Michael Saylor Announces Another Bitcoin Purchase

Strategy is preparing for its third Bitcoin purchase in August. Co-founder Michael Saylor has hinted again about an upcoming cryptocurrency purchase, the third this month.

Another purchase amid falling stocks

Strategy last bought bitcoin on August 18, spending $51.4 million on 430 BTC. That brings the company's total holdings to 629,376 bitcoins, worth over $72 billion at the time of writing.

Strategy’s Bitcoin investment has returned more than 56%, representing more than $25.8 billion in unrealized gains at current prices, according to SaylorTracker. The company continues to accumulate the cryptocurrency despite the decline in its share price from its November 2024 peak.

The August Bitcoin purchases were modest by MicroStrategy standards. The company typically buys thousands or tens of thousands of coins in a single transaction, but this month it bought just 585 BTC in two transactions.

Leader in Corporate Bitcoin Investments

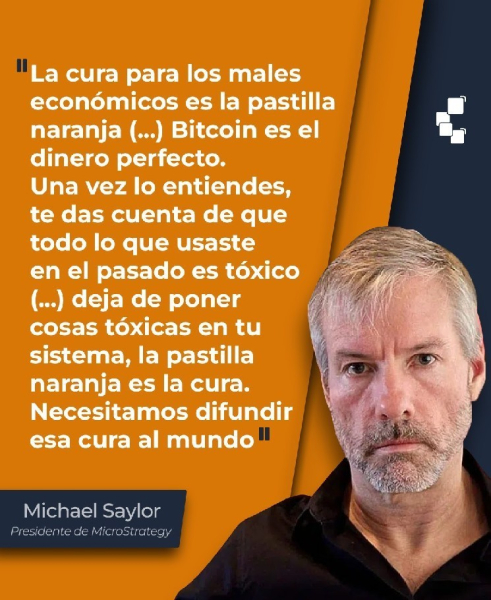

Strategy remains the undisputed leader among companies with cryptocurrency reserves. Saylor actively promotes Bitcoin among individual investors and financial institutions.

The company's top executive, Shirish Jajodia, recently told journalist and podcast host Natalie Brunell that Strategy does not influence the market price of bitcoin with its purchases. The company acquires the cryptocurrency through over-the-counter (OTC) transactions — private agreements between parties that occur outside of spot exchanges — and other methods that do not affect the market price.

“Bitcoin trading volume is over $50 billion in any 24-hour period — that's a huge volume. So buying $1 billion in a couple of days doesn't really impact the market that much,” he added.

Stocks under pressure

Strategy shares fell to a nearly four-month low on Wednesday, hitting $325 a share, levels not seen since April. But by Friday the price had recovered to about $358 a share.

Institutional investors hold Bitcoin for the long term, which pushes the price floor up over time. However, other factors such as speculation and traders have a more immediate impact on the short-term market price of BTC.

Source: cryptonews.net