative bubbles and periods of complete seller exhaustion on the chart, which signal a long-term upward trend reversal.

If the indicator is above 1, it means Bitcoin prices are above the 200-day moving average. Similarly, if the indicator is below 1, the price is below the 200-day moving average.

Historically, a Mayer Multiple above 2.4 indicates a speculative bubble. Trace Mayer, the metric's creator and host of the Bitcoin Knowledge podcast, believes that investors achieve the best long-term results when the primary period of cryptocurrency accumulation occurs when the indicator's values are below 2.4.

At the time of writing, the Mayer Multiple is at 1.14. Meanwhile, digital gold is trading around $121,360—3.6% below its ATH reached on October 6 (according to CoinGecko).

Mayer Multiple indicator dynamics. Source: Bitbo.

Mayer Multiple indicator dynamics. Source: Bitbo.

Source: cryptonews.net